US: Getting that sinking feeling?

The plunge in the ISM manufacturing index adds to the sense of unease about the prospects for the global economy and will reinforce financial market gloom

Trade tensions are hurting

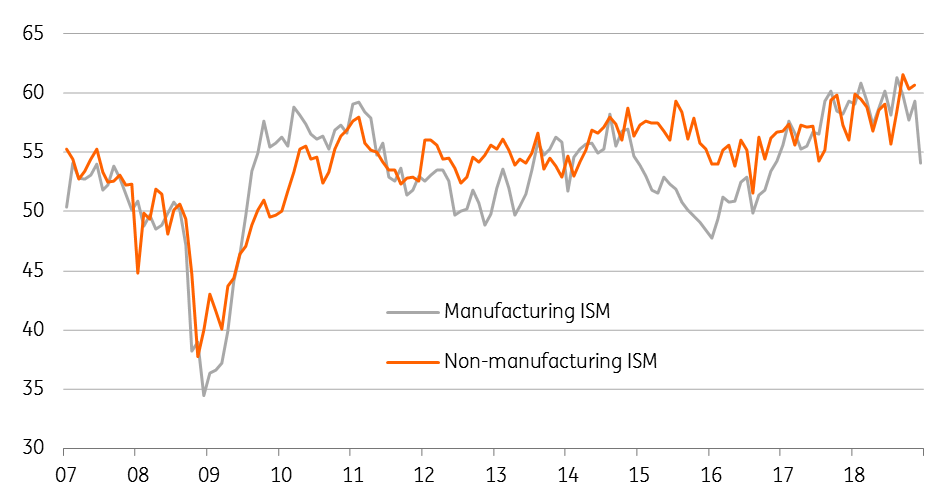

The ISM manufacturing index, one of the oldest and most respected business surveys in the US, fell to a two year low in December. It dropped from 59.3 in November to 54.1 – the steepest decline since 2008. When combined with poor outcomes from the Chinese and Eurozone surveys, it clearly adds to concerns about the outlook for global growth in 2019.

New orders plunged 11 points – its biggest drop in nearly five years

Certainly, trade protection fears are evident given the threat the disruption poses for supply chains with an associated upward impact on cost. New orders plunged 11 points – its biggest drop in nearly five years while the production, employment, supplier delivery and inventory readings all fell. Given the headline ISM index was up at a 14 year high as recently as August this is a concerning development. Interestingly, the export component actually rose, which is hard to reconcile with the weakness seen in other country surveys.

ISM manufacturing and non-manufacturing

2019 will be a tougher year

We always believed 2019 would be a tougher year as the economy battles against more headwinds - namely the lagged effects of higher borrowing costs, the stronger dollar, the fading support from the 2018 fiscal stimulus and weaker external demand at a time of rising trade protectionism.

Given the headline ISM index was up at a 14 year high as recently as August this is a concerning development

This survey, coupled with the recent financial market turmoil offers further evidence to suggest that the pace of Federal Reserve interest rate hikes will be much more modest in 2019 versus last year. Indeed, it is consistent with our view that the Fed will probably pause its policy tightening in Q1.

But there are some positives

We will be looking to the slew of Fed speakers next week to see if they can provide some soothing words for markets, but we have to remember the Fed will remain committed to its mandate of price stability while maximising employment. Moreover, it is important to point out that there are still positives in the US economy, such as the strong jobs market, which is now delivering higher pay rates. Meanwhile, the 65cent/gallon plunge in gasoline prices is leaving more money in drivers’ pockets – around $90bn more on an annualised basis.

Finally, its worth remembering that the ISM index is still pointing to growth, albeit slower than what we saw in the middle of 2018. The current US-China trade ceasefire until March also provides breathing room, and if progress can be made resulting in some form of resolution, or at least an extension of the peace, this would clearly be positive for the economic outlook in the first half of the year.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more