US GDP: The Q1 conundrum

US GDP readings for the first quarter are by far the weakest in any given year. Given our 2.4% forecast for 1Q18, this trend suggests 2018 will be fantastic

| 1.5pp |

How much lower growth is in a typical Q1 versus other quarters |

What's wrong with Q1?

As with most economic data, GDP is also seasonally adjusted to take account of the influence of things such as predictable weather patterns, school term dates or national holidays. For example, severe weather in the winter means construction work grinds to a halt while consumer spending typically gets a lift in the build-up to Christmas. Economists prefer to try and eliminate these patterns to make it easier to observe the "true" underlying cyclical trend.

Yet, looking at quarterly GDP growth rates, there is a clear pattern of underperformance in the first quarter of a year. Going back over 30 years, we find the average quarter on quarter (QoQ) annualised growth rate for a Q1 is 1.7% versus 3.2% for Q2 and 2.5% each for Q3 and Q4. Since the start of the financial crisis, the problem seems to have worsened with Q1 averaging 0.17% versus 2.4% for Q2, 1.9% for Q3 and 1.4% for Q4. Seasonal adjustment means Q1 growth should not be consistently different from any other quarter, so there is clearly some "residual seasonality".

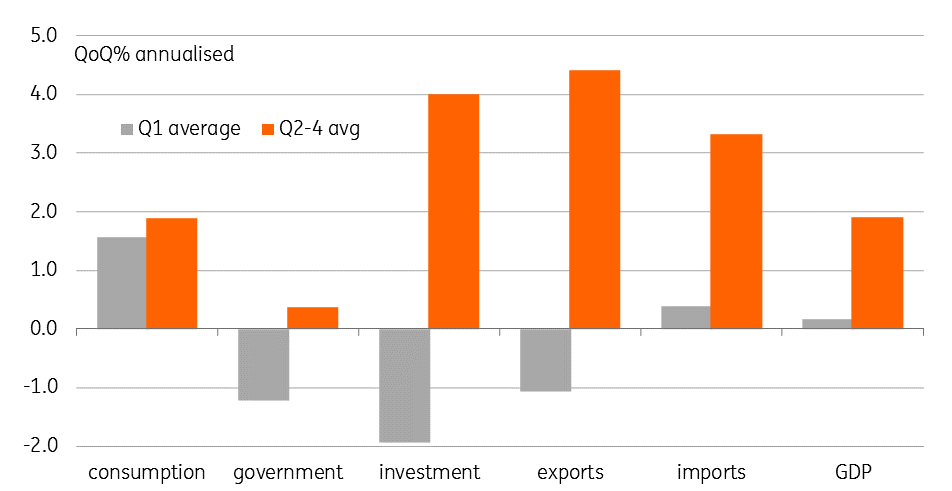

Q1 annualised GDP growth versus Q2, Q3 and Q4 (2008-2017)

Why is it so much weaker?

The obvious point is that there is clearly a problem between Q1 and Q2.

If we have 1.7% growth in Q1 and 3.2% in Q2 that gives a first-half average of 2.5% - the same as the typical growth rates seen in the third and fourth quarter. Problem solved.

However, statisticians continue to debate the reasoning for this. Weather disruption has been severe in recent years with several winter storms right at the beginning of many years, but we can't categorically prove that weather is influencing data more than it has in the past. Some argue that weather may be impacting data in different ways due to changes in the structure of the economy.

Going back over 30 years, we find the average QoQ annualised growth rate for Q1 is 1.7% versus 3.2% for Q2 and 2.5% each for Q3 and Q4. And the problems seems to have worsened since the start of the financial crisis

It is possible that changing economic behaviours may be playing a part, although the ever-growing use of technology and online spending should more likely smooth spending behaviour rather than increase its volatility. There have also been suggestions about problems with price deflators and the quality adjustment factors that go into them (computers may not be getting much cheaper these days, but you are getting more for your money in terms of processing power). Unfortunately, changes to statistical calculations don't seem to have helped resolve the situation.

Looking at the components of GDP over the past 10 years, there appears to be particular problems within investment, which has averaged -1.9% in Q1 versus +4% in each of the other quarters and exports which has averaged growth of -1.1% in the first quarter versus 4.4% in the other three quarters. Other components exhibit evidence of residual seasonality with consumer spending averaging around 0.3 percentage points less growth in Q1 versus other quarters while for government spending it is 1.6pp and for imports it is 1.7pp. Inventories also seem to be run down more in Q1 than other quarters.

The trend looks set to continue

In terms of the specifics of this Friday's report, we look for GDP growth to slow to 2.4% while the consensus is a little lower, predicting 2% (both outcomes would be below the 4Q trailing average).

As is usual with this advanced reading for GDP, there is a broad range of views in the market. The Bloomberg consensus is spread from +1.3% to +2.8% and adding to the uncertainty; various regional Federal Reserve Banks publish “Nowcast” figures based on the monthly economic data flow. The New York Fed’s model suggests 2.9%, the Atlanta Fed’s model says 2.0% while the St Louis Fed says it will be around 3.5%, implying that there is a strong chance of a market moving number when we actually get the data publication on Friday.

Our view, however, is that weakness will be led by domestic demand. 4Q17 activity was boosted by post-hurricane rebuilding and the replacement of damaged/lost home and business equipment, which won't have been repeated. However, net trade should make a positive contribution thanks to the dollar weakness and a strengthening global economy while inventories are likely to be rebuilt after being sharply run down in 4Q17. Nonetheless, a 2% growth rate for a Q1 is still very good by historical standards and if the pattern of the weakest quarter for growth continues, this suggests 2018 will be a very good year.

Good news for 2018!

Our full year 2018 growth forecasts is 3%, and a rebound in the second quarter would set us up nicely for this. Retail sales rebounded in March, suggesting the domestic economy has regained some momentum while confidence is strong and the jobs market is robust, which is contributing to higher wages. Tax cuts will also be supporting spending while a rebound in asset prices following 1Q volatility is helpful.

Meanwhile, the dollar’s weakness means that exporters are in a competitive position that allows the US to really benefit from the upturn in global demand. As such we are provisionally forecasting 2Q GDP at around 3.5%. With inflation pressures starting to become more evident, this will help keep the Fed on course to hike interest rates three more times in 2018.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

24 April 2018

US: A milestone, a short squeeze and a Q1 conundrum This bundle contains 5 Articles