US FX intervention: What are the chances?

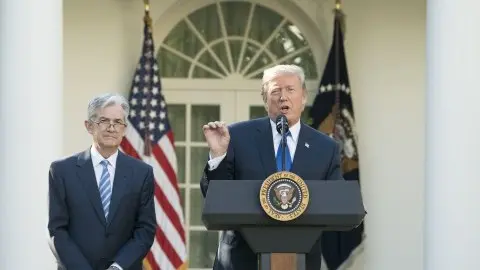

A further tirade from President Trump over the strong dollar begs the question whether he’s prepared to weaken it through FX intervention? We would still only assign a 25% probability to such an outcome, but the chances are rising

The dollar is increasingly on the White House's radar

This week’s move above 7.00 in USD/CNY and widespread monetary easing across Asia has provided further fuel to the President’s criticism that the Fed has kept US interest rates too high and the dollar too strong.

The term ‘currency wars’ has also made a strong come-back – a term last used as countries were softening their currencies to compete for diminishing external demand after the Global Financial Crisis. We agree with most that China has not devalued its currency this week, but has instead allowed market forces to play a greater role in setting its value.

In fact, the US Treasury’s statement supporting the designation of ‘currency manipulator’ against China reads something like ‘if you claim you’re so good at controlling your currency, why couldn’t you keep $/CNY below 7?’.

Intervention: Is it a strong dollar or weak renminbi problem?

There are two schools of thought on FX intervention:

- Is Washington’s key focus an over-valued dollar that is hurting the US manufacturing sector?

- Is the main concern that China is manipulating its currency lower for trade gain and to offset tariffs?

The answer to these questions will require different policy responses.

Listening to the President yesterday, the former certainly seems to be the case. The response required from the White House to this is largely to pressurise the Fed into more aggressive easing and, in exceptional circumstances, to get the US Treasury to instruct the Fed to sell dollars against the EUR and JPY (the two currencies already in the Exchange Stabilisation Fund (ESF). Washington's sense that the dollar is too strong could be backed up by the IMF's own calculations of FX valuations, where the dollar stands out as over-valued (see below).

The latter issue would see US FX intervention entertained against USD/CNY. After the admission of the Renminbi to the SDR in 2016, China has been welcoming public sector investments into its onshore bond markets. In theory then, the Fed should be able to buy the onshore CNY, with the proceeds parked in onshore CNY government bonds, just as fellow FX reserve managers do.

IMF estimates of FX valuation: over-valued dollar stands out

What are the chances of intervention?

There is no perfect way to judge the market’s view here, but a rough gauge is to look at FX options and see what probability the market attaches to certain outcomes. If we assume that unilateral US FX intervention (near unprecedented) would knock the dollar, say, 3% lower, what probability is attached to that for USD/JPY, EUR/USD and USD/CNY? Looking at One Touch option prices, the probability of the dollar falling 3% over the next month against the JPY, EUR and CNY is 23%, 13% and 9% respectively. The USD/JPY is more volatile than the EUR/USD and USD/CNY, so the probability of a 3% move is naturally higher – but the exercise does provide some idea of what’s priced.

We see the probability of intervention around 25%

We see the probability of intervention around 25%, largely because of the risk of failure. How would the White House react to headlines of ‘failed intervention’ if after selling USD/CNY at 7.05, the spot rate trades above that level over later days and weeks as the Fed fails to re-appear with a sustained bout of USD/CNY selling?

We’ve written about the US Treasury’s available fire-power here, but after further discussion and assuming that neither: i) Congress approves a massive increase in ESF resources for intervention, raising US debt levels in the process or ii) the Fed decides to print money and support the US Treasury in unsterilized intervention, most seem to think the US Treasury’s resources for FX intervention is around the US$100bn mark. Not much by international standards.

Indeed, there is much academic literature on the failure of sterilised FX intervention (i.e. the monetary base doesn’t change). And the chances of getting another 1985 Plaza Accord to weaken the dollar, involving co-ordinated FX intervention and co-ordinated monetary policy, look virtually zero.

What would be a significant game-changer here would be if the Fed were to give greater weight to the drag from the international environment, including the strong dollar. The Fed might not wish to risk its credibility in getting sucked into a currency war, but FX intervention backed up by more aggressive Fed easing would be a more compelling proposition for the FX market.

Dollar forecasts

Based on a slowing US economy and the Fed being drawn into deeper easing, we maintain a view that USD/JPY will head down to the 102/103 area later this year. This will be exacerbated by broadening trade tensions over the coming months.

For EUR/USD, we see a risk that the recent narrowing in EUR:USD short rated differentials actually accelerates as US rates fall further, while EUR rates get stuck on the view that the ECB can’t cut the deposit rate below the -0.70/80% threshold.

Narrowing rate differentials – and perhaps a re-think over Washington’s dollar policy – have prevented EUR/USD breaking down to the 1.08 area. We continue to favour a 1.10-1.15 range for the remainder of the year, but will carefully watch the trade-off between US and Eurozone policymakers within a global slow-down.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

9 August 2019

What’s happening in Australia and around the world? This bundle contains 14 Articles