US food supply chains struggle to get back into shape

While food demand patterns have normalised since the pandemic, there are still supply issues due to labour shortages, climate and trade disruptions. Food manufacturers will look to strike a balance between quick fixes and structural solutions to increase resilience. Economic headwinds could ease the pressure but also cast uncertainty on investments

Food and beverage companies keep running into supply chain issues

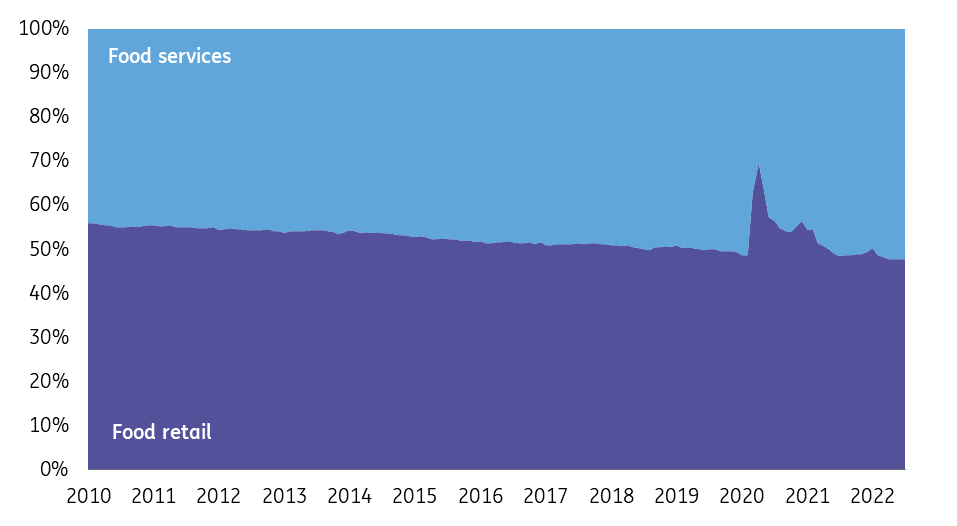

For US food and beverage manufacturers, many disruptions in their supply chains started with the pandemic. When it comes to consumption patterns the initial ‘Covid-impact’ has clearly receded. Spending on food service has recovered to normal levels and currently accounts for 52% of all food and beverage spending. However, demand continues to be dynamic as food inflation tightens household finances and leads some consumers to trade down from premium products to more budget offerings. This requires food makers to review things like product ranges, production volumes and marketing.

On top of that, there are still plenty of other issues that food processors have to deal with. Supplier delays are business as usual for many companies with labour shortages one of the biggest supply side problems. These shortages range from truckers to warehouse workers and from factory staff to grocery stockers and restaurant staff. This situation is aggravated by the fact that absence at work due to illness is still higher than before the pandemic. The lack of suitable workers is more pronounced in the US than in Europe. There are currently two job vacancies in the United States for every single unemployed American. In the UK it is one vacancy for every unemployed Briton while in Germany there are 0.4 job vacancies for every unemployed German.

The temporary channel shift between food retail and food service has reversed since the start of the pandemic

Percentage of total expenditure on food and drink in the US, monthly data

Trade faced setbacks and input prices spiked

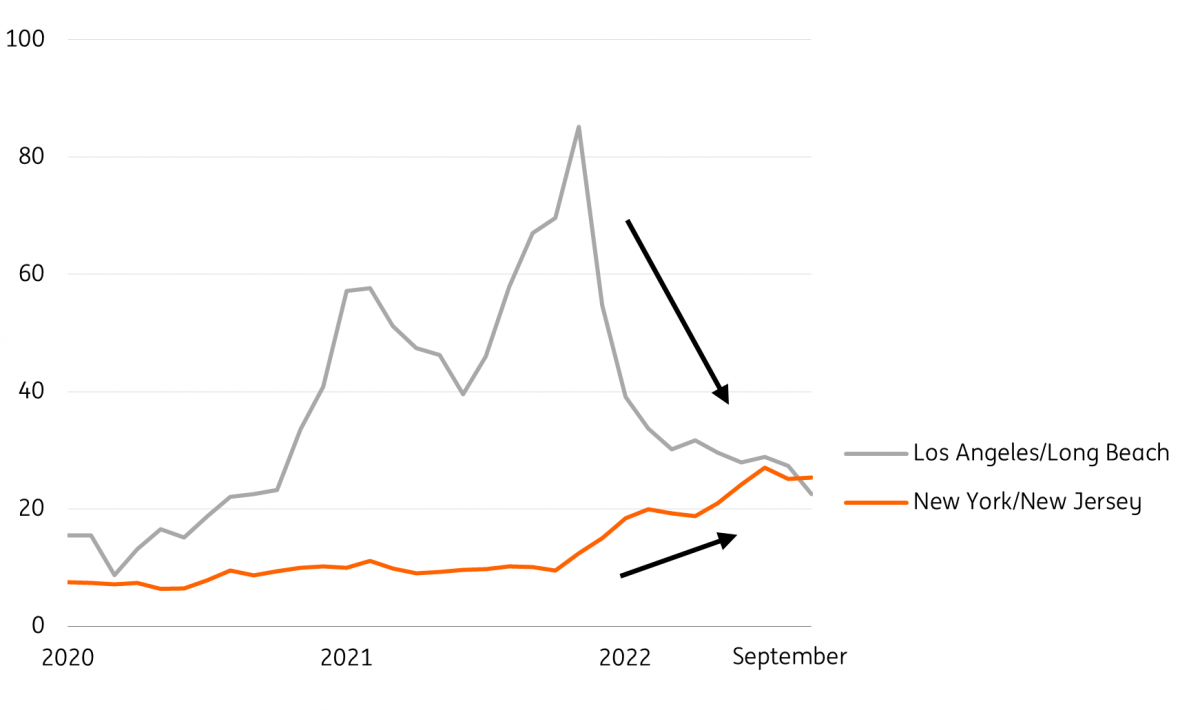

Even though the food system in the US is largely a domestic affair, it’s not isolated from the things happening in the rest of the world. International trade accounts for 6% of all consumed calories in North America, compared to 20% in Europe. For US manufacturers, elevated price levels of raw materials, and non-food inputs such as packaging, energy and fuel are the result of strong domestic demand plus developments abroad. Larger backlogs in ports have caused additional difficulties for food producers over the past two years as they affected import flows of foreign ingredients and commodities (like coffee and cocoa) and export flows of US products. Longer lead times also made it harder to get the equipment, parts and packaging materials needed to keep production lines running smoothly. While the US is not particularly dependent on agricultural commodities from the Black Sea region, the knock-on effect of the war on global prices did trickle down to buyers of grains and vegetable oils in the US.

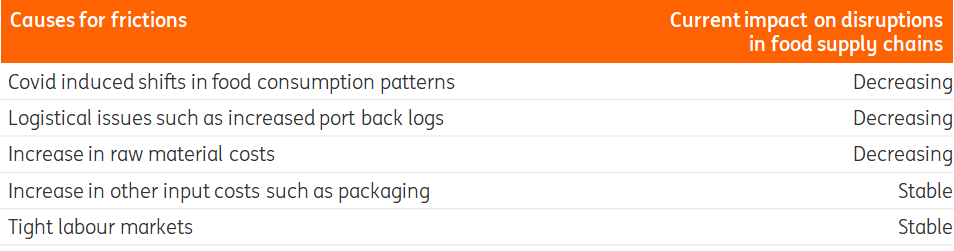

A series of frictions has put US food supply chains off balance

Port backlogs and commodity prices have come down, but issues can spark up again

Over the summer of 2022, the impact of increased backlogs in ports and higher commodity prices has been easing. Backlogs in ports on the West Coast have been significantly reduced and prices for commodities such as grains and vegetable oils have retreated. Stil,l disruptions in ports could resurface as was recently shown by a week of trucker protests in the port of Oakland. And when it comes to seaborne trade there’s less flexibility in the US than in Europe, given only a few ports are able to receive and handle large carriers. On agricultural commodity markets, volatility indicators have eased since 1Q but could easily spark up again due to geopolitical or extreme weather events.

Congestion in Los Angeles-Long Beach significantly reduced as some pressure shifted to the East Coast

Port congestion index based on number of containerships at ports, 7-day moving average per month

Consumers experience higher food prices and more erratic availability

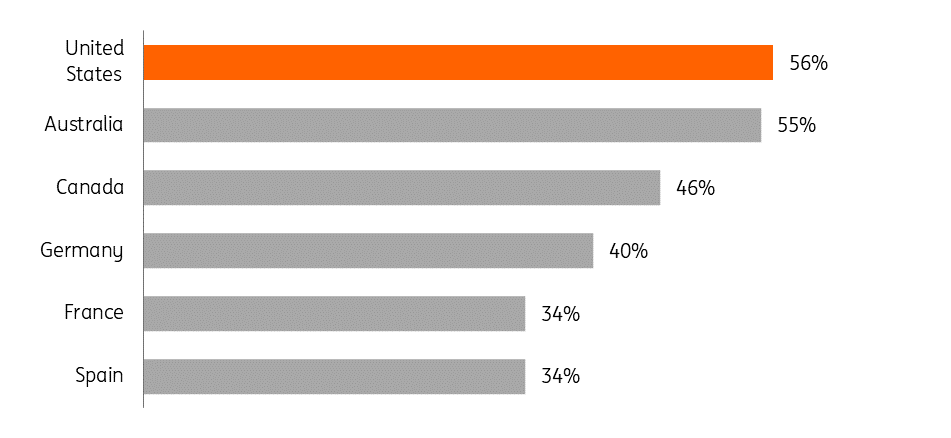

Some causes for supply chain disruptions may be subsiding, but the impact on the food industry is far from over. On the consumer level, you could argue that the impact is currently even more severe than during the early stages of the pandemic. Back then products being out-of-stock posed a major issue for consumers. But at the moment consumers continue to experience more erratic availability, in combination with much higher prices in grocery stores. These phenomena seem to be more prevalent in the US than in Europe with relatively larger year-on-year price increases for food at home (+10.2% in 1H22 in the US compared to +8.1% in the EU) and more consumers experiencing issues with products being out of stock. Beverages are currently the most affected category according to IRI.

Many US consumers have experienced being unable to buy a product due to it being out of stock

Percentage of people who answered the question: how often are you unable to purchase a product due to it being out of stock with ‘occasionally’, ‘frequently’ or ‘almost always’.

A closer look at potential solutions for food manufacturers

Many food companies in the US are accustomed to times when weather or trade-related events temporarily derail some part of their supply chain. However, the current situation seems to be more pervasive as the underlying causes are broader and not bound to a certain region or subsector. As a reaction to the current issues, a range of options can be considered stretching from quick fixes to more profound strategy changes.

It will be a trade-off between what companies might want to do and what they can do, because creating a more resilient supply chain comes at a cost. While these costs can be harder to bear in times of soaring input cost inflation, the costs of shutdowns of production lines and empty shelves might be even higher.

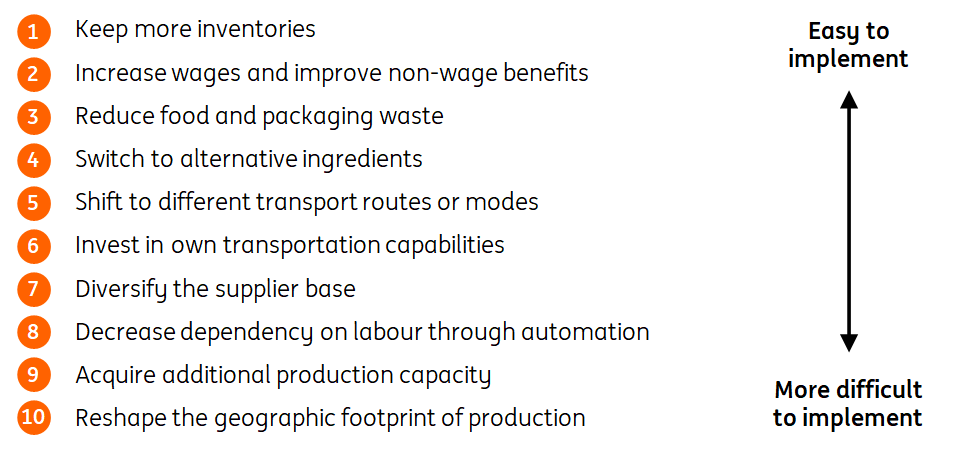

10 measures that food processors can take to cope and adapt with supply chain disruptions

Some can be deployed relatively easily….

- Keeping more inventory of raw materials or finished products is a fairly straightforward option to improve continuity. It requires more physical space and working capital but overall it’s easy to implement. The availability of cold storage facilities has been a bottleneck but has seen an influx of investment according to real estate company CBRE.

- Increasing wages is another quick and common solution and manufacturing workers have so far seen a 6.3% pay raise over last year, above the national average of 5.2%. Meanwhile, companies also look at their non-wage benefits by, for example, introducing more flexible shifts. This only really provides relief for the industry once it attracts additional people to the labour market.

- When inputs are abundant, the stimulus to be frugal is low. But higher prices and erratic availability create a need to further reduce waste. Both investing in better forecasting capabilities and getting clients to share their sales forecasts further in advance can help to improve planning.

- Price increases and (temporary) shortages of ingredients ranging from sunflower oil to stevia, certain starches and hydrocolloids have increased the need to reformulate products and use alternative ingredients. These changes often become permanent as consumers expect consistency in product formulation.

- Over the past year some companies have diverted goods shipments to different ports, or made a modal shift from rail to road or road to air to avoid bottlenecks. While these may have been ad-hoc solutions at first, some companies might stick to this to increase resilience or will use them again as a fallback option when interruptions reappear.

… but others require more of a strategic reversal

6. Allocating more capital to assets such as (reefer) containers, tractors and trailers help to decrease reliance on third parties. Eventually, companies will still find it challenging to get truck drivers in a tight labour market and will also find it difficult to operate as efficiently as specialised logistics providers.

7. Companies often mention that they look to diversify their supplier base to reduce risk. The pandemic has sparked additional interest in dual sourcing and regional sourcing instead of (inter)national sourcing. However, sometimes diversification options are limited due to a lack of suppliers for specific raw materials or packaging. This is also one of the reasons why the United States Department of Agriculture (USDA) has reserved significant funds for improving the availability of suppliers, processing capacity and infrastructure in food supply chains, especially in meat and poultry processing.

8. The business case for automation becomes stronger when labour is in short supply. We’ve discussed the pros and cons in this article.

9. Packaged food companies in the US have tended to divest factories to become more asset-light. But right now vertical integration can help to (re)gain more control and reduce dependency on co-packers. However, it requires suitable takeover candidates, can be costly, and would often mean a strategy change.

10. If market circumstances have changed significantly, a relocation of production facilities can help to decrease shipping distances and costs as well as tap into more labour market potential. This has been a factor in decisions for new production sites for companies like Nestle and Post. Still, the selection of a production site is a lengthy process in which many other factors are considered. In case production facilities can’t be moved easily, companies are more likely to invest in the attractiveness of local communities instead.

Mounting headwinds for economic growth, but labour shortages likely to linger

The US experienced a technical recession – two consecutive quarters of falling economic output – in the first half of 2022. But we wouldn’t term this a “proper” recession given the economy has added more than 3.5 million jobs since the start of the year and consumer spending has been rising. Instead, the contraction was caused by weakness in trade and inventories, which is going to reverse in the third quarter. Moreover, the plunge in gasoline prices is improving consumer spending power and we expect to see the economy expand by 3% in the current quarter.

However, inflation is running at 8.5% and the Federal Reserve is focused on raising interest rates in order to dampen economic activity and constrain price pressures. The dollar is also strengthening, adding a further headwind to US growth at a time when China’s economy is struggling and Europe’s energy crisis is leading it to a recession. We are concerned about the medium-term outlook for growth – it could feel much more like a “real” recession late this year and into 2023. The US housing market is already weakening with falling demand leading to declining transactions while rising supply is intensifying price falls. A significant downturn in the US housing market would intensify the recessionary forces in the US.

The macro outlook implies rising unemployment, which may contribute to a greater labour supply to release some of the pressures within the food sector. That said, many industries continue to experience worker shortages and even if vacancies do drop (remember there are two vacancies for every American right now) it may remain tricky to hire the right people. After all, there will still be more secure and fewer physical job options available for people who (re-)enter the labour market. This suggests worker shortages along the food supply chain won’t be resolved imminently.

Nonetheless, recession and consumer caution suggest that consumers will be very price sensitive. When consumers trade down this will be negative for some food producers, but it can also imply that other food companies face even more difficulties to keep up as demand for their products increases. One example is poultry which is generally seen as the most economic option in the meat aisle. Another example is frozen foods which can be a cheaper substitute for fresh products. Either way, it remains crucial for food producers to be able to adjust their production volumes and product ranges quickly.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article