US: Federal Reserve acknowledges the positives

No policy change from the Federal Reserve today, but a more upbeat assessment on the outlook hints at the first steps on the path towards tapering QE asset purchases. We believe this will be announced before the end of the year and suspect interest rates will rise much sooner than the Fed's current 2024 guidance suggests

Language changes hint at a shifting stance

The Federal Reserve has left monetary policy unchanged with the Fed funds rate range still 0-0.25% and monthly QE asset purchases kept at $120bn split $80bn on Treasury securities and $40bn on MBS.

However, there are some important tweaks to the statement and also the messaging in Fed Chair Jerome Powell's subsequent press conference. To us, they suggest a growing optimism within the FOMC, potentially laying early groundwork for a tapering of their QE program before year-end, despite Powell saying it isn't yet time to have that conversation.

Most significantly the Fed has dropped its assessment that the pandemic “poses considerable risks”. Risks do of course “remain” and the recovery is "uneven and far from complete", but this is a notable shift from the Fed. Powell suggests the successful vaccination program and additional fiscal support are key factors behind their upgraded assessment.

For the Fed risks do 'remain' and the recovery is 'uneven and far from complete'.

They also acknowledge the recent firm activity data and improved jobs market. Both are recognized as having have “strengthened”, whereas in March they had merely “turned up recently” after a period of moderation. The sectors most adversely impacted by the pandemic have also “shown improvement”, where there was little six weeks ago.

As for inflation, it is noted as having “risen”, but this is “largely reflecting transitory factors”. Powell reiterated this in the press conference, stating in his view it reflects "one time" increases in prices.

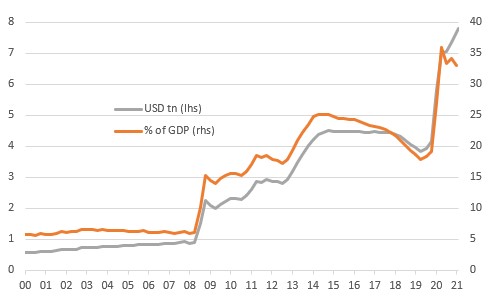

Assets on the Federal Reserve's Balance Sheet (in USD trillions and as a % of GDP)

Risks skewed towards early policy rate rises

This more positive message means that we continue to view the risks skewed towards an earlier reversal of the Fed’s loose policy stance than their guidance currently suggests.

Tomorrow’s 1Q GDP report is likely to show another fantastic growth figure – consensus is 6.8% while we forecast 7.4% annualized growth, led by stimulus-fueled consumer spending. With the vaccination program meaning more than 142 million Americans have had at least one dose and the economy opening-up more and more each day the growth rate could be in double figures for the second quarter.

For 1Q GDP consensus is 6.8% while we forecast 7.4% annualized growth.

This is leading to more job opportunities with next week’s April employment report potentially showing a million more people in work than in March. We expect this positive momentum to continue through the summer. With expanded and uprated unemployment benefits meaning companies are having to offer more attractive pay packages to attract new staff, this implies more costs for companies and potentially more inflation as well.

Consumer price inflation is already likely to hit 4% in April/May and we suspect it will be somewhat stickier than the Fed is publicly acknowledging – largely due to house costs developments and ongoing supply capacity issues.

Given this strong activity, jobs and inflation backdrop we continue to think that the Fed will announce a tapering of asset purchases before the end of the year. We may hear the first hints of this at the June FOMC meeting, with more substantive acknowledgement of “substantial further progress” having been achieved by the time of the Fed’s Jackson Hole Conference in late August. We currently look for the first-rate hike to come in 1H23, with the odds increasingly skewed in favour of an even earlier move versus the Fed’s current guidance of 2024.

The bond market is increasingly believing what it hears from the Fed, for now

Strong demand for fixed income had been the dominant rationale for market rates coming off the March highs.

However, market rates had been creeping higher in the days leading up to the FOMC outcome, not because anything material was expected, but more on account of a lack of inspiration to continue the test lower. Demand for fixed income can go so far, but when the macro data are persistently pointing in the other direction, it becomes difficult for the bond market to resist. The 5yr area of the curve had begun to re-cheapen too, another sign pointing to upside pressure for inflation.

The 5yr area of the curve had begun to re-cheapen, another sign pointing to upside pressure for inflation.

While comments from Fed Powell nodded in acknowledgement that things have improved, it is also clear that the Fed is not for moving away from a super easy policy setting. This leaves the back end of the curve still quite unprotected to unexpected inflation.

That said, the Fed remains confident that medium-term inflation will remain at 2%, and so far the market place is paying a decent amount of respect to this aspirational forecast. This is supporting the persistent ongoing demand for fixed income, including strong pension fund interest that continues to see its fixed income holdings increase. Ongoing Fed buying is another important contributor here.

The impact effect post Powell has been a further test lower in rates. We doubt this will be the aggregate outcome. Rather this is a downside test that is supported by a confident Fed. But it is still a downside test within a bigger picture uplift trajectory for market rates as we push through the coming months.

Patient Fed reins in dollar’s advantage

The dollar had headed into this FOMC meeting on the soft side and the first reaction to today’s statement is for the dollar to soften a little further. Despite the Fed starting to acknowledge the improvements in the economy, the FX market is more interested in signals as to when monetary accommodation will be withdrawn – and those remain lacking. This presents a window for a further dollar decline.

The FX market is more interested in signals as to when monetary accommodation will be withdrawn – and those remain lacking.

From the one side, the Fed is prolonging the period of deeply negative real interest rates and encouraging investors to raise FX hedge ratios on holdings of US assets. From the other, this Fed patience is a allowing monetary normalization stories to advance elsewhere in the world and narrow the dollar’s advantage.

In Norway, Canada and potentially even in the UK central banks are expressing increasing confidence in the recovery and announcing plans to reduce stimulus. NOK, CAD and GBP are the outperformers in the G10 FX space this year and we expect that pattern to continue.

While wary of picking up pennies in the carry trade in front of the potential steamroller of a bond market tantrum on Fed tapering, we do think that seven weeks until the June FOMC meeting is a long time to be holding dollars waiting for the sky to fall in. Instead, if cross-market volatility continues to sink and commodities continue to advance, selected high yield and commodity currencies should continue to perform well against the dollar. Here we like the MXN and in Europe the RUB should continue to perform well on a front-loaded CBR tightening cycle.

The low-yielders – especially the JPY - are typically more susceptible to higher US rates, but assuming the US rate rise does not get out of hand, even EUR/USD may gently advance to the 1.22/23 area as investors focus on European fiscal stimulus and emerging signs of an encouraging 2H recovery in Europe.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more