US economy remains resilient, but there are risks ahead

The US economy shrugged off the effects of Omicron and should be relatively resilient to the headwinds caused by Russia’s military aggression in Ukraine by virtue of being an energy producer and having limited direct economic linkages. Higher interest rates are coming with 2% still targeted for 10Y Treasuries and eventually the Fed funds rate

Russia's actions create headwinds, but rate hikes are coming

The consequences of Russia’s actions undoubtedly pose challenges for the US economy. Higher energy costs will erode household spending power and hurt confidence while pushing annual inflation up to 8%. There are more difficulties for global supply chains while freight routes are also being impacted, putting up costs and causing delays. The fact that the US is a major energy producer helps mitigate some of the economic pain though. Oil and gas rig counts are rising sharply and this will boost industrial output while also creating jobs. US military exports may also receive a boost as European governments re-evaluate defence spending.

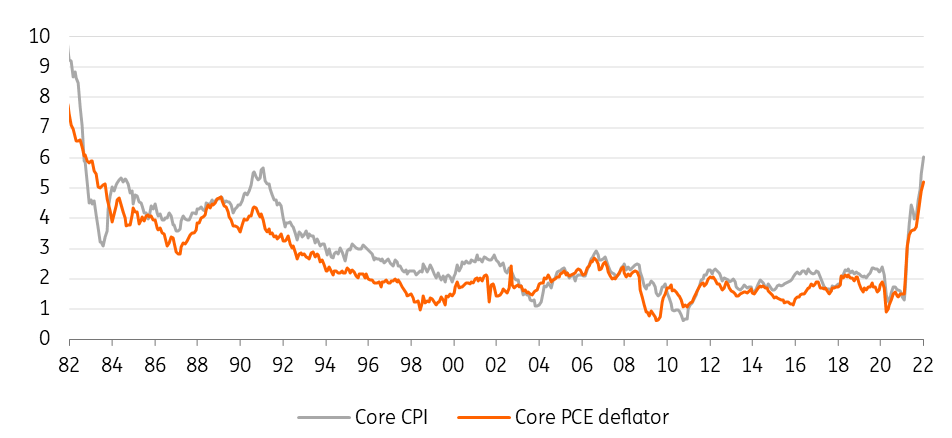

US inflation at 40-year highs (ex food and energy measures YoY%)

Despite the uncertainty that the conflict creates, we expect the Federal Reserve funds target rate range to be increased to 2-2.25% by mid-2023. In fact, we think the Fed will opt to front-load them with six 25bp hikes coming in 2022, with additional tightening likely in early 2023. The Fed is also set to announce a passive rundown of its balance sheet in 2Q22 from its current bloated state of $9tr.

Geopolitics is also going to take up political bandwidth on Capitol Hill with President Joe Biden’s Build Back Better investment plans in tatters. Polling currently offers little encouragement for the Democrat Party at the November mid-term elections, which risks severely constraining the president’s ability to pass legislation in the second half of his term.

Omicron fails to dent the mood

We had been fearful that the Omicron Covid-19 variant would severely derail the economy in the first quarter given the steep drop in consumer mobility data. While it clearly prompted some caution, the recent data shows it failed to dent consumers' appetite to spend and didn’t deter businesses from placing more orders.

The economy also saw much stronger job creation than anticipated with company payrolls expanding 467,000 in January with 709,000 of upward revisions for the previous two months. The numbers would have been even stronger were it not for a lack of applicants. The competition to find workers is intense with 1.7 vacancies for every unemployed person in America and this huge demand-supply imbalance in a strong growth environment is prompting companies to raise pay sharply.

Consumer spending starts the year strongly

Price pressures continue to build

Companies appear to have little problem passing these higher costs on to their customers. The National Federation of Independent Businesses reported a record proportion of companies (a net 61%) who have hiked their prices in the past three months – note that this survey goes all the way back to 1974!

With the US economy posting solid growth, unemployment down at 4%, and inflation running at the fastest rate for 40 years, interest rates look set to be increased in March. A 50bp move cannot be ruled out, but the probability of such aggressive action has declined sharply in the wake of Russia's invasion of Ukraine.

A benign outcome, but there are risks

We are forecasting a relatively benign outcome for the US over the next couple of years. Tighter monetary policy and a less expansive fiscal stance combined with improvements in supply chains, rising worker productivity, and a better geopolitical backdrop allow for inflation to return to target. Higher interest rates will slow growth, but the strong jobs market can keep things ticking along nicely.

Aside from an escalation of Russia's military actions leading to a collapse in global confidence, the obvious risk to this narrative is if the Federal Reserve ends up moving more aggressively in response to a persistent inflationary environment. The housing market would be particularly vulnerable with mortgage rates having already risen sharply, which has prompted a steep drop off in mortgage applications for home purchases. At the same time, the US is seeing the highest number of building permits and housing starts since 2006.

While not our central scenario, a major swing from excess demand to excess supply in the housing market would depress prices, confidence, and construction activity, but it would also drag broader inflation rapidly lower given housing’s heavyweight in the overall index. It is something we will be keeping a watchful eye on.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

3 March 2022

ING Monthly: The Russia-Ukraine crisis forces a global reassessment This bundle contains 14 Articles