US: Dangerous deficits?

Given the pace of economic growth and record levels of employment, it's remarkable that there is a possibility of a $1 trillion government deficit next year. Here we take a look at where the US deficits headed

In recent years there has been a pattern of heavy winter storms and prolonged snowfall depressing economic activity in 1Q before the data rebounds strongly as the weather improves. 2014 saw GDP contract -0.9% in the first quarter, 2016 saw just 0.6% annualised growth and 1Q17 experienced growth of 1.2%. There was bad weather at the very start of 2018 too, but we are hopeful that disappointing retail sales and industrial production numbers for January will be improved upon in February and March.

Why we don't subscribe to President Trump's view

Economic momentum appears strong, with business and consumer surveys indicating confidence is high, while tax cuts, looser fiscal policy and President Trump’s infrastructure plans should provide extra support over the next couple of years. The fact that equity markets have recovered most of their losses following the recent correction should also go a long way to ease fears of a negative economic reaction. Consequently, we believe the US GDP can still grow close to 3% annualised in 1Q18 and can post 3% for the full year 2018 .

However, we do not subscribe to President Trump’s view that the stimulative benefits from tax cuts and higher spending will offset the near-term hit to government finances. Instead, the prospect of widening fiscal and current account deficits could become an increasingly important topic for financial markets.

Widening fiscal deficit is a concern

More chatter regarding US "twin deficits"

We are now looking at a possible $1 trillion government deficit next year, equivalent to around 5% of GDP. This is remarkable given the pace of economic growth and the record levels of employment and corporate profitability. The last time we saw such a disconnect between low unemployment and a widening deficit was in 1968 when the US was spending 9.5% of GDP ramping up the war effort in Vietnam.

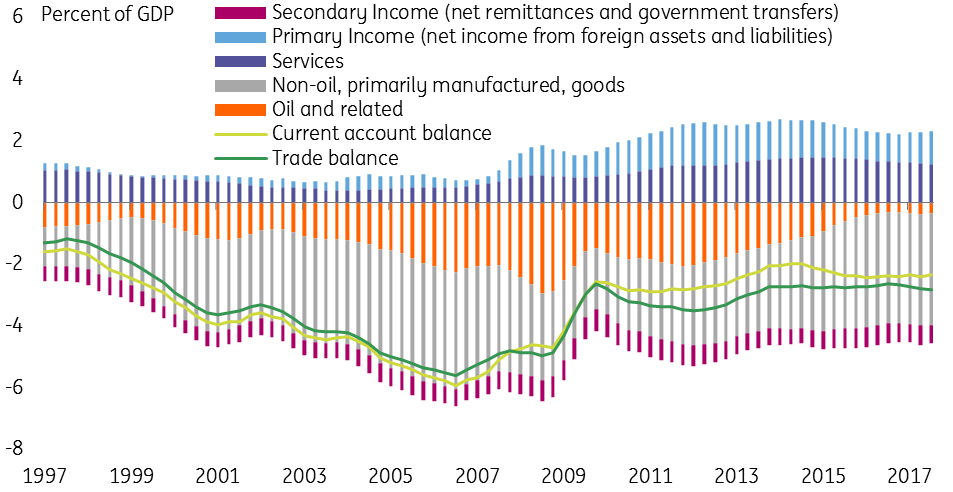

This has contributed in part to the recent sell-off in Treasuries and is leading to more talk about risks for the US dollar. “Twin deficits” on the government fiscal position and the US’ current account have historically been bad news. However, we expect to see greater stability in the current account than on the fiscal side. The dramatic improvement on the oil balance thanks to US shale output has been a clear positive while the dollar’s fall and stronger external demand should help to stabilise the goods position. Nonetheless, this bears watching, particularly given the uncertainty following President Trump’s announcement on steel and aluminium tariffs and the risk of retaliation.

But oil is stabilising the current account position

But the US story looks very positive in near term

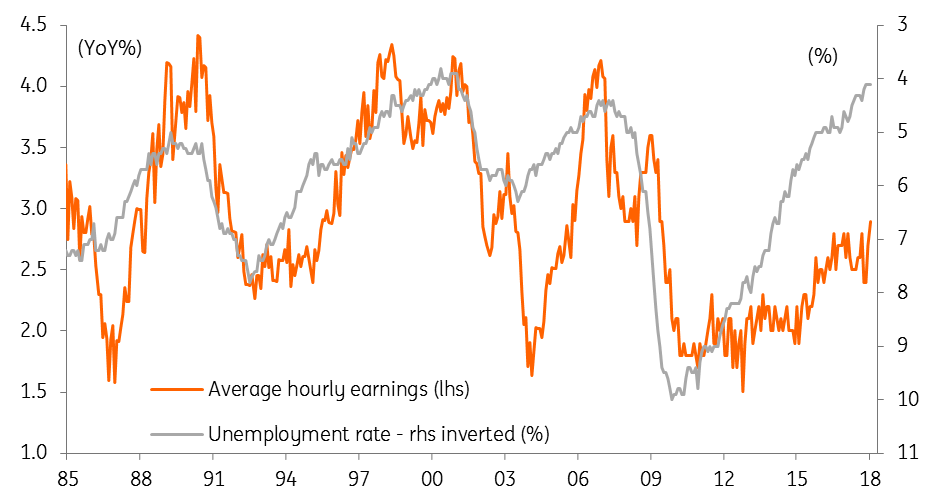

That said, the near-term economic outlook is very positive, particularly for consumer spending. Wage growth has been the missing link in the strong economic growth, tight jobs market story and it finally looks as though something is happening. The 2.9% YoY reading recorded in January was the highest since June 2009 and is likely to be repeated in February before pushing above 3% in March.

Wages finally responding to tight jobs market

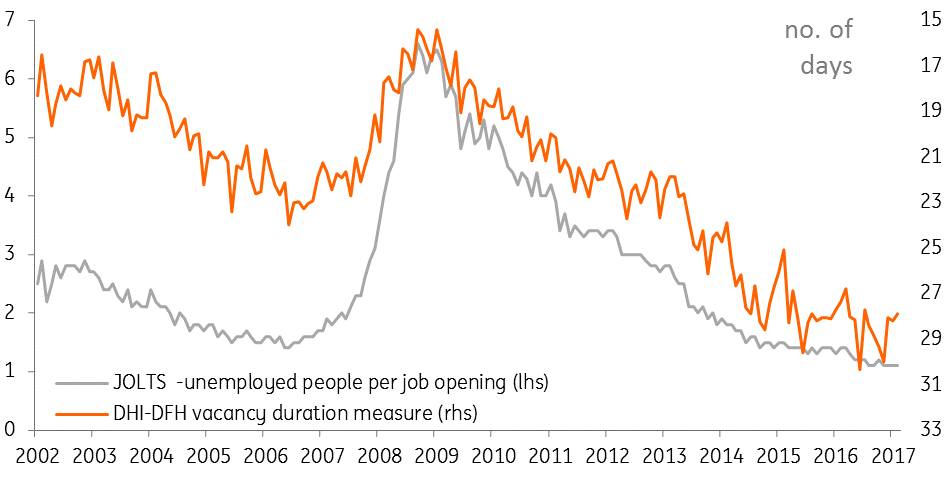

Other evidence backs this story, with the National Federation of Independent Businesses reporting that the net proportion of firms raising worker compensation is at its highest since 2000. Their membership also suggested we have to go all the way back to 1989 to find when the net proportion of businesses planning to raise worker pay was higher. At the same time, it is taking longer than ever to fill vacancies while there is barely one unemployed person for every job opening being created.

Given the US is predominantly a service sector economy and wages are the dominant cost input to such a business, these developments suggest inflation pressures will continue to build – even after taking into account productivity improvements. After all, in an environment of such strong demand, corporates have the pricing power to pass on higher costs. At the same time, rising commodity prices and a weaker dollar are adding to pipeline price pressures while housing and medical care costs are on the increase.

The unwinding of distortions relating to cell-phone data plans will add 0.2-0.3 percentage points by April, and the gradual erosion of slack in the economy will also nudge up inflation pressures. As such we still believe that headline consumer price inflation could hit 3% in the summer.

Worker scarcity is making it harder to fill positions

We are now looking for four Fed hikes

At the moment the Federal Reserve is projecting that it will raise rates three times this year, with financial markets currently pricing in around 80bp of Fed rate hikes by December. We have decided to insert a fourth 25bp move into our forecasts given the risk of a damaging government shutdown has been pushed out into the long grass following the recent budget deal agreed by Congress. We are now forecasting one rate hike per quarter.

Risks to Treasury yields are increasingly to the upside

The Treasury market has responded to this strong growth, higher inflation risk environment with the 10Y yield pushing close to 3%. We believe it will soon break above and could potentially touch 3.5%, given our view that the market is a little too relaxed about the path for inflation and Fed policy (remember the Fed is also shrinking its balance sheet). Should worries regarding the fiscal deficit intensify, the risk to yields will be increasingly to the upside.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more