US confidence wobbles as costs bite

US consumer confidence is being threatened by the rising cost of living. Thankfully the relationship between spending and sentiment has been weak for a number of years and the strong underlying economic position means spending will continue to grow. Meanwhile, people continue to quit their jobs in record numbers as pay rates rise

Confidence hits a 10-year low

In a major surprise move US University of Michigan consumer sentiment has fallen to a 10-year low, which underscores how concerned households are about inflation. A rise was expected given the improvement in jobs, wages and wealth, but $3.50/gallon for gasoline is clearly an issue that households feel strongly about.

The one thing to say in mitigation is that the relationship between sentiment and spending broke down the day Donald Trump was elected President with politics driving a wedge between how households view the economic outlook. Also, the chart below shows a massive disconnect between the Michigan survey and the Conference Board index so caution is warranted in over interpreting today’s number.

University of Michigan confidence versus Conference Board confidence measure

Ignore politics and be happy

For what it is worth, confidence amongst Republicans hit new all-time lows (a 17 point drop), for Democrats there was a more muted 5.3 point drop. However, for people classifying themselves as independents there was actually a 3.4 point rise. Maybe if we all ignored the politics everyone would feel much happier! In any case, all high frequency data suggest that spending has surged late September into early November with GDP expected to grow 6%+ annualised in 4Q 2021.

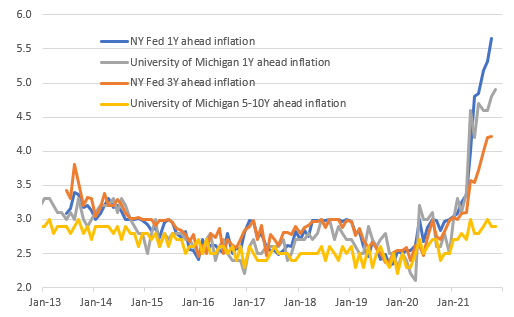

The details show households are increasingly optimistic on incomes and their financial balance sheet, but feel that none of this will keep pace with the cost of living – just 36% expect incomes to run faster than inflation over the coming 5 years with a declining number expecting their pensions to afford them a satisfactory standard of living. On spending it is universally agreed to be a bad time to buy a car, house or any major household item and a good time to be selling any of those things. This is an issue for the Federal Reserve as much as it is for President Biden and with inflation set to stay higher for longer at a time when inflation expectations continue to rise the case for ending QE swiftly is a strong one.

Inflation expectations not looking quite so anchored at 2%

Demand for workers is dwarfing supply = higher pay

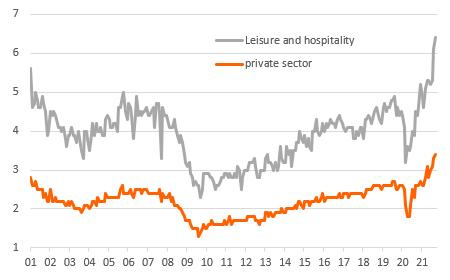

As for the job opening and labour turnover statistics (JOLTS) we have a new high for the quit rate – the proportion of people quitting their job to move to a new employer. 4.4 million people quit their job in September, equivalent to 3.4% of workers moving to a new job in the private sector, with 6.4% doing so in the leisure and hospitality industry, 4.4% in retail and 3.6% in trade and transportation.

This feeds the narrative that companies are paying up to compete for staff in an environment where labour supply is tight with firms also increasingly paying staff more to retain them. This has already been seen in the huge jump in the employment cost index in 3Q while the National Federation of Independent Businesses reports record numbers of firms expecting to raise worker compensation in coming months.

Job openings – the number of vacancies – remains extremely elevated at 10.4mn so based on the October's payroll increase it will take 20 months to fill these vacancies. We all remain hopeful that the labour participation rate will increase soon – maybe the expense of Thanksgiving, Christmas etc will incentivize people – but based on the current data wage pressures will intensify.

The quit rate continues to climb – proportion of workers quitting their job to move to a new employer

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more