US: Racing back to life

The unprecedented stimulus has lifted US economic activity to within a touching distance of its pre-pandemic levels. President Biden isn't finished with more money on its way to complement a private sector reopening spending splurge. The result is likely to be an economy that is larger than would have been the case had the pandemic not occurred

Almost there

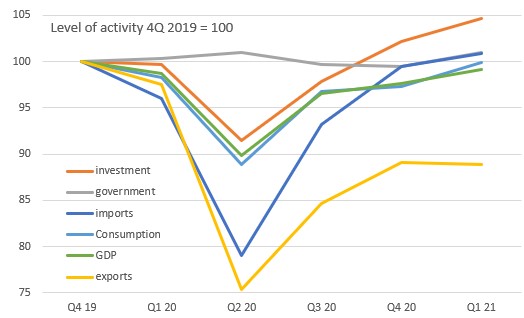

First-quarter GDP growth numbers for the States show the US economy has recovered virtually all its lost output, having contracted a 10% peak to trough last year.

Investment spending is now higher than before the pandemic started thanks to a combination of the red-hot property market leading to a surge in residential construction, while the shift to working from home has seen huge investment in IT infrastructure.

Consumer spending is just 0.1 percentage point below where it was in the fourth quarter of 2019, having fallen 18% between January and April last year. Credit here, of course, goes to government support efforts - expanded and uprated unemployment benefits and stimulus payments - that means income levels actually rose throughout the pandemic despite millions of people losing their jobs.

Government spending is also higher, but trade remains an overall drag with strong domestic demand sucking in imports while ongoing Covid-19 containment measures overseas and weaker economies mean exports have lagged. Inventories have also been run down, which has subtracted from growth.

Level of real GDP components

Even better than a full recovery

High-frequency data, be it daily credit and debit card transactions, restaurant diners or air travel passengers, suggests the momentum has continued into the early part of the second quarter.

With 150 million Americans now having at least one dose of the Covid-19 vaccine and hospitalisations and casualties having plunged, the US is on track to be fully reopened by the end of the summer. This process is already offering a greater range of options on which to spend money and is creating more and more job opportunities, particularly in the hard-hit leisure, hospitality and travel sectors.

The US is on track to be fully reopened by the end of the summer

Consequently, with consumers feeling cash-rich and eager to spend and businesses looking to expand, we fully expect the US economy to post double-digit annualised growth in the second quarter. The economy will be further boosted by President Biden’s plans to inject another $2.2tn in infrastructure investment and $1.8tn of social spending, funded partially by tax hikes on the wealthy and corporates.

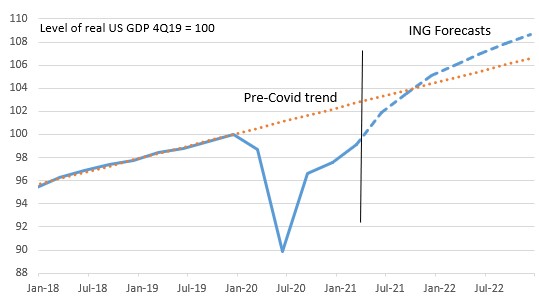

Not only will the US have fully recovered all the lost output this quarter, we now forecast the US economy will end the year 2% larger than if the pandemic had not hit and the US economy had merely continued growing at its 2014-19 trend. Given this situation, we are increasingly confident that the US will be back to new all-time highs for employment within the next 12 months.

GDP to break above pre-pandemic trend

Inflation is brewing

The key issue for the Federal Reserve is whether this generates inflation in a meaningful way. For now, they remain sanguine, arguing that there is significant spare capacity in the economy and while there will be “frictions” in the near term that will see inflation temporarily move above target, we shouldn’t be too concerned over the medium term.

We are a little more nervous. We suspect there has been some scarring of the economy’s supply capacity that could mean inflation stays higher for longer; the global semiconductor shortage is a case in point. Inflation is already evident in commodity prices and freight costs while the producer price report points to growing pipeline price pressures. House prices will also add significant upside risk to CPI over the next 12 months.

We are also starting to see some evidence in the labour market with the employment cost index recently posting its biggest rise in 15 years as home-schooling and expanded unemployment benefits raise the level of employee compensation required to attract workers.

At the same time, companies are seemingly more able to pass higher costs onto customers. The National Federation of Independent Business survey reported the strongest intentions to raise prices since the late 1970s and early 1980s. We also know from the ISM reports the backlog of orders are at record highs while customers’ inventories are at record lows – the perfect scenario for the return of corporate pricing power.

Rate risks are rising

The Fed has made it clear that under their new mandate they are prepared to let the economy run hotter for longer to ensure the recovery is felt by the broadest possible range of people and will tolerate a period of above-target inflation to make sure that happens. However, given our growth, jobs and inflation projections we feel that the Fed will soon need to acknowledge the “substantial further progress:” that would be the trigger for the first steps on the path towards tighter monetary policy.

We expect to see a substantial shift in Fed language at their August Jackson Hole Conference that would pave the way for a December QE taper announcement.

With asset purchases likely to be run down to zero within around 12 months this leaves us to favour an early 2023 starting point for interest rate rises. In our opinion, the risks are more skewed towards an even earlier starting point rather than the 2024 date Fed officials are currently projecting.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

Federal ReserveDownload

Download article

6 May 2021

Someone left the cake out in the rain… This bundle contains 12 Articles