US: As good as it gets?

The US continues to perform strongly and wages are finally gathering pace. But protectionism and a weakening global outlook are significant risks for 2019 and the cumulative effects of Federal Reserve interest rate increases, fading support from the fiscal stimulus and the stronger dollar will contribute to a slowing in growth

Strong economy, for now

Ten years on from the global financial crisis and it is safe to say that the US has come out in a far stronger position than most other major economies. Output is up 23% from the 2009 trough, while there are over 20 million more people in work. Inflation is broadly consistent with the Federal Reserve’s mandate, interest rates have been increased, the central bank’s balance sheet is being run down and the dollar is in the ascendancy. 2018 has been a particularly good year, with the US economy likely expanding at the fastest rate for 13 years and the unemployment rate falling to a 49-year low. The key question for markets, as underlined by recent equity weakness, is how long can this continue?

In the near-term, the story remains very positive. There is broad-based momentum in the economy with huge tax cuts providing additional thrust. Given this environment, the Federal Reserve chose to raise its policy rate corridor in each of the first three quarters of the year with another rate rise looking highly probable in December. After all, the economy is booming, inflation is at or above the 2% target on all the key measures and the jobs market is finally generating wage pressures.

Growth momentum remains strong with the Federal Reserve set to raise rates again in December

However, the US economy will face increasing headwinds in 2019 as the lagged effects of higher interest rates and a stronger dollar act as a brake on activity. The support from the fiscal stimulus will also gradually fade, with the split Congress mid-term election results limiting the chances of additional significant tax cuts or spending increases. Then there is the weaker global growth outlook, with Europe and Asia seeing clear signs of slowdown. Intensifying trade protectionism could exacerbate the softening trend.

Recent Federal Reserve comments have acknowledged these external risks, although officials, in general, remain broadly upbeat on the domestic US story. Still, we see some signals that are potentially troubling. The housing market has been the most notable area of softness, which is understandable given 30Y mortgage rates are close to 5.2% right now – the highest for eight years. Home builder confidence has fallen quite significantly this year while the number of transactions has fallen gradually over the past 18 months. This suggests that construction activity will be a drag on growth in 2019.

Investment slowdown underway

Some positive signs

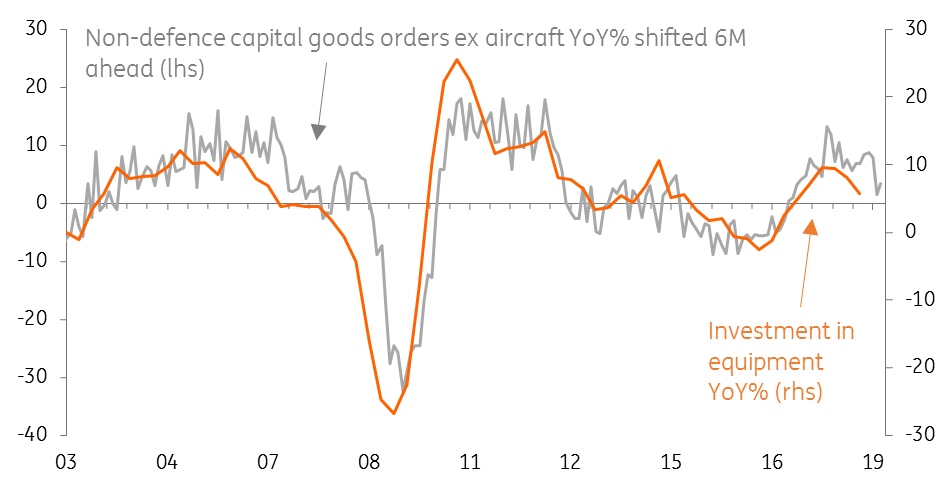

Furthermore, corporation tax cuts do not appear to have yielded the results in terms of domestic investment that President Trump had been hoping for. We are already seeing some signs of softness in durable goods orders, which as the second chart shows, tends to lead investment spending. Instead, a significant amount of those tax cuts appears to have been used to fund share buybacks and special dividends. Additionally, the recent bout of equity market weakness isn’t going to be helpful for business sentiment with regards to investment programmes.

That said, it is important to point out that there are positives. Wage growth has broken above 3% year-on-year and we think there is more upside ahead given the tightness of the labour market. Indeed, the NFIB survey suggests that companies are finding it increasingly difficult to find labour and are consequently increasing compensation while the Federal Reserve has noted greater competition on benefit packages including healthcare, vacation days and signing bonuses. If we are right and wages continue rising, this will support consumption while adding to medium-term inflation pressures.

Moreover, the $30 drop in the oil price since the start of October could be viewed as another mini-stimulus for the consumer. It certainly leaves drivers with more money in their pockets after they fill up on gasoline.

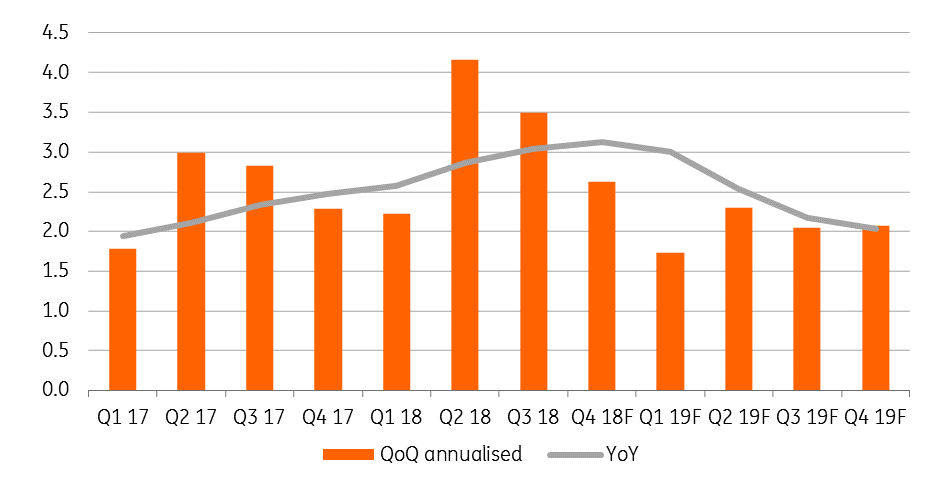

US GDP & forecasts (%)

Outlook for Fed policy

Back in September, the Federal Reserve withdrew its assessment that monetary policy was “accommodative” and the latest comments from Fed Chair Jay Powell suggest the central bank is “closing in” on neutral policy. The criticisms of the Federal Reserve policy stance by President Trump, combined with what appears to be a toning down in Powell’s comments regarding the monetary policy stance (back in November the Fed had suggested the US was a “long way” from neutral), mean that markets are only pricing in two rate hikes by the end of 2019.

However, we remain some way off policy being labelled “restrictive”. On balance, we think growth will slow to around 2.4% in 2019, but inflation will likely persist above target for much of the year thanks to those wage increases and the prospect of higher imported costs caused by an escalation of protectionist measures. As such, we expect interest rate rises to continue in 2019, but we favour three 25 basis point rate rises in 2019 versus four in 2018.

The risks for 2019 seem skewed to the downside

As for the risks for 2019, they seem skewed to the downside. We are not optimistic on a near-term thawing of trade tensions given that China seems to be digging in with a three-pronged strategy of fiscal stimulus, looser monetary policy and a weaker yuan. That doesn’t suggest China is about to come to the negotiating table and offer the concessions President Trump desires on trade access and intellectual property rights. Indeed, tariffs on Chinese imports are likely to be raised and broadened in 2019.

Moreover, should relations worsen markedly we fear that China could use the US’s deteriorating fiscal position and the fact the Federal Reserve is running down its balance sheet as a way of fighting back against the US administration. China holds 20% of US Treasuries, and while it won’t sell those Treasuries, it could choose not to turn up at future Treasury auctions. Given China is typically such a huge buyer, this could mean a failed auction. The result could be a spike in yields, which would have ramifications for US equities and by extension, the US economy. Domestically, tensions could remain high on Capitol Hill. The Democrat sweep of the House of Representatives means that President Trump’s legislative agenda is likely curtailed and there will be a risk of government shutdowns as legislators battle over the budget and potentially the debt ceiling. However, the President could try to forge a grand bargain with the Democrats in an effort to get an infrastructure budget through. While it seems unlikely at the moment it is not beyond the realm of possibility as he seeks re-election in 2020. Such an outcome would be a positive surprise and support growth and employment in coming years.

Download

Download article30 November 2018

December Economic Update: Avoiding Hard Choices This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more