US: A positive outlook despite softer housing figures

US housing starts and building permits were weaker than expected in June, but consumer fundamentals are in good shape and plummeting mortgage rates are stimulating demand, offering hope for a turnaround

Soft June for housing

June US housing starts – the number of new residential construction projects started – have come in a little softer than expected. 1253k projects got underway last month, 0.9% down on May, versus the consensus forecast of 1260k. Building permits were down 6.1% month on month, leaving them at their weakest level since May 2017.

The details show the weakness in both housing starts and building permits was caused by a drop in apartment building appetite (multifamily units saw starts fall 9.2% and permits slump 16.8%). Single family units actually rose for both indicators (+3.5% MoM for starts, +0.4% for permits).

Building permits and housing starts both fall (000s)

The sector has faced headwinds

The sector has been facing significant headwinds. Material costs have been rising and there is the obvious exposure to trade tensions given imports of timber and metal. There has also been plenty of commentary around the lack of available lots while the Fed’s Beige Book (latest issue to be published later today) has talked of a lack of labour in the sector despite strong hiring – construction payrolls rose 21,000 in June. This was something that was also picked up on by Federal Reserve Chairman Jerome Powell in recent testimony.

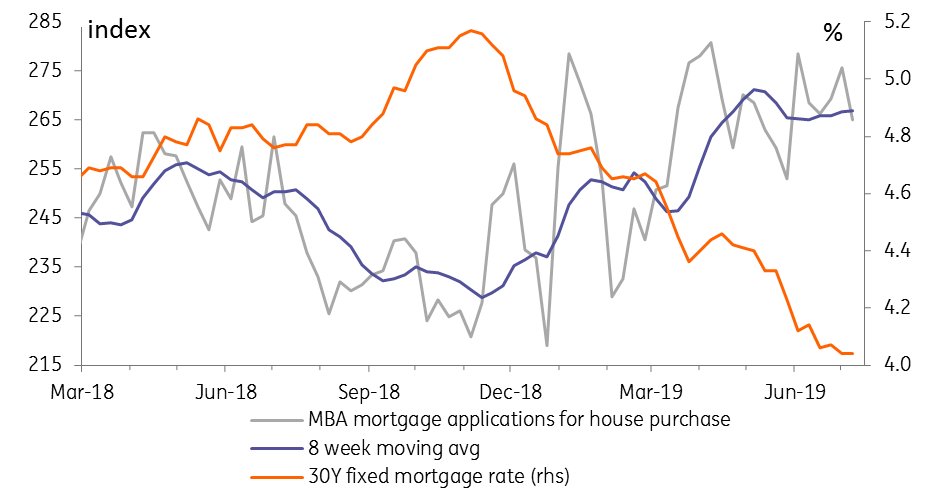

Lower borrowing costs are stimulating home buyer interest

Reasons for optimism on housing

Nonetheless, we remain upbeat on the prospects for US housing. After all, the consumer is in great shape with employment at record levels, wages rising strongly in real terms and confidence remaining firm. Importantly, mortgage rates have plummeted in the wake of the plunge in Treasury yields. The average 30-year fixed rate mortgage is down at 4.04% versus a peak of close to 5.2% back in November. This is making housing more “affordable” despite the strength of home prices. Mortgage approvals for house purchases are looking quite strong as can be seen in the chart above, which should translate into housing demand in the coming months. The NAHB (National Association of Home Builders) index for July also improved, which suggests that like us, builders are hopeful of a turnaround.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article