Unravelling the many value drivers of power prices

Power prices are notoriously volatile and hard to predict. But they are an important value driver of investment in the energy system. This article provides a conceptual framework to analyse power prices so that opportunities and risks can be properly assessed

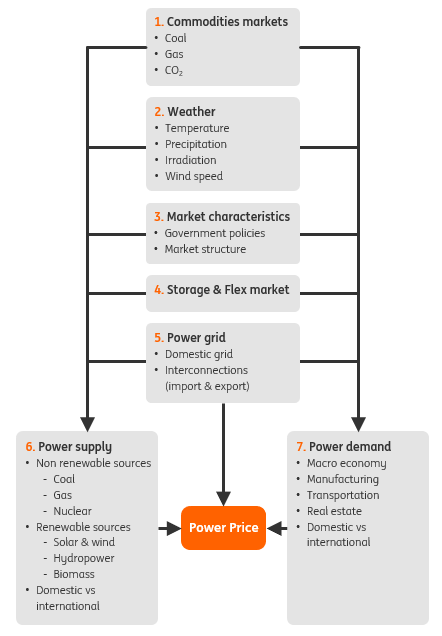

Seven drivers of power prices

In this article, we distinguish the seven most important drivers of power prices.

Commodity markets: gas, coal and carbon prices

According to the International Energy Agency, around 61% of global power was generated in 2020 by power plants that run on fossil fuels, predominantly coal (36%), gas (23%) and to a much lesser extent, oil (2%). During 2020, hydro, wind and solar provided ‘only’ 25% of the electricity and nuclear (~11%) providing must run baseload power. So most of the time, power plants that run on fossil fuels are the price setting technologies in the merit order of power markets. The marginal costs of these power plants are determined by commodity prices, notably coal (in China and India) and gas (in most European countries and the US).

Most of the time, gas fired power plants set the power price in Europe.

There is no shortage of long term supply of coal and gas. Proven coal reserves are by far the largest and most carbon intensive fossil fuel with around 140 years of current demand available. Proven oil and gas reserves stand at 50 to 60 years. Short-term supply heavily depends on supply chain disruptions, geopolitics, collusion in oligopolistic markets (or the lack of it) and current prices that determine the level of investment in new fossil based capacity. Many of these factors are inherently unstable, so while our 2021 Energy Outlook and Commodities Outlook provide a detailed forecast for the coal and gas markets, these markets can swing in an instant.

While there are plenty of fossil fuels available to meet future energy demand, climate policies to limit global warming provide a limitation to fossil fuel use, in particular the use of coal for power generation. The Net Zero Scenario by the International Energy Agency for example limits global warming to 1.5˚C, but requires a strong reduction in unabated coal and gas fired power plants. In this scenario, by 2050, almost 90% of electricity generation comes from renewable sources, with wind and solar PV together accounting for nearly 70%. Most of the remainder comes from nuclear energy that also does not produce emissions. In other scenarios such as the IEA Sustainable Development Scenario and ING's Fast Forward scenario, gas acts as a transition fuel and global warming is close to 2.0˚C. In all scenarios, carbon pricing, is an important policy instrument to bring about such a world, next to the continuation of subsidies on clean technologies. So in addition to coal and gas prices, carbon prices matter too.

Quantitative research shows that changes in power prices are, to a large degree, driven by changes in commodity prices.

Examples of the impact of commodity markets on power prices:

- Geopolitical conflicts can cause gas and coal prices to increase, leading to higher power prices.

- Meeting the Paris Climate Agreement Goals requires a fast and strong energy transition, including in the power sector. This requires the phase out of cheap but carbon intensive coal-fired power plants. Power prices could increase as a result.

- Rising carbon prices lead, all other things being equal, to higher power prices.

The weather increasingly impacts power prices, but shows a high degree of unpredictability

The weather can impact power prices in the short, medium and long run. In the short run irradiation and wind speed (for solar and wind power) and temperature and precipitation (for hydropower) are important drivers of power prices.

Weather unpredictability means that even with perfect models and understanding of initial conditions, there is a limit to how weather forecasts are of use in predicting power prices.

But there is a limit to how far in advance accurate weather forecasts are possible. Scientists show that the weather predictability horizon is limited to 10 to 14 days only. So weather unpredictability means that even with perfect models and understanding of initial conditions, there is a limit to how weather forecasts are of use in predicting power prices.

The weather also has a medium term impact on power prices as the weather changes from year to year and during the year. Aurora Energy Research shows that the yearly average temperature, precipitation, irradiation and wind speed can range from circa +10% to -10% year-on-year.

Finally, climate change is expected to have a long term impact on weather patterns, for example in the US and Europe. In Europe the impact varies per region. It is still unclear if and how these long term trends impact power prices.

Wind and solar: lower power prices on windy and sunny days

Wind turbines and solar panels can provide the vast majority of power on sunny and windy days in countries with a lot of wind and solar power. The near zero marginal costs of wind and solar power lower the power price as a result. We find that a doubling of the share of weekly power generation from wind and solar power in European countries, on average, lowers baseload power prices by 7%.

Coal and nuclear power plants: weather and cooling water

Heatwaves can also impact power prices through their impact on cooling water for inland nuclear power plants or large coal fired power plants. The temperature of cooling water for nuclear power plants must be fairly constant for safety issues. Rivers often provide the cooling water, but they can run dry to critical levels so that water cannot be used to cool the power production. Or hot waste water discharge is prohibited as it further heats up the fresh water which could negatively impact wildlife through algae growth or fish mortality. The reduction of nuclear and coal capacity during prolonged heatwaves drives up power prices, especially in countries like France, Germany and the US.

Examples of the weather impacting power prices:

- Power prices are generally lower on windy and sunny days.

- Power prices could rise during heat waves.

- A warm winter lowers energy demand and could, ceteris paribus, lower power prices.

Market characteristics set the power dynamics of countries apart

The design of a power market has a huge impact on power price dynamics. In principle there are two market mechanisms: energy only markets versus capacity markets, which differ to the degree that power generators are incentivised to invest in power capacity such as fossil fuel power plants, storage capacity (e.g. batteries) or wind and solar farms.

Capacity markets provide generators fixed payments for their ability to provide power when the market needs it. As such, regular capacity payments cover (part of) the fixed costs of the power generating asset.

In energy only markets, generators solely rely on the power price to recover their costs. When available capacity is limited, prices can go through the roof, which allows generators to cover their fixed costs. These periods of high peak prices are rare and usually short lived, but when they happen flexible capacity generators earn a lot of money.

European countries differ in their power market set-up due to past decisions and the fact that energy policy largely falls under the domain of the member states, so there is no common strategy. The UK has a long history of capacity markets, aiming to provide security of supply to the island’s power system. The Netherlands is predominantly an energy only market, but well connected to the German and Nordic capacity power market. That has resulted in power price dynamics that are very similar to the German capacity market. In the US, energy market design differs from state to state.

Storage and flex markets can smooth out power prices, but need to grow first

Energy has three main applications; heating, transportation and electricity. The price dynamics of electricity markets have always been amplified by the fact that electricity, until very recently, was hard to store. That stands in sharp contrast to heating and transportation as heat and gasoline can easily be stored, both technically and economically.

Technologies to store electricity differ in characteristics and market stage

Storage techniques based on storage duration and storage capacity

The need to store electricity becomes urgent as more renewables enter the power mix and weather conditions cause an oversupply of power. The combined supply of wind and solar power often peaks at noon and can be stored in batteries to meet peak demand in late afternoon when many people return home from work and start to use electricity.

The need to store electricity becomes urgent as more renewables enter the power mix and weather conditions cause an oversupply of power.

The mismatch in renewables supply and demand also has a seasonal component as power supply from solar and wind is high in summer months. In the Northwest European power market this can partly be matched with the vast amount of renewable hydropower from the Nordics, but most European countries lack the potential for large scale hydropower and use gas fired power plants as a back up facility.

Hydrogen, thermal storage and mechanical storage provide promising solutions to ‘store’ electricity. Currently, these markets are still in their infancy and it will take a couple of years before large scale storage facilities can smooth power price dynamics.

Hydrogen provides a promising solution to ‘store’ electricity by converting power into hydrogen and vice versa.

Storage techniques such as batteries and hydrogen offer grid operators more flexibility to

match power supply with power demand in order to manage the grid frequency. This is a complex but important business as even small deviations will cause damage to electrical devices. Owners of energy storage assets can provide these frequency response services to grid operators. These services are expected to become a source of meaningful revenue in the near future.

Apart from storage capacity, demand side management offers new and additional tools to increase the flexibility of the power grid. The so-called ‘flex market’ is about the design of market structures, price incentives and technologies that help shift power demand from peak hours (7am till 8pm on working days) to off-peak hours (night time and at the weekends). Think of electric vehicle smart charging where cars are charged during the night when wind power can be high and prices low. As for many storage solutions the technology is proven, but it is not applied on a large scale yet. It will take a couple of years before flex-market structures are in place that change the behaviour of power-intensive activities of businesses and households to such an extent that it will dampen power price dynamics.

Examples of the impact of storage and flex markets on power prices:

- Power from solar panels can be stored in batteries during sunny hours and used during the classic demand peak in the evening. This helps to match power supply and demand which could smooth power price dynamics during the day.

- The same applies to hydrogen storage facilities which could match weekly or even seasonal variations in power supply and demand, thereby smoothing power demand.

- Smart grids could charge electric vehicles at times when renewable power is in abundance. Increased demand from electric vehicles can support power prices during these hours when they are typically low.

Power grids increasingly determine the speed of the energy transition in power markets

In power markets, one cannot ignore the laws of physics as every electron has to be physically transported through the power grid from the point of generation to the point where it is used by an electrical device. Power markets currently change much faster than the power grid infrastructure. That means that the power grid increasingly is a barrier, both on the demand and the supply side.

Power markets currently change much faster than the power grid infrastructure.

Interconnectors with neighbouring countries and a country's high voltage grid determine the main power flows within a country. For example, the long-time planned Nord-Sud link in Germany is intended to better connect the northern part of Germany (where there is a high supply of offshore wind) with the southern part (where there is high industrial power demand).

The grid matters too on a local scale. In the Netherlands for example, the city of Amsterdam had to temporarily call a halt to the construction of new data centres as the grid could not handle the additional power demand. And in more rural parts of the Netherlands, the planning of new solar farms was put on hold as the grid could not absorb the vast amounts of generated power on sunny days.

It is hard to pinpoint the impact of grid limitations on power prices as they prevent something from happening. As a result, one cannot look at historic prices to determine the impact.

Examples of the impact of storage and flex markets on power prices:

- Grid limitations can prevent heavy power users connecting to the grid or scaling up production. In the absence of grid limitations, power demand could have been higher, likely increasing power prices.

- Grid limitations can prevent new solar or wind farms connecting to the grid. In the absence of grid limitations, power supply from renewables could have been higher, likely lowering power prices.

Supply factors: renewables and interconnectors gain importance

The energy transition is very visible in the power sector due to proven technologies such as solar panels and wind turbines. It’s speed of adoption is determined by the degree of policy intervention from governments and the speed of technological progress. ING distinguishes several energy transition scenarios. In its most ambitious scenario, the Fast Forward scenario which is in line with the Paris Climate Goals, the share of renewables in the global power mix rises from 28% today to 70% in 2040 and fossil fuels are phased out accordingly. We find that increasing shares of wind and solar power can, on average, lower short term power prices and could increase the cost of a low carbon energy system in the long run.

We find that power prices are generally lower as more renewables enter the power mix

With the rise of renewables, power markets need to increase scale in order to balance supply and demand. By connecting countries or states through interconnectors in the power grid, an oversupply of wind or solar energy can be transported to regions where the wind does not blow, skies are cloudy or demand is high due to industrial sites.

Examples of the impact of renewables and interconnections on power prices:

- Higher shares of solar and wind energy in the power mix tend to lower power prices.

- The Northwest European power market is highly integrated through interconnecting transmission cables both on land and sea beds. A high supply of hydro power from the Nordics or wind and solar power out of Germany could set power prices in the Netherlands and Belgium lower.

Demand factors: the business cycle and trend towards electrification matter

There is a strong relationship between economic activity and power demand, particularly in developing countries. In past years, energy efficiency gains in developed countries decoupled power demand from economic growth to some degree. However, Covid-19 has put this relationship in the spotlight again as industrial sites were impacted by lockdowns and supply chain disruptions. Daily power demand is one of the main indicators to accurately forecast Covid-19 induced swings in economic activity, according to ING’s weekly economic activity index for the eurozone.

In the long run, electrification is an important mitigation strategy to meet the climate goals in manufacturing (hydrogen and heat pumps), transportation (electric vehicles) and real estate (heat pumps).

Electrification is an important mitigation strategy to meet the climate goals causing higher power demand.

Power demand will also rise from adaptation strategies to climate change, such as more air conditioning in buildings. We expect current global power demand to rise by 70% to 80% by 2040 as a result. This result is stable across our energy transition scenarios. In our Fast Forward scenario, power demand growth is strong due to rapid electrification, but curbed by high energy efficiency gains in energy intensive sectors. Progress in energy efficiency is much slower in our wait and see scenario, so that moderate electrification also increases power demand.

Examples of demand factors impacting power prices:

- Lower power demand and commodity prices could lower power prices in economic downturns.

- A rise in power demand from electrification in manufacturing, transportation and real estate could, ceteris paribus, set power prices higher.

Forecasting power prices: mission impossible and mission accomplished

Given the uncertainties in the seven value drivers, forecasting power prices in many respects feels like mission impossible. As such, it does forecasters great credit to be humble in their ability to forecast power prices.

It does forecasters great credit to be humble in their ability to forecast power prices.

In this article we have, however, depicted a clear framework to analyse the most important value drivers of power prices. It can be used to analyse long term trends that impact the expected return of a power plant, wind or solar farm over the investment period. It can also be applied to analyse actual developments that impact the monthly or quarterly financials of the asset.

Download

Download article

23 June 2021

Energy transition and power prices: ING’s view on long and short-term price moves This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more