UK: Lockdown to shave 6-7% off November GDP

We expect the return of lockdowns in England will shave upwards of 6% off November GDP, and all-but-guarantees a QE top-up by the Bank of England this Thursday. It may well also add further political impetus for both sides to agree a UK-EU trade deal over the coming days

In short: Economy to record sharp hit on England lockdown

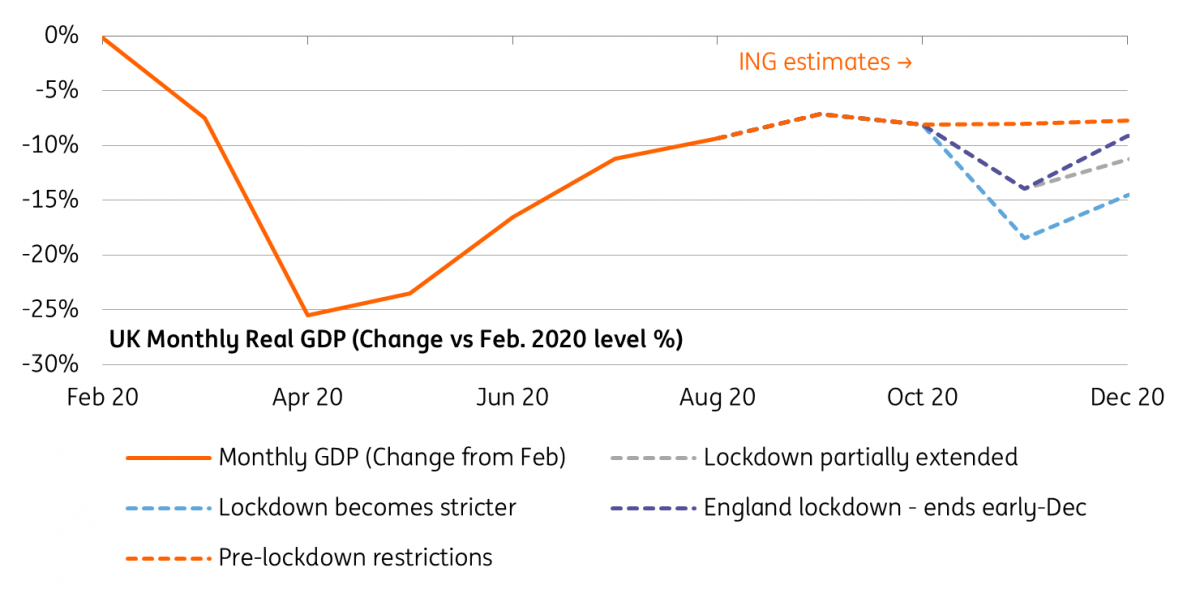

Lockdown measures are set to return to England this week, and we think that will take roughly 6-7% off monthly GDP for November, following a forecasted 1% contraction in October. That figure could rise if some schools are closed, or if there is a knock-on effect on industries not officially required to close.

For the fourth quarter as a whole, that’s likely to mean a contraction of roughly 1.5% if most restrictions are lifted in December, or 2%+ if restrictions last longer.

The economy probably won’t be hit as hard as in April

The effect of the existing restrictions from October and the new ones for November probably will result in a combined hit of roughly 7-8% to monthly GDP. By any normal measure, this is a very sharp contraction. That said, it's clearly not as sharp a decline as we saw at the beginning of the pandemic, where during March and April we saw a 25% contraction.

We think the November lockdown will put the economy back to around 14-15% below its pre-virus levels

The most obvious explanation for this is that this lockdown is not as a restrictive. While the ‘stay at home message’ is similar, the manufacturing and construction sectors will remain open, as will schools. While we’ve assumed a small knock-on effect for these industries, they should largely be able to plough on unaffected.

Were these industries (including schools) to have been hit by closures, then the hit to November GDP would be in excess of 10%.

But it’s also worth remembering that the economy hasn't fully regained its pandemic losses - GDP was still down by 9% in August and we suspect around 7% in September. Put simply, the damage looks less stark than in the initial lockdown, partly because there is less ground to be lost. We think the November lockdown will put the economy back to around 14-15% below its pre-virus levels.

This lockdown will also be different because businesses have adapted. Cafes and restaurants are better set-up to cater for takeaway, while the high street will be more geared up for click-and-collect. That suggests the hit to the most heavily affected sectors - hospitality and retail - may not be as large as it was back in April. Differing restrictions in Scotland, Wales and Northern Ireland, which could remain slightly looser through November relative to England, will also modestly lessen the hit to GDP

We also saw a range of businesses shut in response to the first stay-at-home order in March who were not necessarily required to close. Many essential businesses temporarily halted or limited operations to implement new Covid-19 safety measures. This is much less likely to be the case today.

How lockdown will hit UK monthly GDP

The impact on 4Q GDP depends on how long this all lasts

Prime minister Boris Johnson announced on Saturday that the country will return to its three-tier system in early-December. But the big question is whether the chief scientists will be comfortable that Covid-19 prevalence has fallen sufficiently to justify such rapid reopening. It is likely to be at least 1-2 weeks before we see the rate of case growth slow, and there is uncertainty over how the change in the pandemic curve will compare to the first lockdown given that schools and workplaces remain open.

A rapid reopening in December will probably limit the fall in quarterly GDP to around -1.5%. A more protracted scenario with hospitality shut for much of the rest of the year could see that slip to -2% or more

An extension in one form or another, therefore, looks possible. One scenario might be that non-essential retail reopens in early December, not least because this is a key trading period for the high street ahead of Christmas. But hospitality could remain shut in large parts of the country for a longer period.

Unsurprisingly this timing will have a strong bearing on the overall fourth-quarter GDP numbers. A rapid reopening in December will probably limit the fall in quarterly GDP to around -1.5%. A more protracted scenario with hospitality shut for much of the rest of the year could see that slip to -2% or more.

If that sounds a bit tame, that’s because there are strong base effects at work. Schools reopened in September and because this feeds into the GDP data, we’ll likely see a strong end to the third quarter. That in turn means that the fourth-quarter growth figures will appear higher than you would expect based on the monthly contractions we expect.

Bank of England QE expansion now baked in

Renewed lockdowns mean that action from the Bank of England this week is all-but-guaranteed. We expect policymakers to announce a £100bn extension to its quantitative easing programme, allowing purchases to continue at the current monthly pace until early summer next year. However, it’s too early to expect anything tangible on negative rates - the central bank is still in the process of canvassing the opinions of banks on how the policy might hit profitability.

We’ll be releasing a full preview ahead of Thursday’s meeting.

Brexit deal looking increasingly likely

The chances of a UK-EU trade deal have been growing over recent weeks, but as ever the ball remains largely in the UK’s court on the key issue of state aid.

However the return to lockdowns will inevitably add further political impetus for there to be an agreement. The UK government has slipped behind the opposition in some recent polls, while there is a sense that a no-deal scenario could further boost the campaign for Scottish Independence, something the government in London is keen to avoid. There’s also a fair chance the UK, and parts of Europe, could still be in some form of lockdown at New Year, and a ’no deal’ scenario could therefore be even messier than it might otherwise have been.

We, like most other analysts, therefore think a deal will be wrapped up in coming days. Against the backdrop of lockdowns, a key economic question in the short-term will be what provisions (or unilateral actions, especially on the EU's part) are included alongside the deal to help limit the initial disruption for businesses.

Tags

UKDownload

Download article6 November 2020

Making waves: Covid-19 and the US presidential election This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more