This week’s UK data won’t tempt the Bank of England into hiking rates

Expect the Bank of England to keep “looking through” headline CPI spikes as signs of medium-term inflation pressures remain elusive

Few signs of organic inflation even as headline CPI picks up

We're expecting headline inflation to pick-up to 2.7% this week as the effect of sterling's post-Brexit weakness outweighs the 1% fall in petrol prices in July. We may even see the core rate equal May's four-and-a-half year high of 2.6%. That might test the patience of some Bank of England hawks, but the pound's fall is largely to blame. With wage growth set to remain subdued, we still don't think the monetary policy committee will be tempted into hiking rates this year.

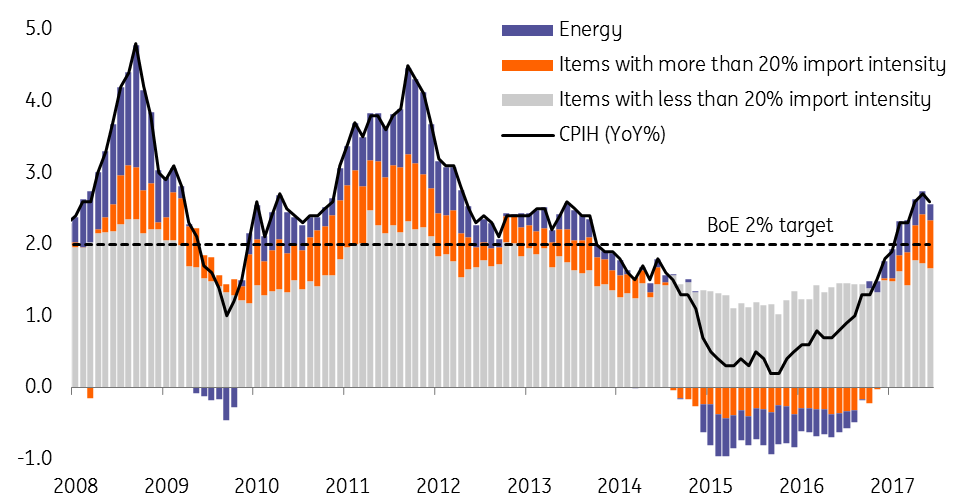

Inflation below target when energy & sterling effects are stripped out

If the Bank of England is to hike rates in the near-future, it needs to see signs of “domestically generated” inflation. There’s no single foolproof way of tracking this, but given the 20% fall in the pound since November 2015, stripping out the currency effect is a good place to start.

One rudimentary way of doing this is by breaking down the CPI basket by import intensity - that's the proportion of a particular good that is based on imports. You'd generally expect goods with a lower import intensity to be less affected by moves in the pound. That's not always true - air fares are a good example of a low import-intensity service that is very sensitive to sterling fluctuations - but it’s a decent enough rule of thumb.

If we strip out everything except goods with less than 20% import content (that still covers roughly 60% of the CPI basket), inflation would be just 1.7% - much lower than the latest 2.6% headline CPI reading and importantly, below the BoE's target.

Wage growth is key - and it's proving hard to find

It's a similar story when we look at other measures of domestically generated inflation. Service-sector CPI for instance, which typically tends to be less affected by commodity and currency moves, has stayed pretty stable since 2013 and remains well below pre-crisis averages.

But wage growth is the real clincher when it comes to rate hikes, and the Bank is betting on a comeback in 2018. They have put much of the latest weakness down to temporary factors, but more importantly, are still expecting the strength in the labour market and a skills shortage to drive up pay. Their latest forecasts put wage growth at 3% in 2018.

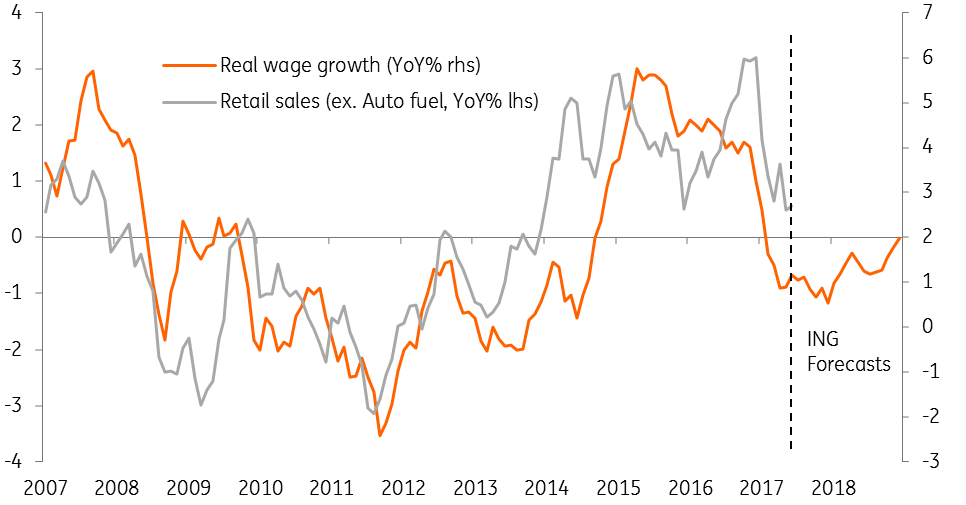

The spending squeeze

We have seen some tentative signs in the most recent readings that some wage momentum is returning after a particularly lacklustre start to the year. But with firm’s costs rising as import prices rise, overall economic growth slowing and political uncertainty still prevalent, we think firms will be reluctant to accelerate pay rises.

Regular pay growth is likely to hold steady at 2% next week and we think that's probably about as good as it is going to get for the rest of 2017.

That means that the household spending squeeze looks set to persist, and expect to see further evidence of this in Thursday's retail sales numbers. After a remarkably warm June gave retailers a temporary boost, the usual wet and windy British summer that we all know and love returned with a vengeance in July. Data released by Visa and the British Retail Consortium suggest households have cut back on non-essentials. The year-on-year rate of growth is set to get perilously close to zero, a far cry from the near-8% increases seen towards the end of 2016.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more