UK housing: Resilient in the face of turmoil

Despite Brexit related uncertainties intensifying, UK house prices continue to weather the political storm – although the story looks quite different across the country

The proverbial saying ‘An Englishman’s home is his castle’ couldn’t be more accurate these days as the UK housing market continues to defy predictions of a complete washout, despite the seemingly never-ending Brexit debate that continues to rumble on.

Don’t get us wrong, the housing market has been cooling, and people have been putting off buying and selling decisions because of the uncertainty for some time now. But according to the latest figures released by the Office for National Statistics (ONS), house prices across the UK rose by 1.4% compared to the same period last year, bringing the average UK house price up to £227,00.

Regional variations persist

North-South divide continues

The regional divide between Southern England and the North is as persistent as ever.

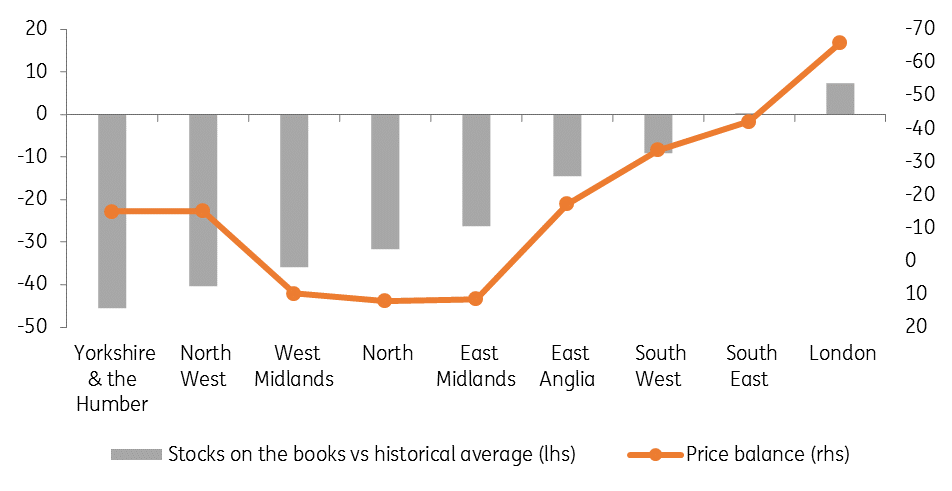

Over the last 12 months, Yorkshire and The Humber property prices have gone up by 3.6%, closely followed by West Midlands at 3.4%. While demand is relatively weak in these areas, few people are putting their properties on the market so supply is limited, keeping prices supported.

The regional divide between Southern England and the North is as persistent as ever

London and the South East are another story altogether. Even though both regions saw declines of 1.9% and 0.4%, respectively, the capital and the South East of England are still the most expensive places to buy a house – with a house in London costing around £463,000 on average. Unlike some Northern areas, there is no shortage of supply in the capital, and the gap between asking and offered prices has stayed relatively wide. Still, the RICS sentiment survey notes that price expectations for the next 12 months remain modestly positive.

What’s driving this slowdown?

For first-time buyers, affordability constraints are one of the most significant limiting factors. In 2014, the Bank of England introduced strict mortgage rules on the size of a deposit and the amount that can be borrowed, to limit house price inflation. Slower price growth and the government’s help-to-buy scheme have helped but data from industry body UK Finance shows the number of loans approved for first-time buyers has fallen modestly over the past year.

On the flipside, the recent changes introduced in the buy-to-let market, such as hikes to stamp duty tax, the introduction of a 3% surcharge on second homes and the upcoming mortgage interest tax relief, which will see most landlords tax bills rise considerably, have made housing in the South East a less attractive investment.

On top of all that, there’s Brexit. Even though consumer spending has been growing at the fastest annual pace since the end of 2016, the looming uncertainty still appears to be restricting demand for bigger-ticket items, as well as ‘hard to reverse’ purchases such as housing.

What does all of this mean for the economy?

When it comes to the outlook for the Bank of England’s tightening plans, we don’t expect housing to feature too highly in their decision-making. In principle, a large or too rapid hiking cycle could spell trouble for some households, although it’s worth noting that over half of mortgage holders are on fixed-rate products, making consumers less immediately exposed to rate rises than in some other countries.

We think the Bank of England is likely to keep rates on hold throughout this year, but recent hawkish comments from Governor Mark Carney signal that some further tightening shouldn't be completely ruled out in November if either a Brexit deal is ratified (unlikely) or the Article 50 period is extended further. Even though a hard Brexit is opposed by the majority of MPs and isn’t our base case, we still think there is a 20% probability of a no-deal Brexit. And if that were to happen, we’d expect house prices across the country to spiral downwards.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more