Booming Britain! Latest figures smash consensus

Despite all the doom and gloom surrounding the economy, the toxic political backdrop and Brexit uncertainty, Britain is supposedly booming based on July data

New monthly GDP figures

The UK has released a raft of decent data for July. The headline figure is the GDP number – the ONS' new monthly series – which showed the economy apparently growing 0.3%MoM in July, well ahead of the 0.1% consensus and faster than the 0.1% growth rate of June. This means the 3M/3M change is 0.6%, which is the best figure since August last year. Services sector output rose 0.3% while construction was up 0.5% and production industries increased 0.1%. As such it supports the Bank of England’s decision to raise rates last month.

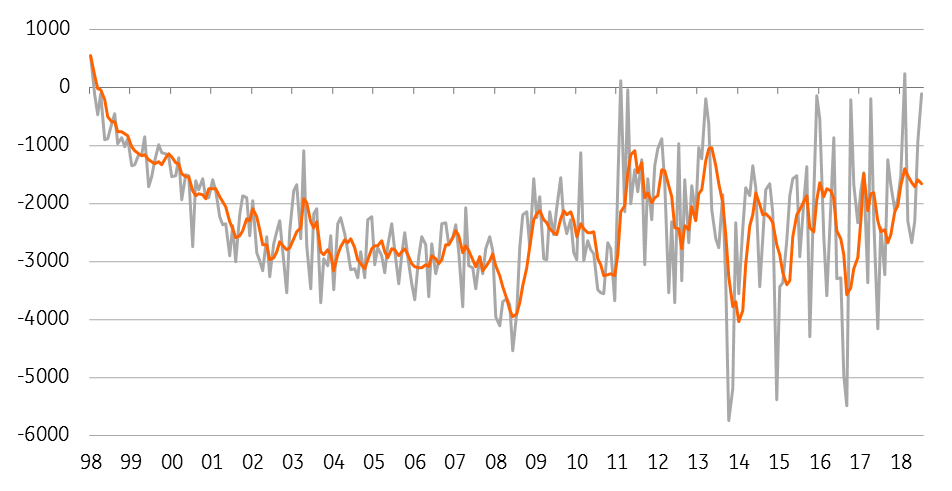

Separately, the trade numbers showed a sharp narrowing in the goods deficit to a five-month low of £10.0bn while the total trade deficit for July shrank to just £111mn - £2bn smaller than predicted by the market. Remarkably, this is the fourth best monthly trade balance figure in the past 20 years with the real encouragement being that it was caused by a jump in exports rather than purely slower imports.

UK trade balance with 6M moving avg (£mn)

A tough environment

These are great figures and suggest there is still life in the UK economy despite all the negative political headlines and the pressures faced by the household sector. However, the UK is still expected to be battling it out with Japan and Italy as to who is the worst performing developed market economy this year and next. Tomorrow UK jobs report is likely to show a renewed slowdown in employment growth while real wage growth is likely to remain depressed by inflation. Furthermore, the outlook for investment remains poor given the ongoing uncertainty over the UK’s future trading relationships. Given this tough and uncertain environment, we think it highly unlikely that the Bank of England will raise rates before the UK leaves the EU on 29 March next year.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more