UK: Carney goes cautious

As Bank of England opts to keep rates on hold this month, have markets interpreted the overall tone of the meeting as more dovish than anticipated?

It’s fair to say the build-up to the May Bank of England meeting was a rollercoaster. Having more-or-less fully priced in a May rate hike, markets received quite a shock following cautious comments from the Bank of England Governor Mark Carney a few weeks ago. In the end, this concern was probably what saw the Bank keep rates on hold, which was all the more surprising given other BoE rhetoric so far this year, which had appeared to guide markets to a more rapid path of tightening.

First quarter growth was particularly bad

So why the sudden change of heart? Well, over the past few weeks it had become increasingly clear that the economy had a very tough time in the first quarter. Growth came in at just 0.1% QoQ, the weakest result since 2012, and the Bank was aware that hiking in such an environment would be a tough sell.

Admittedly, some of the causes of the slowdown were temporary – multiple bouts of snow saw construction activity make an unusually large negative contribution to first quarter GDP. And interestingly, the Bank of England thinks that the initial GDP reading for the first quarter has been wildly underestimated.

Serious cracks are appearing in consumer-facing sectors. The perfect storm of weaker demand, higher business rates and rising minimum wage costs resulted in one of the worst quarters for retail since the financial crisis. A rate hike might have proved to be one headwind too many for retailers, many of whom have become highly leveraged in the post-crisis years.

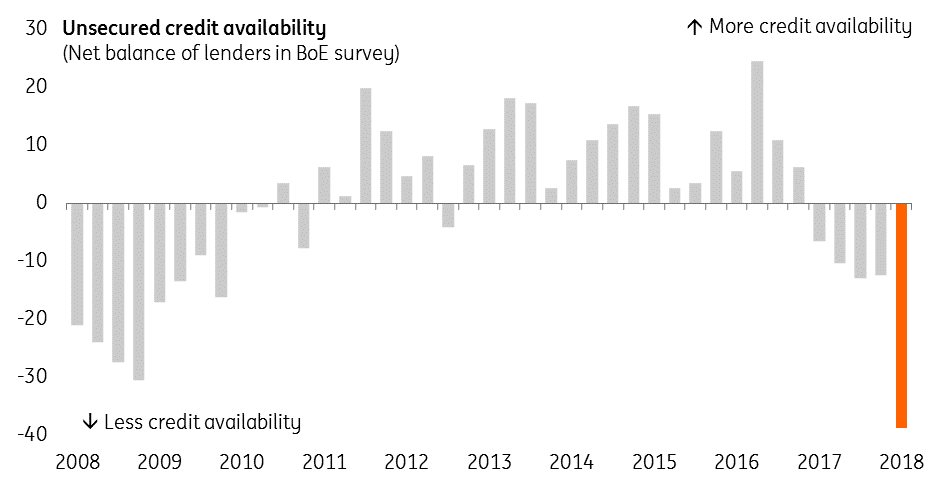

Credit growth appears to have collapsed

Unfortunately, we don’t think things are about to get much better immediately. Real incomes remain pressured by higher food and fuel costs. Alarmingly, consumer credit growth also appears to have collapsed in recent months, with banks reportedly scaling back loan availability significantly. This may prove to be a blip, but we suspect the Bank wants to buy more time until the underlying drivers of this rapid downfall become clearer.

Lenders have tightened up on credit availability

However, we don’t expect the Bank’s pause this month to turn into a permanent hiatus. Away from the activity story, the major drivers underpinning the Bank's recent tightening bias have remained largely on track. The prospects for global growth still look relatively bright, despite the recent moderation in Eurozone activity. Similarly, wage growth has continued to outperform over the last few months, giving policymakers greater confidence that skill shortages in the jobs market are boosting pay. Bank agents have indicated that this could be the best year for pay settlements since the crisis.

Brexit noise could close the window of opportunity pretty soon

Nonetheless, policymakers will also be acutely aware that their window to hike rates could close soon. If the build-up to the December and March EU leader's meetings is any guide, the months leading up to the October summit could see negotiations get increasingly noisy. Talks are already heating up, as the cracks with the UK government widen over the future customs relationship with the EU.

At the same time, we expect to see core inflation fall back to target over the summer, given that prices have now virtually adjusted to the new value of the pound. This has seen inflation fall noticeably faster than the Bank of England forecasted in February.

We still expect an August rate rise

These two factors could complicate efforts to hike rates later in the year, and we think the Bank will be keen to capitalise if the data allows. Assuming that the faltering consumer sector doesn't deteriorate further, we think policymakers still have a preference to hike rates in August if they can.

Download

Download article11 May 2018

ING’s May Economic Update This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more