UK: A turbulent November

We expect England's lockdown to trigger a sharp contraction in November GDP, albeit perhaps not as steep as we saw back in March/April. Alongside fresh Bank of England stimulus, these tighter restrictions could put additional pressure on the UK and (to a lesser extent) the EU to agree a trade deal over coming days

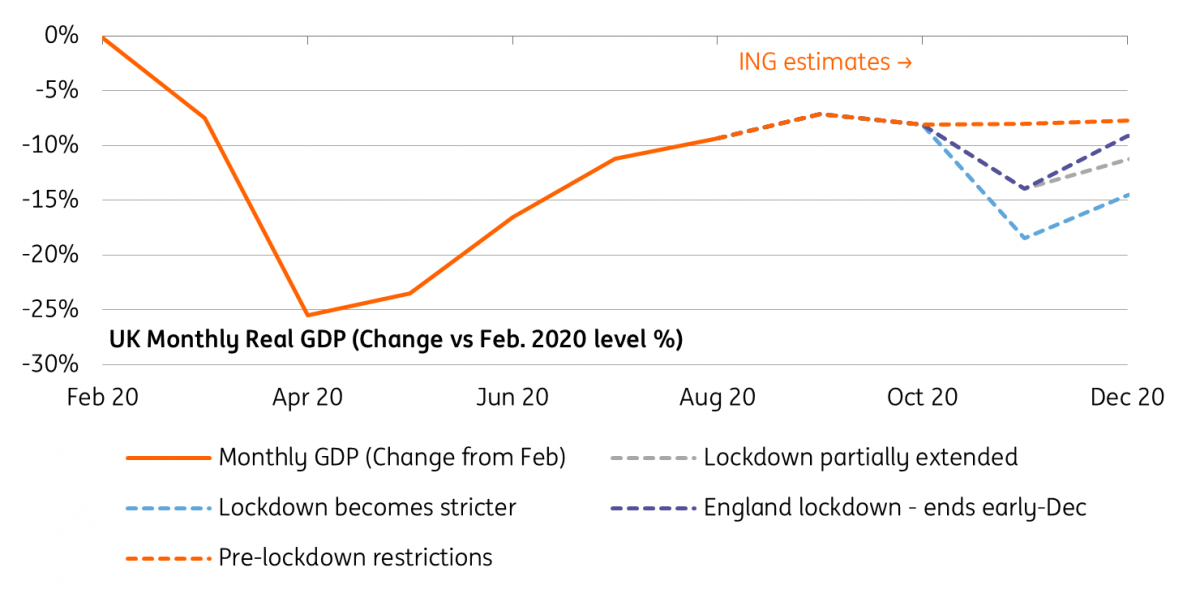

UK GDP set to plunge, albeit not as much as in the first lockdown

By any normal measure, the 6-7% contraction we expect in November UK GDP on the back of England’s month-long lockdown is a sharp decline.

But these are not normal times, and importantly, the hit to economic activity is unlikely to be quite as steep as it was in March and April, when GDP plunged by quarter in a matter of weeks. The principal reason is simple: this lockdown is less restrictive for the economy than the first, even if the rules for individuals are comparable. Manufacturing and construction will plough on, as will schools. We also know that businesses are more prepared for this lockdown - we’re unlikely to see essential businesses temporarily close, as we did back in March so that they could revamp their operations to be Covid-safe. And in the hospitality and retail sectors, more businesses - particularly smaller ones - will be more geared up for online and takeaway options.

We’d also reiterate that the economy has not fully recovered from the first round of restrictions. In August the size of the economy was still 9% below February levels, and put simply that means there is ‘less to be lost’ this time around. We expect this lockdown will take the size of the economy some 14-15% below pre-virus levels.

Our estimates of how the English lockdown could hit UK GDP

Lockdown adds to economic case for a Brexit deal

All of this has piled on the pressure for the Bank of England to act, but it may also have a bearing on the direction of Brexit talks. Negotiations have appeared to make steady progress following ‘intensified’ meetings, with the most recent reports suggesting that a deal on fishing rights may be in the offing. If there’s to be a deal, most analysts think it could come in a matter of days, given the time needed for ratification.

The return to lockdown on both sides of the Channel will inevitably boost the economic case for a free-trade agreement. Admittedly in the longer-term the difference between having a free-trade agreement and not is perhaps not huge. Both involve the UK leaving the single market and customs union, which is where the bulk of the new costs and headaches for businesses will come from.

But in the short-term, there is hope that a deal could unlock a wider array of measures to help minimise disruption at the ports early on. With Europe still likely to be in the midst of some form of tightened Covid-19 restrictions come 1 January, these sorts of measures could be even more important than they already were likely to be.

The politics are more complicated

But while the economics are clear, the politics are unsurprisingly more complex. There are undoubtedly some political advantages for the Johnson administration to agree a deal. Entering 2021 without an agreement could leave the door open to further criticism from the Labour Party which, according to some polls, is now ahead of the Conservatives. It would also likely play into the hands of the Scottish Independence campaign, which has seen its support boosted during the pandemic, and is an outcome Prime Minister Boris Johnson is keen to avoid.

That said, the compromises required for a deal - on state aid, fishing and on the Internal Markets Bill (which the UK would need to rewrite) - will be deeply unpopular with many Conservative MPs, many of which have publicly voiced their frustration about the latest Covid-19 restrictions.

In our opinion, this does not necessarily reduce the chance of a deal being agreed (we’d unscientifically say the probability is now at around 70%), but it does mean the end-game will have to involve some careful political choreography. That suggests there could still be some dramatic twists set to come. It’s not over yet.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

5 November 2020

November Economic Monthly: Navigating a sea of waves This bundle contains 10 Articles