UK: A summer of tough decisions

Markets have reassessed their Bank of England expectations. But as wage growth rises, we suspect rates hikes are coming

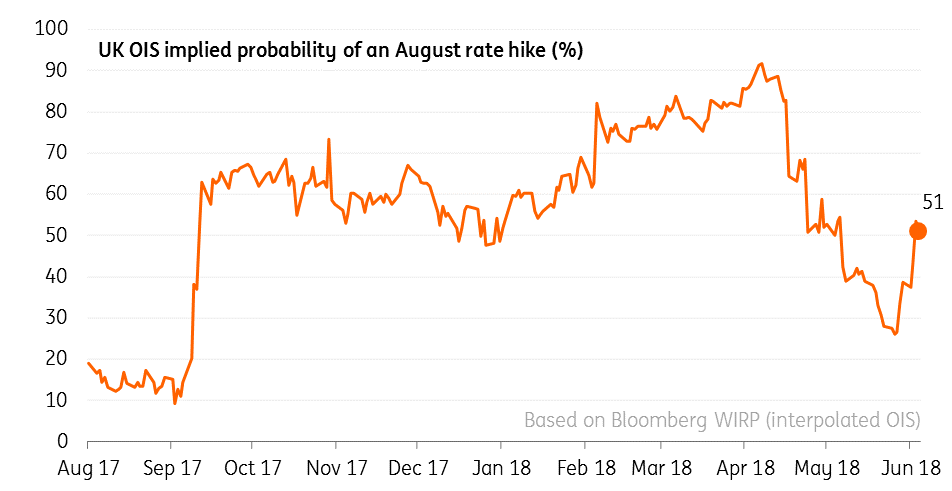

It’s fair to say markets have had quite a big rethink on the Bank of England over the past few weeks. Governor Mark Carney’s surprisingly cautious comments back in April were compounded by what investors interpreted to be a fairly dovish May BoE statement. Markets are no longer looking for a rate hike this year.

We suspect this might have been a bit of an overreaction. Our own read of the May statement was not so different to that of February or March. Wage growth, a central plank of the Bank’s tightening bias, has continued to show signs of life and policymakers remain confident that the tight jobs market will see the upward trend persist.

The BoE isn’t overly concerned about growth

The BoE was also surprisingly blasé about the sharp slowdown in first-quarter growth. The Bank thinks most of the dip is explained away by the bad weather, and in fact suspects the worryingly-low 0.1% quarterly growth figure could be subject to quite hefty upward revisions.

But the big risk to a summer rate hike comes from retail

All of this leads us to think that policymakers want to hike rates further if they can, and that at roughly 50%, markets may still be slightly underestimating the chances of an August rate rise. That said, this is far from a done deal and relies on the data proving the Bank right on growth. The biggest risks lie in the retail sector.

Odds of an August rate hike have tumbled

It’s clear that the period since the start of 2018 has been one of the roughest for retailers since the financial crisis. Admittedly, the better weather of the past few weeks will have provided some much-needed respite, but equally we don’t see the ‘perfect storm’ of slower demand, higher wage costs and elevated business tax rates blowing over anytime soon.

Consumers remain cautious, even the income squeeze eases

Household incomes aren’t being squeezed quite as heavily as they were late last year, but equally they aren’t rising in real terms either – particularly in light of the recent upsurge in petrol prices. And while consumer confidence appears to have recovered a little since the start of the year, shoppers remain pessimistic about the general economic environment. Assuming that stems from generally slower growth and Brexit uncertainty – both of which look to persist – we think an imminent recovery in spending is unlikely.

The government is divided on the best customs arrangement after Brexit

Speaking of Brexit, the fierce debate over the UK’s future customs relationship with Europe may finally be about to reach a head. As both sides continue to search for a solution to the Irish border conundrum, the UK government has continued to discuss two options – so-called “maximum facilitation”, which would use technology and trusted-trader schemes to minimise border checks as much as possible, and a “customs partnership”, a scheme that would see tariffs/VAT collected on the EU’s behalf when a Europe-bound good first arrives in the UK.

Both have been widely criticised in recent weeks. The former is untested and risks flaring tensions at the Irish border, whilst the latter would be extremely complicated to implement and perhaps ultimately unworkable. Importantly, the EU has rejected both of these UK visions – but even with that aside, it’s clear both methods would take years to implement.

The UK has agreed the need for a backstop but disagrees on what that backstop should look like

And this is time that the UK doesn’t have. With just two and a half years until the post-Brexit transition period is slated to end, focus is switching to a possible ‘backstop’ solution, that would kick-in should the overall EU-UK trading relationship fail to avoid a hard Irish border.

The EU’s proposal would see Northern Ireland remain in the customs union and single market for goods, which would avoid the need for physical checks at the border. But this raises the possibility of creating barriers within the UK itself, between Northern Ireland and the rest – and as we know from previous rounds of talks, the DUP (the party that supports Prime Minister Theresa May’s majority in parliament) is vocally against this. Recall that May said just a few months ago that “no UK prime minister could ever agree to this”. As such, the government’s alternative would see the UK overall remain in a customs union until 2021, by which time it hopes a better solution would have arrived.

The House of Commons will vote on whether to remain in a customs union

We could carry on discussing this, but the upshot is that things are beginning to get pretty messy. Interestingly though, this whole debate could be rendered redundant as early as Tuesday 12 June. That’s because the House of Commons is set to vote on a series of amendments to a Brexit-related bill, one of which – if voted through - would require the government to take steps to remain in a customs union after leaving the EU.

The House of Lords has already voted in favour of this, and whilst the government is staunchly against remaining in a customs union, a number of Conservative MPs, alongside the opposition Labour Party, feel differently. The vote looks set to be very tight, but if the government loses the vote, it would come as a major blow to PM May’s Brexit vision.

Download

Download article

8 June 2018

ING’s June Economic Update This bundle contains 8 ArticlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more