Turkish banks: Macro confidence remains key

Turkish bank bonds have become a lightning-rod for sentiment regarding the sovereign but we think solving the crisis of confidence in the macro situation is key to a sustained recovery as fundamentals remain solid

We'll look at bank fundamentals in detail including their profitability, asset quality, liquidity & funding and capitalisation but first, we turn to the three issues overhanging the sector: the Halkbank situation, ratings risk and the lira funding gap.

Halkbank: desperately seeking clarity

Although the US case against Halkbank’s deputy general manager, Mehmet Hakan Attila, was completed months ago, investors are still seeking clarity on what happens next. Attila’s trial implicated the bank in transactions that the US alleges violated sanctions against Iran.

While rumours abound of a possible fine for the bank, we've had no guidance on what its size might be. There is also no clear process, as Halkbank has not formally been charged with any wrongdoing. As such, next steps and their timing remain unclear. However, we can make some broad points:

- We think it is very difficult for the US to ignore sanction breaches, especially in the context of its new tough stances against Iran and North Korea. This argues for penalties to be imposed on sanction violators.

- Turkey remains a key NATO ally in a complex region, with the alliance’s second largest land forces. It would not be to either side’s benefit to rupture this relationship.

- Halkbank’s Iranian business is well-known but relatively small. Its last annual report disclosed that Iran constituted just 0.13% of RWAs of Halkbank’s Banking Book for Private Sector Lending.

- No other Turkish banks engage in significant business with Iran. It is thus hard to see how any punishment that Halkbank might face could be broadened out to include Turkey’s other major banks.

- Though the timing is uncertain, Halkbank has engaged two external law firms to audit its business. Their report should be completed in about a month, after which it will be sent to the US authorities for evaluation. We are hopeful that the proceedings will be completed this year. We believe that a painful but ultimately manageable fine for Halkbank (maybe around $1-2bn) remains the most likely outcome. This would be ample punishment, sending a signal that the US will not tolerate any flouting of its sanctions regime. The fact that Halkbank seems most likely to be guilty of operational weaknesses rather than criminal intent supports our position. Restricting the fine to a payable size would also avoid escalating the issue to an intergovernmental crisis between the US and Turkey. In this scenario, we expect Halkbank bonds to rally strongly. There is no fundamental reason for Halkbank bonds to trade wide of Vakifbank’s paper, which trades 100bp tighter.

- However, there is a small chance that the US could levy a very high fine against the bank, which it could not pay from its resources. The Turkish State would then have to decide whether to help the bank. Recall that Halkbank is 51% state-owned. This would be a very negative scenario for markets, as Turkish officials have repeatedly denied that they would help the bank. Investors would worry that Turkey may refuse to pay the fine at all, risking further retribution from the US. In this scenario, we expect all Turkish credit to underperform. However, we believe that mutual self-interest should prevent this scenario from becoming a reality.

Ratings risk – Could Turkish banks be single-B?

On 8 June, Moody’s downgraded all Turkish banks but QNB Finansbank to Ba3 and left them on review for further downgrade to reflect the status of the sovereign (Ba2/review for downgrade). As we wrote here, this action seemed harsh. With RoEs of around 17%, NPL ratios of 3-4% and Tier 1 ratios of 10-14%, we struggle with the possibility that Turkish banks could soon be rated single-B. Nonetheless, this is the position in which they find themselves. We think that the banks will be downgraded if the sovereign is taken down a notch.

What would be the pricing effect of a downgrade to a B1 rating, to which all banks but QNBFB are now vulnerable (see table)? As the Turkish banks are not rated by S&P, they would be considered single-B entities at the index level, which may cause some technical selling. However, we do not believe that ratings are the main spread driver, as investors are more exercised by macro concerns. We also note that Turkish banks trade well wide of other B1-rated institutions and we are therefore hopeful that any downgrade will not cause more than moderate further weakness in Turkish bank senior bond spreads.

Liquidity – banks can withstand a market shut-out

We talk in more detail below about banks’ liquidity position, but it is such a big theme that we would like to highlight some key points.

- Turkish banks’ liquidity position is such that they can withstand a prolonged market shut-out. In aggregate, they have $90bn of liquid assets covering $55-60bn of maturities in the next year.

- Their funding imbalance, as we have written about extensively before, lies in the lira, where the loan/deposit ratio averages 146%. They are over-liquid in FX due to the highly dollarized deposit base. This means that the central bank of Turkey would be able to assist in an extreme scenario where the banks could no longer fund their lira loan books.

- The main avenue for raising FX is the syndicated loan market, where we have seen very little stress so far, despite all the volatility since the failed coup of summer 2016.

- Pricing of such loans is little changed over the period, and each loan attracts a syndicate of around 25 banks, showing that demand for short-dated Turkish risk remains strong.

- Other than deposits, the banks’ main avenue for raising TRY is the currency swap market. Once again, this market is functioning smoothly. International lenders are happy to take USD and lend TRY as they are on the right side of the trade if something were to go wrong in Turkey. As such, there is no reason to believe that this market will become stressed.

- Remaining maturities this year are under $2bn, which is eminently manageable. However, next year they rise to over $6bn. As such, we believe that a market shutout for the balance of 2018 can be managed. However, investors are likely to grow increasingly nervous if there is no relief by early 2019.

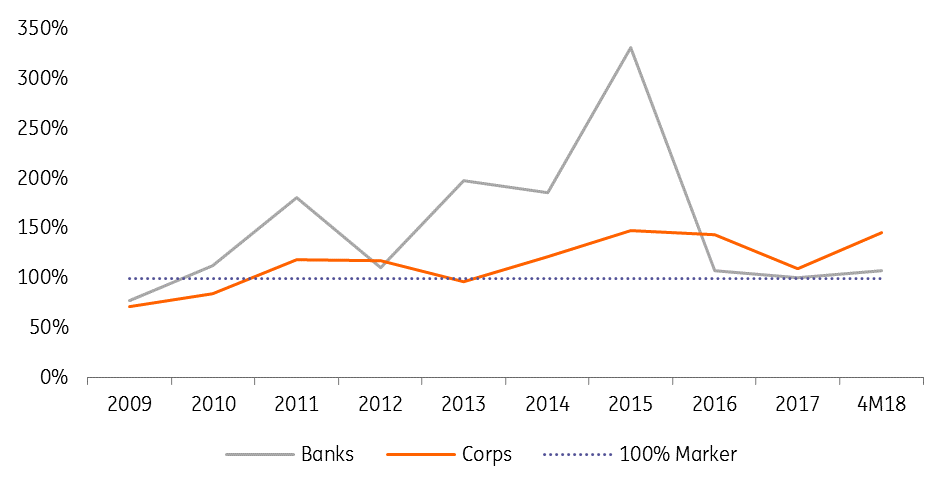

Rollover ratios have exceeded 100% since 2010

Bank fundamentals – an overview

Profitability

The Turkish banking sector’s overall net profits rose 2.6% YoY to TRY12.5bn in 1Q18. The key driver was an increase in revenues, driven by loan growth (+20% YoY to TRY2.2tn), offset by falling NIM as funding costs rose. We expect slowing activity and tight monetary policy to reduce bank profitability in H2 from the very high levels of the past year. The loan growth will be discussed in greater detail in the Asset Quality and Liquidity sections. Falling NIM is a function of increasing bank funding costs, particularly following the CBRT’s decision to increase the bank’s average cost of funding by hiking rates by a cumulative 500bps between April and June 2018. Banks are now re-pricing loans to get ahead of higher funding costs as TRY deposits become scarce and the CBRT tightens liquidity provisioning (Figure 25), so we hope to see this decline in NIM reverse in 2H18.

CBRT weighted average cost of funding

Non-interest expenses remained tightly controlled, rising just 11.7% YoY across the sector, compared to increases in net interest income of 13.5% and non-interest income of 32.8%. As a result, banks’ cost/income ratios improved across the board (see Figure 28), averaging a very healthy 38%. However, provisions rose sharply YoY as the risk offset provided by the CGF was overwhelmed by the impact of IFRS 9 and the effect on some large private banks of large corporate exposures that are the subject of restructuring requests. In sum, while Turkish banks had a strong 1Q18 from an earnings perspective, we expect performance to slow to more normal levels through the balance of 2018 as the slowing economy, lower TRY and weaker consumer sentiment take a toll on the demand for, and supply of, credit.

Asset quality

A key feature of 1Q18 was the weakening of asset quality. While headline NPL ratios remained steady, credit costs and Group II loans surged following the introduction of IFRS 9 and restructuring requests from a few large corporates. We remain fairly confident that widespread corporate restructuring are not imminent; in fact, we have had no further news on this front in Q2. However, we question how long SMEs can bear up in this difficult environment. We expect gradual weakening in the credit metrics of this sector, though the CGF, strong provisioning and good collateralisation of non-CGF loans make us think that banks are well placed to weather any developing squalls.

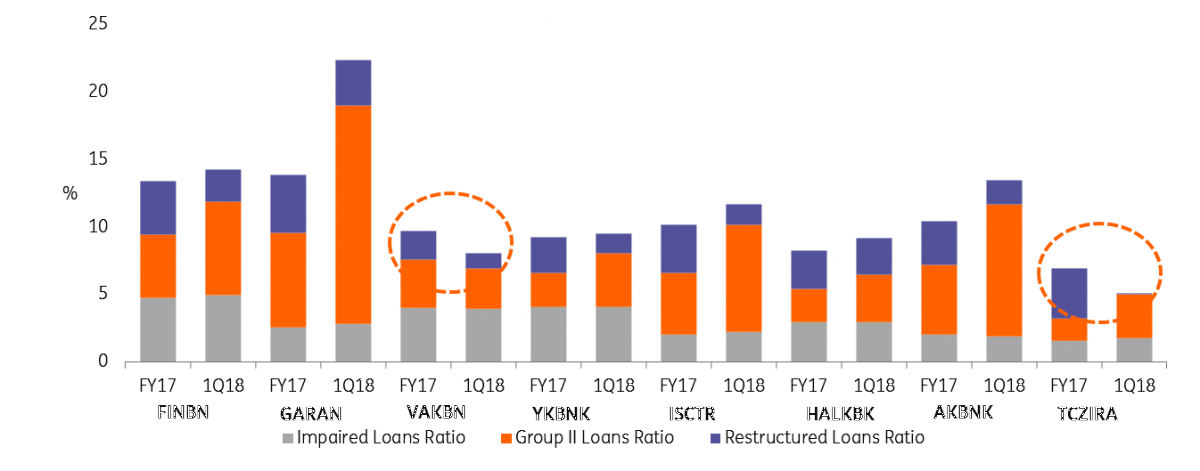

Unusually, banks with a greater concentration of Corporate & Commercial loans on their books underperformed in terms of asset quality, while SME loans and unsecured retail lending remain the more stressed asset classes. This was due to some big-ticket loans, such as Yildiz and Otas, being acknowledged as likely restructurings, affecting AKBNK and GARAN in particular by inflating their Group II loan ratios. The introduction of IFRS 9, which calls for pre-emptive provisioning against expected problem loans, exacerbated the issue. This is illustrated in Figure 38.

Headline NPL ratios were little changed, while SME asset quality improved YoY, helped by the denominator effect created by the CGF rollover. Consumer loan quality has been quietly improving for several quarters (Figure 35). Finally, provisioning remains robust, with coverage ratios exceeding 100% across the board.

However, all this must be kept in perspective. There is no doubt that asset quality has been on a declining trend over the past few years, as the chart showing GARAN’s performance shows. Moreover, we note that banks have plenty of restructured loans on their books that do not qualify as impaired. We are relatively sanguine about this, as we have the transparency to form our own views about the true picture of banks’ asset quality. It confirms our view, for instance, that GARAN should not trade on top of AKBNK for fundamental reasons (see Chart 19, showing the rapid recent growth of GARAN’s Restructured Loan book). It also remains true that Turkish banks’ asset quality is considerably more robust than similarly rated peers’. The full development of banks’ asset quality during 2017 is shown in Chart 20 – all but VAKBN and TCZIRA have registered declines.

Turkish Banks' Impaired Loan Ratio Development (9M17)

Liquidity and funding

This is the area where the Turkish banks come under the most scrutiny., Turkish banks have plenty of liquidity reserves to cover their next twelve months’ maturities in case of a complete market shutdown, with around $90bn of resources covering $55-60bn of external debt servicing requirements. Debt maturities also do not spike significantly until next year (see Figure 45). And, as we pointed out above, rollover ratios have remained healthy. We have also not seen any stress in the syndicated loan market or currency swaps market.

Banks’ main problem is the imbalance between a heavily dollarised deposit base and the strong growth in TRY lending. The sector average loans/deposits ratio now stands at 122%, which is uncomfortably high compared to peers. This headline number concealed a striking disparity in the ratio for FX and TRY. FX liquidity is plentiful for the large banks (FX loans/deposits ratio is well below 85% in many cases), while access to TRY is limited (the TRY ratio is 146% for the sector). Figure 39 shows how the ratio has evolved in the case of HALKBK.

All this implies that banks’ access to FX is plentiful, but swap costs will pressure banks’ P&Ls as FX deposits are converted into TRY loans. Moreover, it increases banks’ reliance on the short-term swap market, harming efforts to term out average liability maturities. This risk is mitigated by the banks’ healthy levels of liquid assets (ranging from 20-35% of total assets), of which securities make up the majority (13-23% of assets).

Capitalisation

After falling steadily at the start of the decade, capitalisation has broadly stabilised and begun to rise over the past couple of years. Tier 1 ratios broadly range from 10-14%, which is healthy, although the banks have been helped by regulatory forbearance in the form of 0% risk-weighting for CGF loans, which has helped offset some of the RWA inflation driven by currency depreciation. YKBNK’s $1bn recapitalisation has also been positive, easing worries around a bank that has long been seen as the weak link from a capital perspective. Banks’ consistently strong profitability has also enabled them to generate sufficient capital organically to support their growth. We expect this to continue even in a scenario where earnings tail off somewhat.

While the Tier 1 numbers are resilient, CAR ratios are lower than might be expected. Turkish banks are aware of this, which is why we saw a spate of Tier 2 issues last year. For now, the market will not allow any more such issuance. If sentiment improves later in the year, we expect to see further Tier II bonds issued as banks build up buffers to bring themselves into line with Basel III standards by the end of the decade. AT1 issuance is unlikely before 2019, even if the market strengthens.

"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).