Turkcell becomes interesting (again)

Turkcell's latest earnings outline its strong profitability, modest leverage, decent currency hedging, an enthusiastic customer base and also that it remains little affected by Turkey’s geopolitical issues

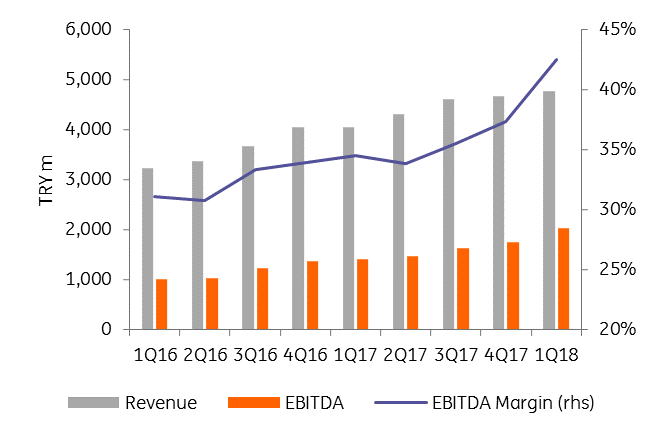

Robust revenues of TRY 4.8bn (+18% year on year) and EBITDA of TRY 2.0bn (+44% YoY), boosted by increased data usage and increasing customer penetration, showed that Turkcell remains little affected by Turkey’s geopolitical issues.

The balance sheet was also solid. Net Debt / EBITDA of 0.8x is strong, despite a modest increase YoY (rising to 1.4x if we include Turkcell Consumer Finance, while the company’s short FX position is now just $204mn. 69% of cash is held in FX to mitigate currency risk, while liability hedging reduces the FX component here from 79% to 35%. While some profitability metrics were inflated by new IFRS standards, this is nevertheless an impressive set of results which provided reassurance on currency exposures and balance-sheet strength.

1Q18 results: Strong and more to come

- Turkcell’s 1Q18 results were very strong. Robust revenues and EBITDA of TRY 2.0bn were driven by the strong ARPU performance of the Turkish operation (86% of Group revenues) following a solid performance by the data and digital services segments as smartphone penetration increased, the number of data users rose and data consumption grew. However, a change in IFRS accounting played its part; an 8ppt increase in EBITDA margins to 42.8% would have been more usual – though still strong – 35.7% under the old rules.

- Nonetheless, this should not deflect from the company’s very impressive performance. 59% of mobile customers are now in triple-play packages, up from 42.4% last year, while mobile blended ARPU rose 10.2% YoY to TRY 33.6.

- The balance sheet was also solid. Net Debt / EBITDA of 0.8x is strong, despite a modest increase YoY (rising to 1.4x if we include Turkcell Consumer Finance, which is excluded under the new rules), while the company’s short FX position is now just $204mn, well within its $500mn comfort zone.

- Use of hedging has also improved. 69% of cash is held in FX to mitigate currency risk, while liability hedging reduces the FX component here from 79% to 35%. In fact, despite the TRY volatility in the past year, the extra FX loss YoY amounts to just TRY 49mn, compared to an EBITDA gain of TRY 622mn.

Earnings in detail

-

Revenues increased by a very impressive 17.5% YoY to TRY 4.8bn as past (and ongoing) investments in infrastructure and content bore fruit, particularly in 4.5G. As ever, Turkcell Turkey contributed the lion’s share, with revenues rising TRY 554mn, with other subsidiaries adding TRY 155mn between them. EBITDA performance was even more impressive, rising 44.4% YoY to TRY 2.0bn. The EBITDA margin rose a tremendous 8ppts YoY to 42.5%, mainly on higher revenues. New subscribers were added across all growth areas of the company in 1Q18: Mobile (+1.3mn YoY to 34.6mn) and Fibre (+63,000 to 1.2mn) and TV (+133,000 to 2.4mn). Note that the EBITDA figures were inflated by new accounting standards (see below).

Revenue and EBITDA development

-

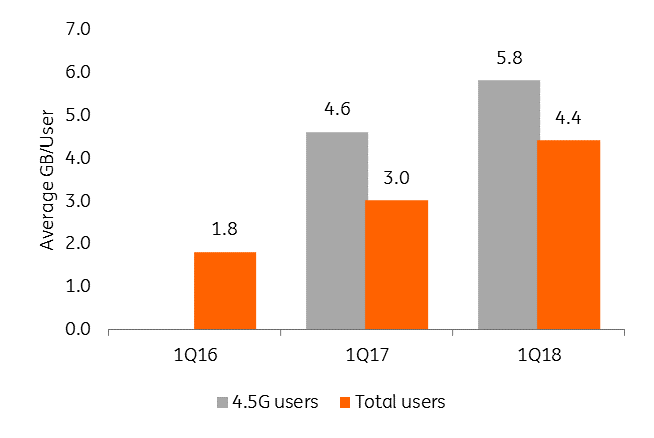

As well as growing volumes, ARPU increased across all segments, as Turkcell saw further success in upselling products to customers. To illustrate the point, Fixed Residential ARPU increased 4.1% YoY to TRY 55.3 as the number of fibre customers and data consumption rose, while Mobile Blended ARPU grew 10.2% to TRY 33.6, as smartphone penetration rose – 70% of smartphones are now 4.5G compatible, with quarterly additions of around 1mn – and average monthly data usage increased 47% YoY to 4.4GB per subscriber (rising to 5.8GB for the growing class of 4.5G users). Finally, TCELLT’s mobile churn rate in 1Q18 was down to 4.2%, down from 5.0% in the prior-year period.

- Looking at the company’s operations, 86% of revenues were generated by Turkcell Turkey (revenues +15.6% YoY to TRY 4.1bn), 6% by Turkcell International (+12.6% to TRY 279mn) and 8% by Other Businesses (+51.0% to TRY 365mn). Turkcell began rolling out its 4.5G capabilities two years ago. Today, 89% of TCELLT’s mobile customers are 4.5G subscribers, of whom 52% use a 4.5G-capable smartphone. These customers also use more data than their non-4.5G peers (see above), increasing ARPU for the company. The Organic Capex/Sales ratio declined from 13.2% to 11.5% over the period.

Turkcell's customers are using more data

- Turning to the balance sheet, the increase in EBITDA failed to offset a rise in net debt from TRY 3.6bn to TRY 5.0bn QoQ, causing leverage to increase from 0.6x to 0.8x YoY. This number excludes Turkcell Consumer Finance, including which leverage rose from 1.3x to 1.4x over the period. This is still very healthy, and the company demonstrated good market access by launching a $500mn 10 year bond in April at ms+324bp.

- The company has total gross debt outstanding of TRY 15.1bn (including TRY 1.1bn from IFRS 16; see below), of which 38% will mature in the next twelve months. Net debt excluding IFRS 16 was TRY 9.4bn. Turkcell has worked hard to reduce its FX risk. 69% of its cash pile is denominated in FX, while this holds true for only 35% of its debt (after hedging). The company maintains that its net FX short position is just $204mn, down from $1.2bn in 2Q16.

- As stated above, Turkcell has introduced new reporting standards: IFRS 9 (which governs the classification of financial assets and allows provisioning against expected losses), IFRS 15 (which governs the accounting of revenue from contracts with customers, essentially capitalising contract costs, which are then amortised as revenue flows in) and IFRS 16 (governing leases, on which right-of-use assets are recognised on the balance sheet and amortised over time, balanced by an equivalent increase in the Borrowings line). IFRS 9 did not have a significant impact on Turkcell’s financial position. IFRS 15 inflated EBITDA by adding to Depreciation and Amortisation as customer contracts run down (IFRS 15 thus increased the cost of revenue by TRY 84mn in 1Q18). IFRS 16 increased Borrowings, as mentioned above, as well as adding TRY 56mn to finance costs as leases came due. In sum, these changes added TRY 323mn to revenues and inflated the EBITDA margin to 42.5%, from 35.7% if they are excluded.

Looking forward, Turkcell continues to guide to revenue growth of 14-16% this year, along with higher EBITDA margins of 37-40% and operational capex / sales of around 18-19%.

Following the strong performance in 1Q18, the new accounting rules that boost EBITDA, ongoing evidence of strong increases in data consumption and digitalisation and the slowdown in Capex as the investment cycle turns, we find these targets entirely credible.

"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).