Trump & Trade: Feeling the pressure

President Trump has announced the latest round of tariffs on imports from China with China vowing an immediate response. With the president's approval rating at a four-month low and the mid-terms fast approaching, there is no prospect of an imminent easing in tensions

More and more tariffs...

President Trump has announced the latest round of tariffs on $200 billion of Chinese imports, which will start next week. After considering evidence from impacted businesses he has started the rate at 10% and excluded some technology items, safety products and chemicals. However, the tariff will be increased to 25% next year if China fails to make concessions on trade practices and intellectual property protection.

The US had already imposed tariffs on $50 billion of Chinese imports so this takes us up to $250 billion of goods that are taxed - just under half the value of all Chinese imports last year. However, should China retaliate – Bloomberg headlines suggest there will be retaliatory tariffs launched simultaneously - then all Chinese imports into the US will face tariffs. As such this is a real ratcheting up of trade tensions that certainly heightens the risks for global and US growth.

Our China economist, Iris Pang suggests that China is unlikely to return to the negotiating table given the threats. There is little sign yet that Chinese authorities are willing to acquiesce and that more monetary and fiscal stimulus is likely to be used to try and offset the negative impact of trade protectionism. However, a new round of trade tariffs on US imports into China is clearly being readied with aerospace and car companies most likely in the firing line.

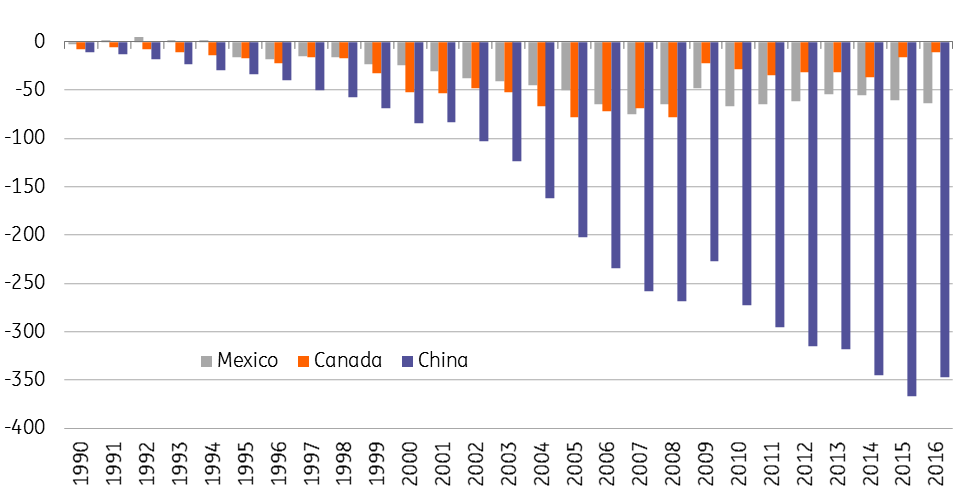

US trade deficit driven by China

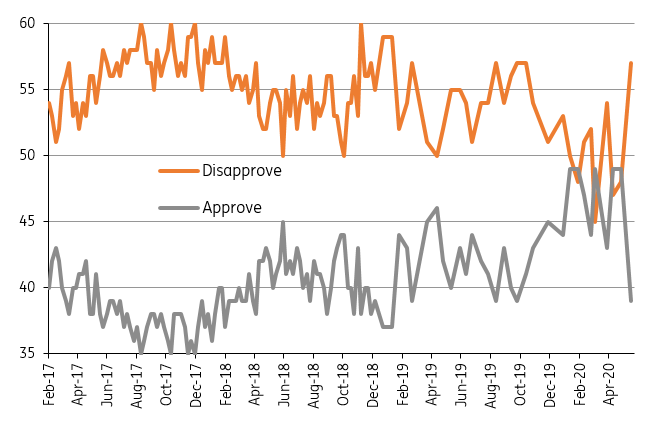

A president under pressure?

This has to be viewed in the context of the US mid-term elections. President Trump has demanded that the bilateral US-China trade deficit is cut by $200 billion by 2020 – the goods deficit totalled $370 billion in 2017. The economy and trade had been seen as Trump’s strong point, however, his presidential approval rating has dropped four percentage points over the past month to just 38%. This is lower than any other president at this stage in his presidency in the past 70 years and these latest trade protection measures could be seen as an effort to bolster his standing.

Trump Presidential approval rating

Risks for the economy

With the Republicans lagging well behind the Democrats in generic polls there is a growing likelihood of a split Congress – House controlled by Democrats and Senate controlled by Republicans, Trump may increasingly be limited to executive powers, which include trade. This suggests little prospect of a de-escalation from the US side anytime soon.

In terms of the economy, President Trump has arguably tried to limit the damage to the US by excluding some products and starting the tariff at 10%, but this will still put up costs that may well be passed onto consumers. It also adds to corporate uncertainty, although the US administration would say that by staggering the rate of the tariff it gives US companies time to move more manufacturing back to the US so they can avoid the full 25% tariff if China doesn’t back down.

As for the outlook for Federal Reserve policy, the official position up until now has been that tariffs pose a threat to medium-term growth and so the reaction function is more likely to be one of caution rather than hiking rates to combat higher inflation brought about through tariffs.

For now, the US economy is very strong with the Atlanta Fed Nowcast GDP estimate suggesting GDP is likely to have accelerated to 4.4% from 4.2% in 2Q18. But the effects of a strong dollar, higher US interest rates, fading US fiscal stimulus and emerging market woes are likely to gradually exert a toll. Trade tensions will only exacerbate the downside risk. We look for GDP growth to slow to closer to 2% next year with the Federal Reserve taking a more gradual approach to rate hikes of just two 25 basis point moves for the full year 2019 versus four in 2018.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more