Trade in 2018: Nowhere close to its heyday

Trade in 2018 will pick up speed but rebalancing of the Chinese economy and global value chain trends mean we won’t see world trade growth doubling GDP growth, as it did before the crisis

With fourth-quarter trade data still to come, we expect 2017 to be the strongest year for world trade since 2011. With an annual growth of roughly 4.5%, world trade will outpace world GDP growth for the first time in six years.

World trade exceeds world GDP growth in 2018 and 2019

However, the high growth rate this year is largely the consequence of a favourable carryover effect from last year. Trade dipped in 1H16, but it recovered strongly towards the end of the year. Simply hanging on to the trade level of December 2016 – with no growth whatsoever in 2017 – would already have been enough to deliver a 3% annual trade growth in 2017. So 2017, has done a little better than this, but not much.

Don't let the data fool you

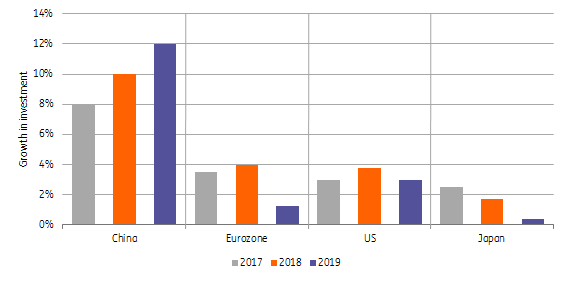

In 2018, trade growth will pick up some speed thanks to increases in GDP and investment growth in the largest trading nations. Japanese growth will come down, but US growth will pick up. Russia and Brazil will continue recovering from their recessions in recent years. Economic growth in the Eurozone will cool off a bit, but investment growth will increase.

We're not expecting a surge in trade growth in 4Q17 like 4Q16, so the carryover effect should be smaller in 2018.

These developments should deliver higher monthly trade growth, but annual growth in world trade for 2018 as a whole is expected to be lower than 2017, at 3.7%. This is because the base for comparison is less favourable. We're not expecting a surge in trade growth in 4Q17 like 4Q16, so the carryover effect should be smaller in 2018. In 2019, we expect investment growth in the major trading countries to slow somewhat and, hence, trade growth to fall back to 3.25%.

Higher investment growth in 2018, but lower in 2019

Although world trade growth is set to outpace the growth of world GDP in both 2018 and 2019, this will only be by a small margin, and nowhere close to the decade before the financial crisis when world trade grew twice as much as world GDP. This was, among other things, the result of the fast spread of global value chains, boosting business in intermediates.

Offshoring has lost its appeal

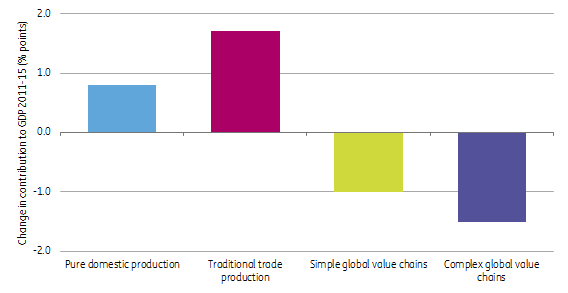

The latest data on global value chains indicate offshoring has slowed. The data shows production chains are contracting, which is reflected in less cross-border trade in intermediates, which are no longer rising as a share of global trade.

The contribution to world GDP from products made within a global value chain has declined since 2011.

Global value chains are adding less to GDP

One of the reasons for the lower trade in intermediates is China increasingly using domestically produced intermediate goods in place of imports, which is reflected in its declining import ratio.

The Chinese economy is less import intensive

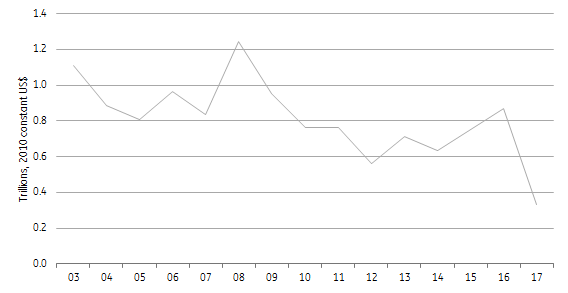

Greenfield foreign direct investment flows have - with the exception of 2016 - have remained weak in recent years compared to the period before the crisis and taken a nosedive in 2017. As with the stagnating growth in the share of intermediate goods in total trade, this suggests that offshoring is not about to generate another acceleration in world trade growth.

Nosedive for Greenfield FDI flows in 2017

China’s broader rebalancing strategy towards consumption and away from exports also limits the potential for trade growth, because the import intensity of consumption is lower than that of investment and exports.

Protectionism: the dog is barking but will it bite?

Protectionism in the Trump era is the barking dog that hasn’t really bitten in 2017. World Trade Organisation (WTO) figures published in November show that G20 countries introduced an average of three trade restrictive measures per month in the past six months, the lowest rate in the post-crisis period.

Fewer restrictive measures in the Trump era

Trade facilitating measures, in the meantime, continued to be introduced at a rate similar to previous years. These measures are not limited to national or bilateral agreements, but also include important international agreements that will stimulate international trade in the coming years. This includes ratification of the 2013 Bali Agreement to lower custom barriers, the extension of the free trade agreement for IT products (ITA) and the decision of TPP countries to go ahead with liberalising trade without the US. It all shows that free trade is far from over.

Nevertheless, the downside risks from protectionist policies remain. We have not heard the final word on NAFTA re-negotiations yet, and the situation certainly looks dangerous. Were NAFTA to fail, it would be a severe blow. The same risks are involved in the prospective EU and the UK trade agreement, where the best outcome can only be neutral for world trade, but risks are firmly on the downside.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

5 December 2017

ING’s outlook for 2018 This bundle contains 7 Articles