Tightness takes hold of the oil market

The last month has seen the oil market convincingly break out of the range it has been stuck in since early May. Tightening fundamentals and prospects for a softer-than-expected landing for the US economy have pushed the market higher. Constructive fundamentals should mean more strength in the months ahead

Oil prices still have more upside

While the oil market has seen quite a bit of strength in recent weeks on the back of tightening in the physical market, we believe that there is still room for the market to move higher. Our balance sheet suggests that the oil market will continue to tighten as we move through the second half of the year with a deficit in the region of 2MMbbls/d.

We have left our forecasts for the remainder of the year unchanged. We still expect ICE Brent to average US$86/bbl over 3Q23 and US$92/bbl over 4Q23.

Our balance shows that the market will remain in deficit over 2024. However, this deficit is heavily skewed towards the second half of 2024. In fact, we see a small surplus in 1Q24, which suggests that prices could pull back early next year, before moving higher once again. While we still expect Brent to average US$90/bbl over 2024, we have revised the profile.

The assumption behind our 2024 forecasts is that OPEC+ sticks to its planned production targets, whilst the 1.66MMbbls/d of additional voluntary cuts from a handful of OPEC+ producers also continue through 2024.

Oil market set to remain tight through 2024 (MMbbls/d)

Saudi cuts intensify market tightening

It was largely expected that the oil market would tighten over the second half of 2023 due to OPEC+ supply cuts and further demand growth. OPEC+ has a production target of 41.86MMbbls/d through until the end of this year and 40.63MMbbls/d for 2024. However, in reality, we are seeing much deeper cuts from OPEC+.

Firstly, a handful of OPEC+ members have made additional voluntary supply cuts of 1.66MMbbls/d. These are currently set to continue through until the end of 2024.

In addition to this, Saudi Arabia announced a further voluntary cut of 1MMbbls/d for July but has since rolled this over in August and more recently into September. Saudi Arabia will want to be careful with how it goes about unwinding this. The ongoing cuts have finally had their desired effect for OPEC+ and specifically Saudi Arabia. Relaxing them too soon or too quickly will obviously have an unwanted impact on prices. This is particularly the case at the moment, where concerns are growing over the state of the Chinese economy with it clearly not recovering at the pace many had expected.

OPEC+ cuts and crude quality

The scale of cuts we are seeing from OPEC+ might have taken time to be reflected in outright prices as well as time spreads. However, where it has been much more evident for several months, and only becoming increasingly more apparent, is in quality spreads. OPEC+ cuts have led to a reduction in medium sour crudes, whilst the supply growth we are seeing will be largely driven by lighter sweet crudes. This trend is well reflected in the Brent/Dubai spread which is seeing Brent trading at an unusual discount to Dubai. In fact, the spread has traded to deeper discounts than seen in 2020, where we saw 10MMbbls/d of supply cuts from OPEC+. The move in the spread suggests that we should be seeing Asian buyers turning increasingly to cheaper Atlantic Basin crudes. It is difficult to see a quick reversal in the Brent/Dubai spread, at least until we start to see Saudi and other OPEC+ members unwinding supply cuts. In the absence of this, we would likely need to see a tightening in the light sweet market.

The tightness in the medium sour crude market is having an impact further downstream as well, with it leading to a tightening in the high sulphur fuel oil market. And in fact, in NW Europe this has seen the HSFO crack briefly trade at an unusual premium.

Russian oil supply risks

Since Russia’s invasion of Ukraine, there has clearly been plenty of uncertainty over how Russian oil flows would evolve. However, Russia has surprised many in the market with how stubborn its export volumes have been. Large discounts have ensured that there have been willing buyers for this crude. Although, admittedly seaborne exports have been trending lower more recently, and the four-week rolling average has fallen below 3MMbbls/d, which is the lowest level seen since the start of the year.

The supply cuts previously announced by Russia finally appear to be feeding through to lower export volumes. Although, it’s also worth pointing out that with Urals now trading above the G7 price cap, Western shipping and insurance cannot be used, although Russia seems to have built a fleet large enough to get around the price cap.

There has also been an increase in tensions between Russia and Ukraine after Russia pulled out of the Black Sea Grain Initiative and threatened that any vessels calling at Ukrainian Black Sea ports could be treated as a potential military target. This development has only increased risks in the Black Sea with Ukraine retaliating with a similar threat. This obviously poses a potential risk to Russian crude oil exports from Novorossiysk with exports in the region of 500Mbbls/d. However, this is not the only volume exported from Russian Black Sea ports, Kazakhstan also exports in the region of 1.3MMbbls/d from the CPC terminal in Novorossiysk.

For now, though, the risk to this supply is thought to be low. Whilst Ukraine has targeted two Russian vessels recently, it has refrained from targeting commercial vessels. Any disruptions to energy or food supplies from the region will likely not be well received by Western allies.

US drilling activity continues to slow

The number of active oil rigs in the US has fallen by a little more than 15% since the start of the year to 525, according to Baker Hughes, which has left oil rigs at their lowest levels since March 2022. This slowdown in drilling activity will unsurprisingly have an impact on the supply outlook, specifically over 2024. US crude oil supply is expected to grow by a little over 200Mbbls/d between July and December this year, whilst in 2024, average annual supply is expected to grow by a little more than 300Mbbls/d year-on-year. While more modest supply growth is expected, the US is still forecast to produce record levels of crude oil this year as well as in 2024.

As for US inventories, commercial inventories continue to trend lower, having fallen by close to 42MMbbls since mid-March to a little under 440MMbbls currently. Stocks are at their lowest levels since early January, and whilst they are above the levels seen at this stage last year, they are trending just below the five-year average (a number which is admittedly inflated by 2020 inventory numbers). We are likely to see crude inventories continue to trend lower until September, which is when we should start to see refinery run rates fall due to refinery maintenance.

Global oil demand growth dominated by China (MMbbls/d)

Demand concerns linger

Despite lingering demand concerns, global oil demand is still set to grow by around 1.9MMbbls/d this year to a record 101.8MMbbls/d. More than 60% of this growth is driven by China. Therefore, it is not too surprising to see that the oil market is nervous given the weaker-than-expected Chinese macro data that we have seen recently. However, despite this weaker data, the oil-related numbers remain largely supportive. Crude oil exports so far this year average 11.26MMbbls/d, up 12.4% YoY. Refinery activity has hit record levels this year, with a record 14.94MMbbls/d processed in March, whilst activity in July was the second highest on record.

Finally, apparent oil demand has also hit record levels this year with the post-Covid rebound. Obviously crucial for the market is whether these numbers are sustainable over the second half of the year, given the slowdown we are seeing in other parts of the economy.

The US for much of the year has also been a concern for the market. Given the pace of rate hikes, market participants were expecting a fairly aggressive slowdown in the latter part of 2023. However, the market is coming around to the idea that the US may be able to pull off a soft landing. We are still assuming that US oil demand will be largely flat year-on-year, but this may be too conservative, given that implied gasoline demand has been tracking above last year’s levels for much of the year. Implied US gasoline demand so far this year has averaged 8.88MMbbls/d, up by 1.4% YoY.

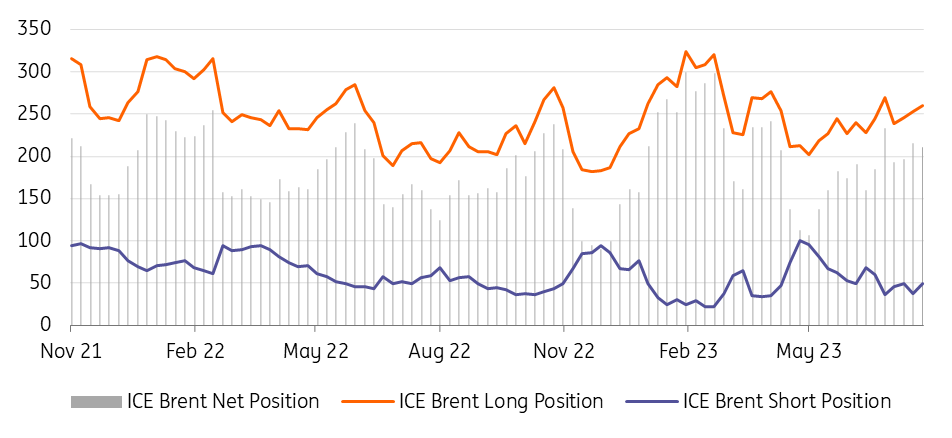

Speculators still holding a fairly neutral position in ICE Brent (000 lots)

Speculators holding back

Speculative activity in oil, as in most commodities, continues to be relatively muted. This is despite constructive oil fundamentals for the remainder of the year. Speculators appear to be reluctant to carry too much risk at a time when China's recovery is clearly not going to plan, while there has also been plenty of uncertainty over how much more tightening we could see from central banks.

When you combine these uncertainties along with higher rates, speculators may be less willing to hold too large an exposure in oil. However, any change in speculative appetite, combined with the current supportive fundamentals, could propel prices higher. From a historical perspective, speculators still have plenty of room to increase their positioning.

ING oil forecasts

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more