Three political scenarios for Italy with FX and rates implications

The collapse of Italy's ruling coalition opens the way for three possible scenarios: new elections, an extension of the current coalition or a new technocratic government. Timing will be crucial, given the proximity to the budget season. Rising political uncertainty is likely to prompt a widening in the 10Y BTP-Bund spread and to weigh on the euro

Three scenarios ahead of the government crisis

Italy is facing another political crisis after the leader of the country's Lega's party, Matteo Salvini, told the prime minister and the Five Star Movement coalition partner that he wants fresh elections and that the government is now technically dead. It comes after Five Star failed to block the construction of a high-speed train link between Lyon and Turin, something strongly supported by Salvini. Polls suggest that Lega could be close to winning the 40% of votes needed to govern either alone or through a coalition, probably with the ultra-conservative Brothers of Italy (currently at 7%).

This crisis comes at a critical juncture

This crisis comes at a critical juncture. Only last month the prime minister, Giuseppe Conte, managed to get an agreement with the European Commission to avoid an EU disciplinary procedure over its growing debt. But the 2020 budget looks set to become even more challenging and the absence of a working government in October will complicate matters even further.

Timing is the key variable to consider when analysing the possible scenarios for Italian politics. First, it will be crucial to see when Prime Minister Conte will decide to officially resign. That allows the President of the Republic, Sergio Mattarella, to start a period of consultation with the leaders of the main parties whilst weighing the different options. How long these consultations last is relevant: there is not a fixed deadline and it is mostly up to the discretion of the President. The more the decision is delayed, the more complicated it will be for a new government to deal with the busy schedule of budget-related obligations starting in October. At the moment, PM Conte appears reluctant to loosen his grip just yet and he called for a formal no-confidence vote in the parliament. The current situation suggests three possible scenarios ahead.

Opinion polls suggest Salvini is close to a majority

New elections

Salvini has explicitly called for new elections as he pulled the plug on the governing coalition. General elections in Italy can take place no earlier than 45 days after the President dissolves the parliament and announces snap elections. In practice, at least 60 days are probably going to be needed to set up the electoral procedures. Should President Mattarella decide to rush things and dissolves parliament next week, then we would be realistically looking at either the 13th, 20th or 27th of October as the earliest possible dates for an election.

This would inevitably collide with the deadline set by the EU to submit the 2020 budget draft (October 15th), although the Commission may well grant an extension given the extraordinary situation. Waiting much longer to announce snap elections can be very risky: the new government may not have enough time to receive parliamentary approval of the budget before the December 31st deadline. This would increase the possibility that the “provisional system” would automatically come into force. That's a system provided for in the Italian constitution that forces the government to spend only a limited amount of resources each month, thereby blocking any long-term investment previously included in the budget. All parties (and the President) would likely want to avoid this situation given the possible dampening effects on the already-battered Italian economy.

Extension of the current government

With those concerns about the budget deadlines in mind, President Mattarella may decide to try to convince Salvini and his co-deputy prime minister, Five Star's Luigi Di Maio to extend the current coalition at least until the end of the year. He would likely require a commitment by the two parties to deliver on the budget. Such an agreement may include demands for a cabinet reshuffle, with a bigger presence of League representatives in some key roles. This would likely lead to elections at the beginning of 2020.

A new technocratic government

Similar to the second option, the President may try to ensure a “calm” budget season, but this time by calling for an external figure to lead an interim government with the specific task of having the budget approved (by the EU and the parliament). The President would inevitably need to ensure there would be a majority backing the technocratic government, which may turn out to be a anything but a simple task. Also in this scenario there would likely be snap elections in early 2020. There's also some speculation of a possible agreement between the 5-stars and the Democratic Party to form a new government, but no official negotiations have started and the parties' political views are, for now, very far apart.

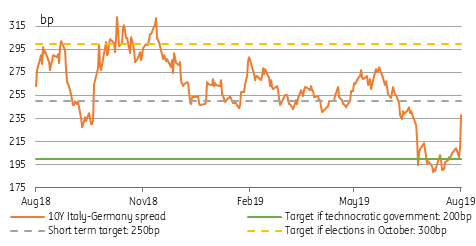

Rates: 10Y BTP-Bund spread to widen

From now until we know the date of the election, we're going to see further volatility in Italian markets. And that prospect is enough to flush out positions established with a view to benefiting from carry over the summer months, in our opinion. This justifies our short-term call for a widening of the 10Y Germany Italy spread to 250bp. The range of possible outcomes discussed above, and market reactions discussed below, also justifies a greater risk premia baked into this spread in the near term.

For investors, the interplay between the election and budget dates will be crucial. The failure to pass a 2020 budget before the election would expose holders of Italian bonds to a period of uncertainty until it becomes apparent whether an Excessive Deficit Procedure (EDP) will be reopened against Italy or not. It could also raise doubts in investors’ minds as to whether the ECB would restart PSPP (the Public Sector Purchase Programme) and risk being seen supporting a government breaching EU fiscal rules.

On balance, we think the political turmoil is unlikely to prevent a restart of purchases, given that easing is required by conditions within the eurozone’s economy as a whole. The tone of the League’s campaign on fiscal issues will also be important, not least because prominent party members have expressed reservations about Italy’s euro-membership in the past. More broadly, the prospect of a more assertive, and more powerful, Salvini raises the prospect of protracted tensions with the EU.

Different reactions from the 10Y BTP-Bund spread

If we get elections in October (scenario 1 above) then the period of uncertainty is likely to be short but intense. League election rhetoric will gain in importance given its implication for the 2020 budget. There is a possibility that the League’s economic agenda might ultimately be perceived positively by investors, but the near-term risks surrounding the election should dominate price action, especially as the build-up to the Italian election would coincide with the build-up to Brexit. If we get that, we see the 10Y Italy-Germany spread testing 300bp to the upside during the campaign.

In the event that the current coalition survives the crisis (scenario 2) until after the 2020 budget process, we think the likelihood of a clash between the government in the autumn is high but manageable given the proximity of ECB easing. This was the closest outcome to what markets were pricing prior to this week. We doubt a retracement of the 10Y spread below 200bp is likely in this event, however, because Salvini’s strengthened position will give him more leeway to push for his fiscal demands. We see the spread staying around 250bp in this scenario.

If President Mattarella manages to muster a technocratic government (scenario 3) with the main aim to pass a 2020 budget giving no ground for the EC to restart the EDP against Italy, then we expect the 10Y Italy-Germany spread to recover from today’s widening, and BTP correlation to other EGB markets to return to positive territory. This outcome would dispel any lingering doubt about the ECB’s willingness to include government bonds, and thus BTPs, in its purchases. In this scenario, we see the 10Y spread retracing inside to 200bp into the restart of PSPP.

FX: Another negative added to the EUR outlook

About a year ago, the freshly-formed Lega-5 Star government spread uncertainty in the markets as they announced a 2.4% deficit target to be included in the draft budget. In the following weeks, Italian political uncertainty was a constant dragging factor on the euro. The main takeaway from our scenario analysis is that the breakup of Italy's ruling coalition is probably the first step towards a period of extended uncertainty stemming from the country.

An escalation in political risk is likely going to add more negatives to the euro outlook

This may add more negatives to an already clouded outlook for the common currency. Our economists are expecting the ECB to deliver a heavy package of monetary easing in September: a rate cut and the announcement of a new round of quantitative easing. In addition, the global environment continues to bode quite badly for the already-concerning European economic outlook: trade wars may soon hit the EU directly, with President Trump possibly aiming to levy tariffs on autos, The lingering Brexit-related uncertainty also continues to weigh on forward-looking indicators.

An escalation in political risk stemming from Italy is likely going to add more negatives to the euro outlook. In particular, we expect such potential escalation to have a magnified effect on EUR/CHF among other crosses. The pair proved to be highly correlated to the dynamics of the 10Y BTP-Bund spread during the troubled 2018 budget season. On the opposite side, EUR/USD may face more resistance in entering an extended downward trajectory, given that simultaneously-escalating trade tensions may join recent pressure from the White House to suggest more easing by the Federal Reserve, thereby weighing on the US dollar.

Despite the upcoming easing moves by the ECB, the outlook for the EUR-USD rate differential appears more likely to move in favour of the euro. Negative rates in the eurozone may only have limited space for a further drop, whereas an easing cycle by the Fed may keep pressuring the relatively-higher US rates. In the table below, we outline the potential reaction of EUR/USD and EUR/CHF to the three different scenarios discussed in this article.

One thing's for sure, the collapse of the Italian government is paving the way for more uncertainty, and not just as far as politics are concerned. The spill-over effect will likely depend on the number of implications about the future Italy-EU relationships and the stability of the battered Italian economy. We believe that the balance of risks for Italian sovereign bonds is tilted to the downside, with the 10Y BTP-Bund spread that may well edge back to the 300bp area in case of new elections in October. Similarly, this scenario would probably add selling pressure to the EUR, with the CHF likely to come up as the main beneficiary: EUR/USD may explore the 1.10 area while EUR/CHF could touch 1.07.

Given the early stages of the government crisis and the lingering uncertainty about the upcoming developments, we're not putting probabilities to the scenarios, although we acknowledge a significant increase in downside risk for eurozone sentiment.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

9 August 2019

What’s happening in Australia and around the world? This bundle contains 14 Articles