Three calls for the Dutch economy in 2024

With 2023 being a year that included a technical recession and high but moderating inflation rates, here are our three calls of the outlook for the Dutch economy in 2024

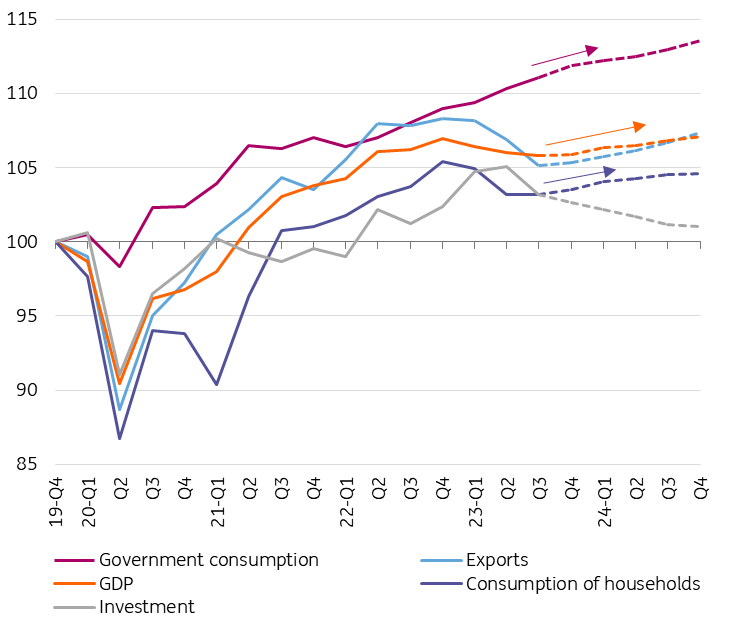

Dutch economy leaves recession

The Dutch economy should exit the mild recession that so far has lasted three quarters. Forward-looking indicators for business activity have improved, while consumers have also recently become more upbeat. October figures for retail sales indeed seem to confirm that high wages combined with lower inflation translate into the return of growth of not only nominal consumer spending in 4Q23 but also the growth of consumption volumes. The increase in purchasing power continues into 2024, when the government will also contribute to higher net incomes, for example, via a further increase in the minimum wage and its related old age and welfare benefits.

Partly thanks to an improving consumption outlook, the Dutch economy is expected to grow by a modest 0.7% in 2024, following economic stagnation in 2023 (0.2%). The largest contribution to economic growth in 2024 is however expected to come from the government. Demography and policy interventions increase public spending. The cooling of the global economy is expected to coincide with only a moderate export development for Dutch firms. Subdued demand expectations and increased financing costs are leading to a contraction in investment. So, despite the end of the recession, the growth rate is expected to remain below the country's long-term potential in the coming period.

For our Dutch readers, we refer here to our more elaborate Outlook 2024 (published November 30th 2023).

Return of consumption growth calls Dutch recession to an end

Expenditures* as index where fourth quarter of 2019 = 100

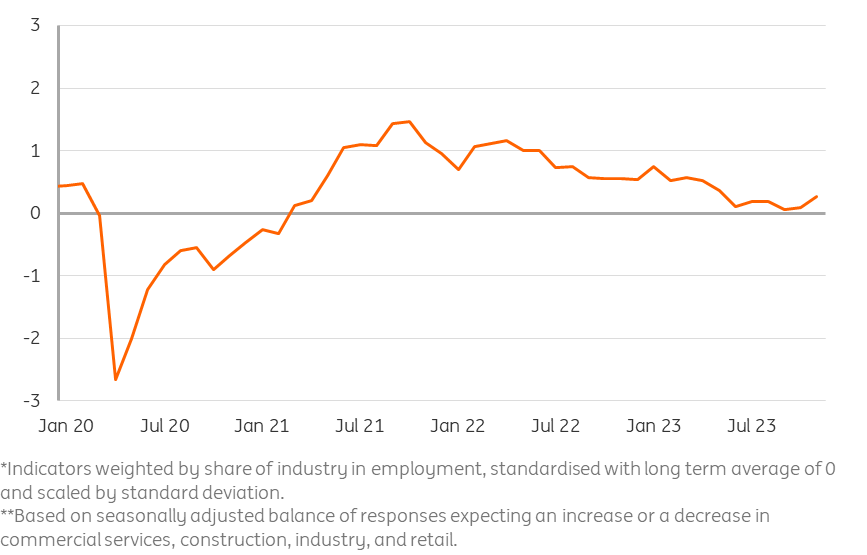

Strain in Dutch labour market not wiped out quickly

The earlier contraction during 2023 and below-potential growth in the period ahead, combined with increasing bankruptcies and firm exits (now that the tax authority is enforcing inviable businesses to pay back the tax bill that was deferred as part of the Covid support programme) will weaken demand for workers somewhat. This is visible in the employment expectations of businesses.

Employment expectations of Dutch business deteriorated, but remain close to the long-term average

Employment* expectations** of business for the next 3 months

We, however, believe that this will not translate into a very large increase in the unemployment rate. We expect the rate to rise moderately to a still relatively low number of 4.2% in 2024. While employment expectations of businesses have come down, they are still slightly above long-term averages, possibly signalling some labour-hoarding behaviour and mild optimism about a return of demand growth. Furthermore, ageing and the expansionary policies of the government, such as investment in greening the economy and in defence, will increase the semi-public sector's claim influence on the labour market.

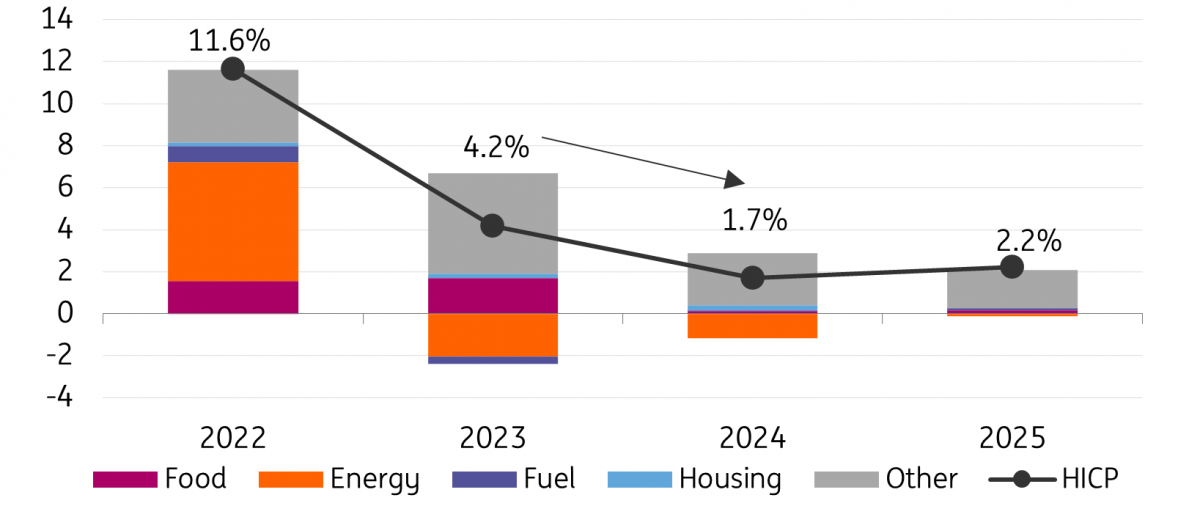

Inflation falls below 2% despite core inflation not yet reaching usual levels

In 2024, price pressures will clearly ease compared to 2023, when the HICP consumer price inflation rate was still high (4.2%). Items that will lower inflation in 2024 compared to 2023 include food, transport, transport services, hospitality services and education. Albeit less than in 2023, the energy bill will lower the inflation rate in 2024 too, despite the termination of the energy price cap. This time, the negative contribution of the energy bill comes from tax cuts and lower prices on the international wholesale market for energy.

As such, the HICP headline inflation rate is expected to fall to a relatively "normal" 2% in 2024. Core inflation - the rise in prices without volatile goods such as food and energy - of 3.4% will still be at an unusually high level, but it is also coming down from a high 6.5% in 2023. A projected deceleration of wage cost increases will eventually help to reduce service inflation in 2024, which is part of core inflation, but this is expected to happen only gradually. In addition, although the expectations of firms outside the service sector about their sales prices have fallen considerably recently, they are still somewhat higher than on average in the past.

Consumer price inflation in the Netherlands falls below 2%

Change in harmonised index of consumer prices year-on-year in % and contributions in %-points

Note: For our Dutch readers, we refer here to our more elaborate Outlook 2024 (published November 30th 2023).

Download

Download articleAuthor

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more