This is what China’s economic recovery will look like

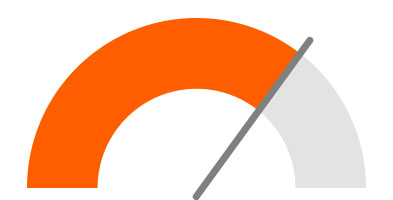

A recovery in China's economy this year looks certain, but the nature and speed of that recovery remain in doubt. After a slow start, we believe the economy could pick up in the summer, but there is a risk that the economy will start to overheat by year-end

There are risks to the reopening story

A great many research notes on China's reopening story tell a very positive and optimistic story. But we believe that some of these ignore the many challenges that still face the economy. This includes, for example, the likely consumption leakage due to outbound tourism, the probable slow recovery in the real estate market, and the difficult export environment. We are also concerned about the intensifying technology war and the impact this will have on foreign direct investment in China. Another risk that we don't think is talked about enough is the potential high-leverage risk of some local governments. This could morph into problems several years in the future, creating a situation similar to the real estate crisis in 2022.

We will start with our forecasts on the macro environment and dig deeper into the opportunities and risks of the economy.

Growth will mainly come from consumption and investment but less from manufacturing

We forecast GDP growth of 5% in 2023. An upward revision of this forecast is more likely than a downward revision after the release of the first quarter data. But these figures will not be released until mid-April. For now, the rationale behind the forecast direction is more meaningful than the figures themselves.

With almost all Covid-19 restrictions lifted, workers are back at work, the vast majority of factories are no longer running closed-loop operations, and land and port traffic are back to normal. A return to normalcy means more jobs for workers, and most idle workers should be able to find new work in the first quarter of this year. We also expect wages to rise in the second half of 2023 as a result.

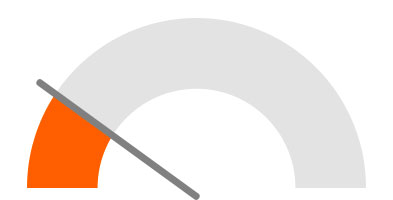

Consumption growth

Consumption to lead growth

Job growth will create consumption growth, and this looks likely to be the main driver of China's economy this year. During the Chinese New Year, cash-rich individuals were able to spend lavishly as shops were open for business and people were no longer locked down. But for the middle-income group, spending power has declined because some have lost their jobs. We project that most of those who have lost their jobs should be able to find new work by the end of the first quarter. Those working in factories, especially the younger generation, may choose to move from manufacturing to the service sector, where jobs are growing faster as the economy reboots. Consumption should rebound significantly during the May holidays. So, after contracting by 0.2% in 2022, China's retail sales could jump by about 8-10% to CNY48 trillion in 2023.

We expect retail sales to grow strongly

Outbound shopping versus inbound duty free shops – leakage of consumption

In recent years, more duty-free shops have been established in China with a wider range of goods, satisfying the luxury shopping needs of some Chinese residents. However, when outbound tourism regains momentum, it is likely that China will face some consumer leakage as some of that shopping will take place abroad.

We expect shopping trips to Europe during the Golden Week holiday in May to return to pre-pandemic levels. In the decade before Covid, Chinese consumers accounted for a third of global luxury sales. This means that luxury sales growth should be very fast on a year-on-year basis in 2023.

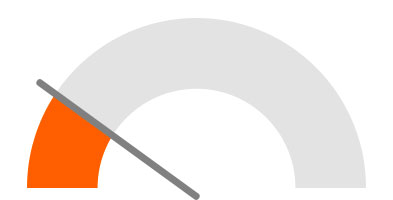

Infrastructure

Infrastructure is a supportive driver

Infrastructure investment will be the second-largest driver of China's economic growth this year. The total amount of new local government special bonds to be issued this year will be CNY4 trillion, roughly the same as the CNY4.04 trillion in 2022, and higher than the CNY3.65 trillion originally planned for early 2022 due to spending on Covid.

For 2023, while not all of the funds from these bond issues will be used for infrastructure, we expect around 70% of the funds to be used for such purposes. One reason for this is the government's desire to ensure a smooth recovery of the economy after reopening, and another is the limited infrastructure spending over the past few years, apart from that associated with Covid.

In 2023, we expect local governments to catch up on planning for infrastructure facilities. We expect more inter-provincial infrastructure and soft infrastructure, including science and technology development, to take place in 2023. If a large portion of the CNY4 trillion of special local government bonds is issued around the Two Sessions in early March, then we should see a rebound in infrastructure investment in the second and third quarters. The charts show that infrastructure investment usually lags the issuance of special local government bonds by about three months. Construction activity for infrastructure will then be concentrated in the third quarter.

Infrastructure replacing real estate as the engine of investment growth

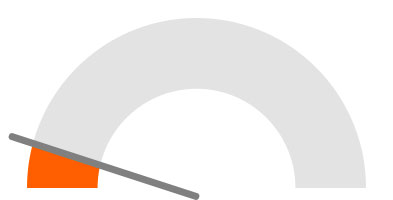

Exports are not promising

External demand is a challenge for the economy

The pain points for the economy this year will come mainly from weak growth in the US and European export markets. This will be reflected in smaller export orders for the Easter holidays. Depending on the length of the economic weakness in the US and Europe, export orders for this year's winter holidays may also be affected. Although net exports contribute only 0.5 percentage points to GDP growth in 2022, it also creates activity in manufacturing, logistics and trade finance, which all contribute additionally to GDP. A slowdown in export markets in 2023 will therefore be a challenge for China's economic growth.

We expect overall industrial production to grow by around 4% in 2023, but export-related manufacturing activity could contract by around 5%, particularly semiconductors.

China's exports to fall further as US and EU demand weakens

Real estate still weak but bottoming

Real estate is recovering quietly

Home sales are recovering, but very slowly and most noticeably in the core areas of the four major cities. Overall, average house prices are still in a state of year-on-year contraction, but as you can see from the chart below, their year-on-year decline looks to have bottomed out. As a result, the housing stock should have peaked. However, a solid recovery will require a return of confidence by potential homebuyers in the ability of property developers to complete projects. More recently, property developers have had additional access to funding, including from banks through the People's Bank of China's (PBoC's) accommodating policy for property developers, as well as access to overseas funding. This should help some property developers complete their projects, which will still go some way to rebuilding the confidence of potential home buyers.

After several years of economic downturn in China, are there enough potential home buyers in the market to support house prices? During the crisis faced by property developers in 2022, mortgages (which fall under the category of medium to long-term household loans) fell sharply and household savings increased. This suggests that some of these savings resulted from deferred down payments on residential property purchases. So at least, for some potential homebuyers, savings for down payments are ready. But some potential home buyers may remain hesitant. For one thing, confidence in the housing market remains low. In addition, job security remains challenged by recent events. When the economy starts to grow in the second quarter of this year, there should be an improvement in the labour market and sentiment for home buying activity should increase, resulting in more housing transactions and higher home prices.

China house prices are bottoming

Potential home buyers have saved enough for down payments

CPI inflation

No inflation threat

Although economic growth is likely to rebound to pre-pandemic rates by the fourth quarter, we forecast CPI growth of only 2.2% year-on-year. There is currently no inflationary pressure on the Chinese economy. The main CPI increases come from food, where pork prices have been volatile.

Nevertheless, PPI should start to rise once the construction sector picks up. As mentioned above, construction activity in 2023 includes residential property construction and infrastructure construction. Unless energy prices jump in 2023, which is not our base case, PPI is not usually easily transmitted to CPI in China. We can see from the chart that PPI in the downstream consumption category is fairly stable, while PPI in the upstream production category is much more volatile. This is because commodity prices have a greater impact on PPI in upstream production. So, when infrastructure and residential construction activity is strong, upstream PPI will rise more quickly. However, this should not have much impact on CPI inflation. Industries that have a big proportion of their costs related to building materials could suffer a squeeze on profit margins as a result.

CPI breakdown

PPI not easily transmitted into CPI

Foreign direct investment (FDI) interests in China

In 2022, China's actual use of foreign investment reached CNY1.2 trillion, up 6.3% from 2021, but much less than the 14.9% growth in 2021. The main reason for the slowdown in FDI growth is that some companies are planning to or have already relocated their factories out of China following supply chain disruptions during Covid.

An important question is whether China's economic recovery will reverse the decision of companies to relocate their factories. After China lifted its Covid restrictions, land and port logistics were no longer an issue. If that had been a key driver behind relocation decisions, it no longer is.

However, there is another supply chain risk on the rise. As the technology war between China and the US intensifies and companies become more concerned about geopolitical issues, companies may continue to plan to move production out of China or add additional production elsewhere to complement production in China. The ASEAN region is growing as an alternative location for multinationals as well as some Chinese companies.

When discussing relocation from China, consideration is usually given to the cost of production in China, which is no longer cheap in terms of land costs and wages. Wages in China are higher than in most ASEAN economies. As a result, the industries that are most likely to move production out of China are low-value-added products such as textiles and garments, plastics and paper industries.

But the focus is not only on production costs, it is on the technology war. Multinational companies involved in technology, such as semiconductor manufacturing, could have more concern about continuing production in China. Semiconductor manufacturing companies with production sites in China could be the first industries to move out of China as a result of the technology war.

Monetary policies

Lending growth was strong in January and the PBoC left the 1-year medium-term lending facility rate (MLF) unchanged at 2.75%. This suggests that the central bank wants to adopt a wait-and-see approach at the start of the economic recovery. In addition, we have seen the PBoC increase liquidity injection through the 1-year MLF instrument, which implies that it sees bank loans growing further after January.

For similar reasons, we do not expect the central bank to lower the reserve requirement ratio.

However, this does not mean that the central bank will do nothing. We believe that the PBoC will continue to offer re-lending programmes to complement central government policies in specific areas. These include property developers to avoid new defaults, rural development to narrow the wealth gap, and technology to enable self-advancement.

PBoC to stay put

The threat from excessive local government debt is growing

The International Monetary Fund estimated China's total general government debt to be RMB 94.73 trillion in 2022, or about 78% of GDP. That sounds fairly unthreatening. But concern about China's fiscal health is not coming from the central government but from some local governments.

This is not an issue for all local governments, and the risks are greatest for those that have historically relied on land sales as a large source of revenue. As the property market was quiet in 2022 and will only partially recover in 2023, these local governments face a debt service risk this year, which suggests that they will have to raise more debt to pay off payments as they fall due.

The central government understands this problem and so has accelerated land sales. But the demand for land by property developers will take time to recover due to ongoing cash shortages, and uncertainty over future land revenue has become the focus of our concern about local governments.

Local governments still rely on land revenue to repay debts

Overheating concern

It may be too early to talk about overheating as it is so early in the economic recovery. But China has a record of helping the economy to recover too fast with supportive policies.

This year, we expect that the central bank will channel liquidity into specific industries, and as a result, we are concerned that some areas of the economy could receive too much cheap funding within a short period, resulting in some overheating in some areas.

We expect technology research and development (R&D) could be one of those areas, as China is eager to become self-reliant in advanced technology. But technology R&D in China is not purely private sector activity. As such, the overheating could be shared between local governments and private companies. We will possibly know more about the potential for overheating concerns after the "Two Sessions" annual government meetings in early March.

Strong yuan

Yuan to go stronger

Though the US Federal Reserve may delay its much-anticipated pivot to lower rates, and the PBoC is on hold, it is clear that the relative economic strength of China and the US in 2023 will be different from 2022. The story for 2022 was that of Chinese weakness and US strength. But for 2023, it is more likely to be the reverse of that.

The change in the relative economic strength of China and the US (read here for our US economist James Knightley's recent note on US CPI) has already resulted in net portfolio inflows in the Chinese onshore equity market since December 2022. There should be more capital inflows if the US and European economies weaken further. Global asset managers could reallocate their asset portfolios again around mid-2023.

Expected net portfolio inflows to push the yuan stronger

US and China stock markets

Conclusion

There are many opportunities in China for the domestic market in 2023, from consumption to infrastructure, though far fewer for export-oriented industries. Our 5% GDP growth forecast is likely to be revised upward rather than downward. The technology war is going to affect foreign direct investment in China, and China needs to rely more on itself to advance technology. This will put fiscal pressure on some local governments while land revenue will remain less than during pre-pandemic times. As the domestic economy will be stronger than it was last year, while the US economy could be weaker than in 2022, we expect the yuan to appreciate in 2023, to USDCNY 6.5.

Forecasts

"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).