THINK Ahead: Yes, central banks. We see your 4-stage strategy

When it comes to dealing with President Trump, James Smith reckons central banks are taking inspiration from the 1980s. And no, he’s not talking about economic history. More 'Yes, Mr President' than 'Yes, Prime Minister'. There's a lot riding on next week for the global economy, and here's what we're looking out for

THINK Ahead: Central banks’ four-stage strategy

Sir Humphrey Appleby might just be one of the most influential UK political figures of the last century. He’s not even a real person. In fact, he’s a thoroughly fictional civil servant in Yes Prime Minister, a British TV series.

Forty years have passed since he last graced our screens, but his comedic musings are still scarily accurate today. When it comes to the way central banks have approached the return of President Trump, look no further than Sir Humphrey’s “four-stage strategy” for crisis management. If you've not seen it, give it a watch.

Stage 1? Say nothing is going to happen. When that fails, in stage 2, you say that “something may be going to happen, but we should do nothing about it”.

You’d be forgiven for thinking that sounds eerily familiar to the December round of central bank meetings. Remember, policymakers generally don’t like confronting government policy proposals until they become official.

Sure enough, Fed boss Jay Powell conceded in December that not all of his officials had factored in Trump’s proposed policies into their most recent predictions. As James Knightley wrote this week, those comments cast doubt on the Fed's forecast of two rate cuts this year and whether it's a true reflection of what officials really thought at the time. The reality may have been more hawkish.

Here in Europe, the ECB’s December forecasts looked similarly disconnected from reality. So much so that officials, including President Lagarde, have since commented that the situation is gloomier than those relatively optimistic GDP projections suggested.

But President Trump is formally back in office now. His flurry of executive orders this week left nobody in any doubt about his intentions.

Central banks are going to need a new line. And so we move onto stage 3 of Sir Humphrey's strategy: “Maybe we should do something about it, but there's nothing we can do.”

The ECB, for instance, might fairly argue that there’s not much they can do in the face of mounting structural pressures across Europe, many of which would be amplified by lighter-touch American regulation and potential tax cuts. That doesn't mean, of course, that they won't end up doing the heavy lifting.

In fairness to the central bankers, we’re still none the wiser on the details of Trump’s major economic policies not least whether the President follows through on his threat to impose tariffs next Saturday on Mexico, Canada and China. A move, as Inga Fechner explains, which would require a national emergency to be declared using this year’s hottest new acronym – the IEEPA (International Emergency Economic Powers Act). It’s a law that’s never yet been used to introduce tariffs.

If there are any lessons from the President’s first week back in power, perhaps they lie in what he didn’t do. Lynn Song notes that Trump’s decision not to impose sweeping 60% tariffs on China on day one is being read positively. That doesn’t make the task of securing a deal any easier, of course, and Lynn argues that markets are underpricing a more forceful response from China should a full-blown trade war unfold.

The good news for central banks, if you can call it that, is the economic data is largely telling them to take policy in the same direction that Trump’s policies will probably necessitate anyway.

In Europe, Carsten Brzeski makes the fair point that sentiment indicators, like the latest PMIs, have for some time embodied the Trump effect. That helps give the ECB a way of becoming more dovish without citing Trump explicitly. And it's why next week's rate cut is proving uncontroversial. Even the most hawkish officials concede more easing is inevitable.

Over in the US, the Fed can point to an economy that’s holding up well and inflation data that has, this month’s data notwithstanding, been proving sticky. That makes it much easier for the Fed to justify an extended pause while it awaits more clarity on Trump’s agenda. James K notes that a March rate cut is becoming less likely, even if further easing is still probable later this year.

He explains more below, and my takeaway is that the Fed's balancing act is only going to get more complicated as the year goes on.

Let’s just hope Powell doesn’t need to turn to the final stage, stage 4 of Sir Humphrey’s playbook: “Maybe there was something we could've done, but it's too late now.”

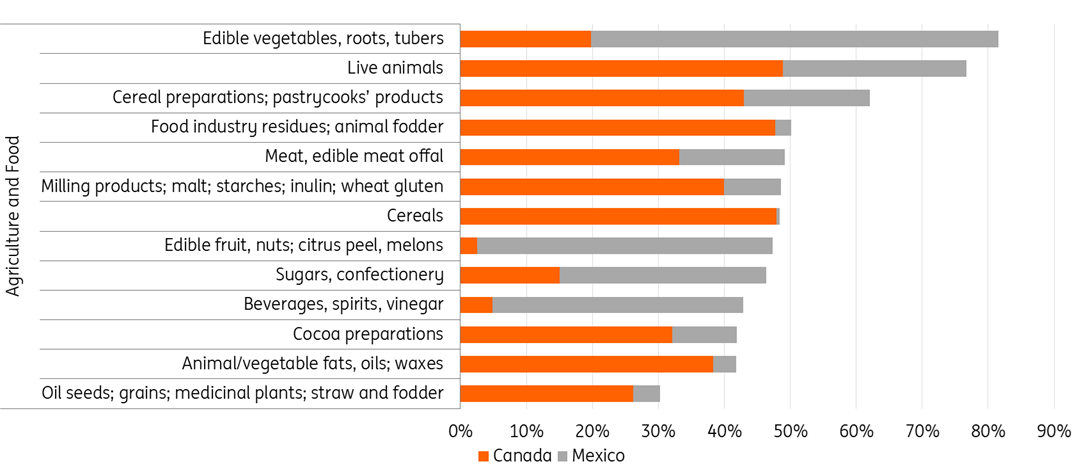

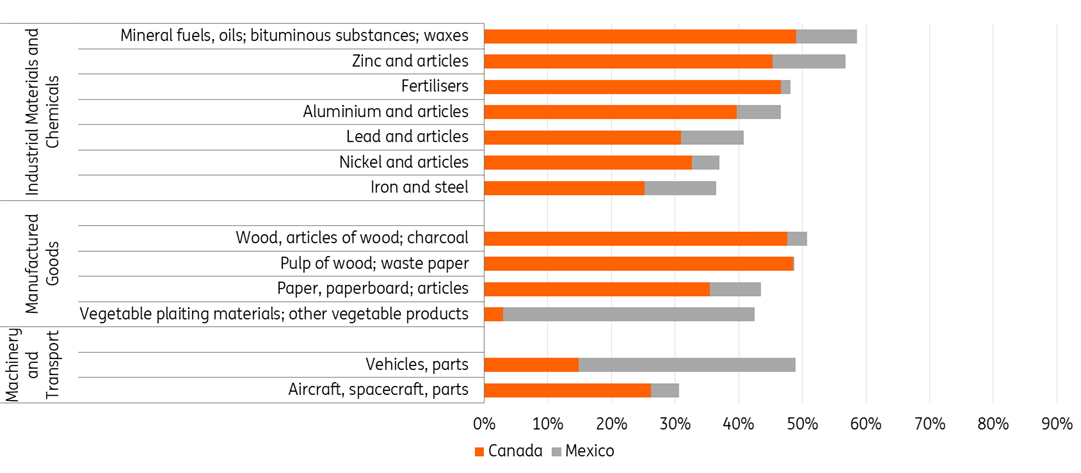

Chart of the week: The products most at risk from US tariffs on Canada/Mexico

Share of Mexican and Canadian goods in all US imports, as of 2023, by HS2-Code (read more)

THINK Ahead in developed markets

United States (James Knightley)

- Interest rates (Wed): After 100bp of rate cuts through late 2024 the Federal Reserve has signalled it needs evidence of economic weakness and more subdued inflation prints to justify further policy loosening. That means no change to monetary policy is a certainty on 29 January and it makes our previous call of a March rate cut look unlikely – currently just 6bp of a 25bp move is discounted by financial markets.

- We are still forecasting three rate cuts for 2025, though. The jobs market is cooling and next month's annual benchmark revisions to non-farm payrolls could see significant cuts to the numbers originally reported. At the same time, rapid increases in Treasury yields have pushed both consumer and corporate borrowing costs sharply higher, and the dollar has strengthened by more than 8% on a trade-weighted basis since September. This is all counteracting the Fed’s 2024 rate cuts. Therefore, we take the view that the Fed may need to push harder and cut rates a little further than currently priced by markets, but nothing is likely before June.

- GDP (Thu): In terms of economic data, 4Q GDP growth should come in close to 3%, boosted by a strong end to the year for consumer spending, but we are looking for some encouraging news on inflation with the Fed’s favoured measure – the core PCE deflator – expected to post a relatively modest 0.2%MoM increase. Wage pressures should also be relatively benign with the 4Q employment cost index suggesting a cooling continues.

Eurozone (Carsten Brzeski/Bert Colijn)

- Interest rates (Thu): Contrary to the run-up to the ECB’s December meeting, the preparation for next week’s has been relatively quiet, at least in public. There haven’t been any controversial views about the next steps. Instead, there seems to be a growing consensus about the need for further rate cuts. Comments by ECB president Christine Lagarde suggest that a 25bp rate cut at next week’s meeting is a no-brainer and that the rate cut cycle will continue. Read more

- GDP (Thu): Data for 4Q will shed light on whether the eurozone has indeed slowed down from a decent growth path seen in the earlier quarters of last year. Data so far shows that the services sector may have contributed positively to growth but that manufacturing continues to contract. Overall, we expect the economy to have stagnated in 4Q and see little uptick for 1Q so far. The winter months are coming in weak for the eurozone before some acceleration of growth can be expected.

Canada (James Knightley)

- Interest rates (Wed): The Bank of Canada is widely expected to cut the overnight rate next week with a 25bp move to 3% looking as the most likely outcome amidst tepid growth, benign inflation and an unemployment rate that’s trending higher. Until there is clarity on what is happening on the US-Canada trade policy front, the BoC is likely to tread cautiously. Nonetheless, the risks to our view that the Bank for Canada policy rate bottoms at 2.75% appear to be skewed to the downside given the relatively subdued economic backdrop and the clear threat to growth and jobs from potential US trade tariffs. Read more

Sweden (James Smith)

- Interest rates (Wed): We expect a 25bp cut from the Riksbank, bringing the policy rate to 2.25%. The Swedish economy was hard hit by rising interest rates, but following one of the most aggressive cutting cycles, rebounding sentiment and housing activity point to a more cautiously optimistic growth outlook. Helpfully, CPIF is also consistently undershooting the 2% target. Read more

THINK Ahead for Central and Eastern Europe

Poland (Adam Antoniak)

- GDP (Thu): On the basis of monthly data, we estimate that the Polish economy expanded by 2.8%YoY in the fourth quarter. Consumption improved, but industry was still broadly stagnant and construction was in decline. In 2024 as a whole, we see economic growth at 2.7%. This year we see growth accelerating to 3.2% owing to a continued expansion in consumption, accompanied by a rebound in fixed investment, as projects financed from the Recovery and Resilience Facility (RRF) and other EU funds kick in. Earlier in the week (Monday), we will learn that registered unemployment increased slightly on seasonal factors but remained close to an all-time low owing to a lack of domestic labour supply.

Hungary (Peter Virovacz)

- Base rate (Tue): We expect National Bank of Hungary to keep things on hold next weel, keeping the key interest rate will remain at 6.50%. Some early red flags on the macro side (unanchored inflation expectations and narrowing external surpluses), combined with high financial market volatility, keep the door shut on conventional easing in the coming months.

- GDP (Thu): We expect fourth-quarter GDP data to be somewhat ambivalent. There will be positive quarter-on-quarter growth, which means that the technical recession in Hungary is quickly coming to an end. However, the growth rates (both quarterly and yearly) will be pedestrian, so it will be more of a correction than a major upturn in economic activity. Given such a sluggish final quarter, we see GDP growth averaging 0.5% in 2024.

Czech Republic (David Havrlant)

- GDP (Fri): The first 4Q24 real GDP estimate will likely show a continued Czech economic rebound, with annual growth gaining traction around year-end. Household consumption likely remained the main driving force of economic expansion in both annual and quarterly terms, supported by continued real wage growth and robust real retail sales. Meanwhile, fixed investment continued to play the role of Cinderella in the economic activity breakdown, dragged down by mounting uncertainty about the future of Czech and European manufacturing in a rapidly changing world.

Key events in developed markets next week

Key events in EMEA next week

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article