The Fed hikes, but a slowdown is coming

A fourth 25bp hike for 2018, but with growth headwinds intensifying and market tensions rising the Federal Reserve will tread a more cautious path in 2019

A more dovish hike

The Fed has hiked its policy rate 25bp to 2.25-2.5% as widely expected, but there is a dovish narrative to the accompanying press release and forecast pace. Having signalled back in September that 3 rate hikes in 2019 was the most likely scenario, 5 FOMC members lowered their projection so the median forecast is now for just two 25bp moves in 2019. They still expect one more rate hike in 2020, but have lowered the longer run projection for the Fed funds rate to a median of 2.8% from 3%. Their predictions for growth, unemployment and inflation were little changed.

The statement incorporates these forecast changes by inserting the word “some” to the assessment that “some further gradual increases” in interest rates will be needed. It also inserts a comment stating the Fed will “continue to monitor global economic and financial developments and assess their implications for the economic outlook” – perhaps hinting they are keeping a watchful eye on equities. There are some other very subtle changes here and there, but all clearly gave the impression the Fed is looking to slow the pace of rate hikes from the four seen in 2018.

Headwinds are intensifying

2018 has been a great year for the economy with output likely expanding at the fastest rate for 13 years and unemployment hitting a 49-year low, but 2019 will undoubtedly see more economic headwinds. The lagged effects of higher borrowing costs – a 30Y fixed rate mortgage is averaging 5% - and a strong dollar will act as a brake while the support from this year’s fiscal stimulus will fade. At the same time concerns about trade tensions, weaker external demand and the resulting hefty declines in the stock market add to the sense of tougher times ahead. This will mean that the Federal Reserve takes a more cautious, data dependent approach to policy decisions next year

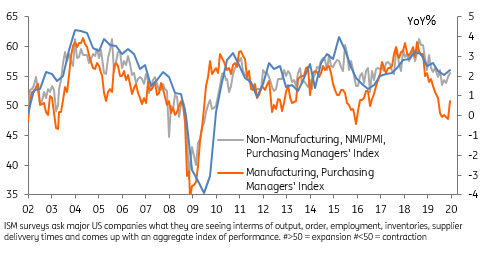

US ISM business surveys remains strong despite trade fears

But there is still reason for optimism

However, there are the upsides from the strong labour market, which is finally feeding into higher worker pay. At the same time, business surveys, such as the ISM reports, remain at very strong levels and given the lack of spare capacity in the US economy we see core inflation continuing to rise through the first half of 2019. In addition, the recent plunge in energy costs could help support consumer demand and if the US and China can resolve their differences this could provide a major boost to the global economic outlook. As such, the fact financial markets are not even fully pricing in one rate hike in 2019 seems far too complacent at this stage.

The skew toward two

We have been forecasting three rate hikes in 2019 for some time, but there is a lot of economic and market uncertainty, particularly relating to trade. We also have to remember that the Federal Reserve is shrinking its balance sheet while there is growing talk – most notably from Lael Brainard – concerning raising the countercyclical buffers. This could be used as a way of shoring up financial risks while also tightening monetary conditions. Consequently we, like the Federal Reserve, see the risks increasingly being skewed towards just two hikes in 2019.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more