The eurozone will struggle to avoid a temporary drop in GDP growth

The eurozone recovery is likely to come to a standstill on the back of the fall-out from the war in Ukraine. A multitude of adverse shocks is set to push inflation to 6% in 2022. For the time being the ECB will limit itself to 'normalising' its monetary policy: stopping QE in the third quarter and a first rate hike in the fourth

Consumers under pressure

With the Ukraine border a mere 1,500 km away from the European capital, it is no surprise that Europe is more directly affected by the war than the US or Asia. Admittedly, it is hard to foresee how the conflict will evolve and how structural its consequences will turn out to be. It looks very likely, however, that the short term positive growth effect caused by the lifting of the Covid-19 containment measures will be more than compensated by this new negative shock. We now actually expect GDP to shrink in the second quarter, though a recession for the whole of the year still looks a long shot given the substantial carry-over effect from 2021.

There is still very little economic data that reflects the situation since Russia invaded Ukraine, although the first survey results are now coming in. We know that consumer confidence plummeted in March. While this definitely indicates a negative impact on consumption expenditure, the amplitude of the fall in confidence has to be qualified. Indeed, consumers tend to react quite strongly in surveys to 'headline-grabbing' events, but that doesn’t mean that consumption will suffer too dramatically. For the time being the labour market remains relatively strong, which continues to support household expenditure. In March businesses still reported strong hiring to combat staff shortages. But we can’t deny that real income is facing downward pressure from high inflation which is, for the time being, not compensated by higher wages.

Mixed confidence figures

Strong business confidence unlikely to last

Business sentiment also softened in March, but still remained relatively strong, with the composite PMI printing 54.5, still comfortably above the 50 points boom-bust level. However, orders slowed with export orders in the manufacturing sector actually declining for the first time in 21 months. Supply chains frictions are also increasing again on the back of the Ukraine war, sanctions in Russia and renewed lockdowns in China. As a consequence supplier delivery times lengthened in March to the greatest extent since November 2021. At the same time, a number of energy-intensive businesses are being forced to shut down product lines in the wake of too expensive energy costs. So the current relatively high business confidence readings are probably not going to last.

We now expect GDP growth to hover around 0% in the first quarter, contract in the second quarter, to give way to a subdued recovery in the third. This is under the assumption that energy prices remain high for the remainder of the year. For the whole of 2022, this results in a GDP growth downgrade to 2% while 2023 could see a slight growth acceleration to 2.3%.

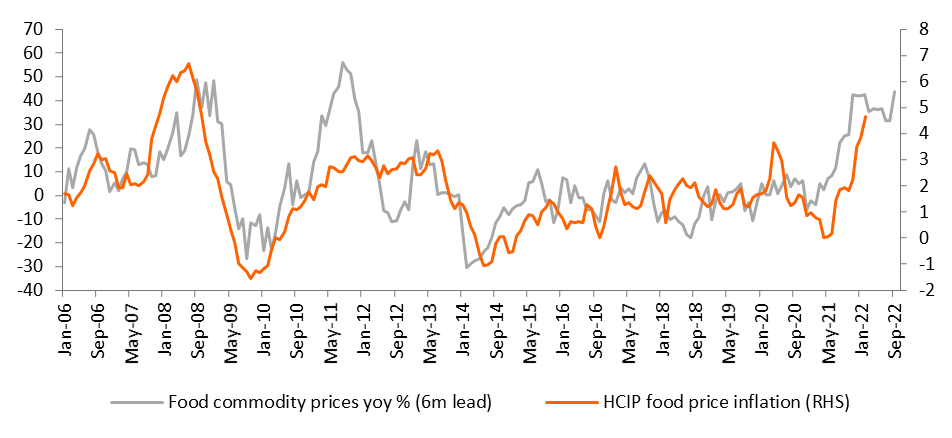

Higher agricultural commodity prices will keep inflation high

ECB caught between a rock and a hard place

We might have used the expression before, but the inflation horror show continues. Every adverse shock is followed by a new one, meaning that the normalisation of inflation rates just isn’t happening. Apart from energy prices the war in Ukraine is now also affecting food prices, as both Ukraine and Russia are important producers of agricultural commodities. We, therefore, had to revise our inflation forecast once again, this time to 6.0% for 2022, with the year ending with an inflation rate of around 4.5%. Because of more favourable base effects, inflation could fall back below 2% in the course of 2023, but we see underlying inflation remaining above 2%.

The European Central Bank continues to struggle with the risk of stagflation. Because of the short term downward risk to growth, there is still little likelihood of an early rate hike. The 5yr 5yr forward break-even inflation rate is now at 2.25%, significantly higher than a year ago, but still close to the ECB’s medium-term inflation target. That said, we believe that the ECB will stick to its plan to get rid of exceptional policy measures, ending net assets purchases in the third quarter. We see a first rate hike in the fourth quarter and a second in the first few months of 2023. While this is already fully anticipated by the markets, the 10 year Bund yield is still likely to creep higher in tandem with US treasury yields to reach 1% in 12 months’ time.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

31 March 2022

ING Monthly: There’s nothing normal about the global economy This bundle contains 17 Articles