The Euro: Only as strong as its weakest link

The Italian political crisis has heaped more pressure on EUR/USD and has re-introduced the topic of a Eurozone crisis onto the FX risk map. While we cannot now rule out EUR/USD falling to the 1.10/12 area this summer, we would say that current EUR pricing already includes a substantial 4% political risk premium

A setback to the Euro recovery story

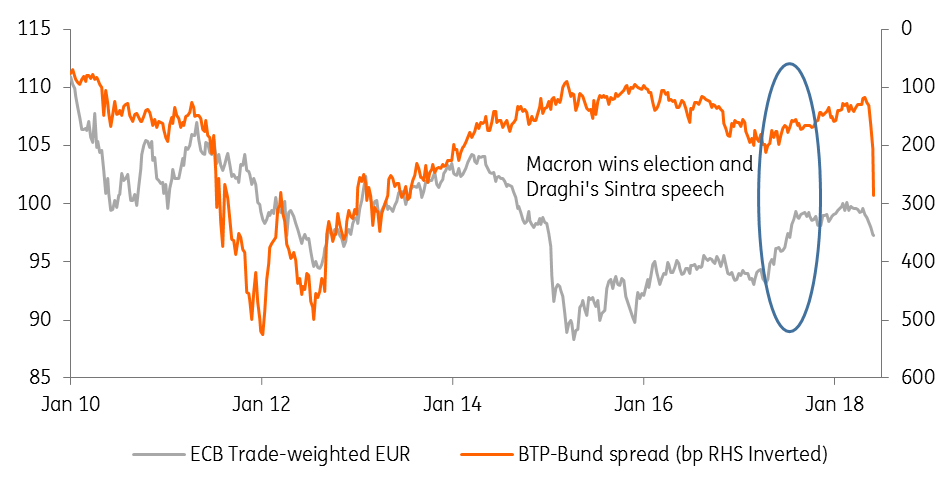

The 2017 rally in EUR/USD owed a large part to independent EUR strength. Emmanuel Macron had fought off the populists and demonstrated that centrists could govern after all. That success was followed by President Mario Draghi in June signalling the ‘all-clear’ for the Eurozone crisis and firing the starting-pistol for policy normalisation – QE tapering and then eventually rate hikes.

The Italian political crisis has proved the first major set-back to that trend. Our team feels that we’re headed to new elections in the September/October window – with the prospect of the same outcome. Together, the Five Star Movement and the Northern League have 57% support in the polls and it seems unlikely that the current volatility in Italian debt markets will force them to alter course.

Despite concerns that both parties choose to radicalise their election manifestos following their choice of Finance Minister being vetoed by the President, our team feels it is too early to assume that euro-scepticism will be the core of their agendas.

The Macron/Draghi 2017 EUR rally is under pressure

Euro 2H17 gains to evaporate?

Investors are already asking: ‘what happens now?’ Mechanisms to save the Euro such as the European Stability Mechanism (ESM) or the ECB’s Outright Monetary Transactions (OMT) require a country to request financial assistance and agree to a programme – typically involving more austerity. Needless to say, it’s hard to see any Italian government signing off on any more austerity right now.

On paper then it looks as though the trade-weighted EUR will fall back to levels seen last Spring, before the Macron-related rally. That means another 3% downside for the EUR, sending EUR/USD to 1.12 – all other things being equal. But a lot of bad news looks to be already in the price. What kind of further political risk premium can be built into the EUR this summer?

Risk premium being built into the euro

Substantial risk premium already in the EUR

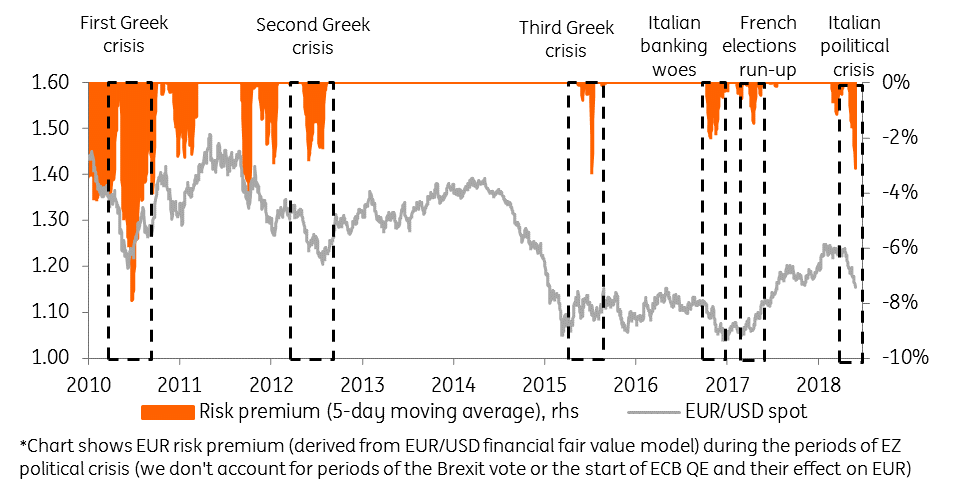

We estimate that EUR/USD now trades with a substantial risk premium (worth of 4.0% based on our short-term financial fair value model, which is well outside its 1.5 standard deviation band).

This is a rather large risk premium and equivalent to the peak of the short-term EUR/USD under-valuation seen during the 2015 Greek crisis (when Greece was closest to leaving the EMU). Only back in 2010 was the risk premium larger, worth 8% on average (and peaking at 9%), as per the EUR risk premium chart above.

Should EUR/USD reflect the peak level of Eurozone political risk premium of 8% (i.e. the 2010 Greek crisis) then EUR/USD would be trading around 1.1000 level.

However, in our view the bar is set high for EUR/USD to endure the same level of political risk premium witnessed in 2010 because:

(a) the ECB provides a backstop via the “whatever it takes” threat (which was not the case prior to the first Greek crisis and prior to the existence of the OMT and ESM programmes)

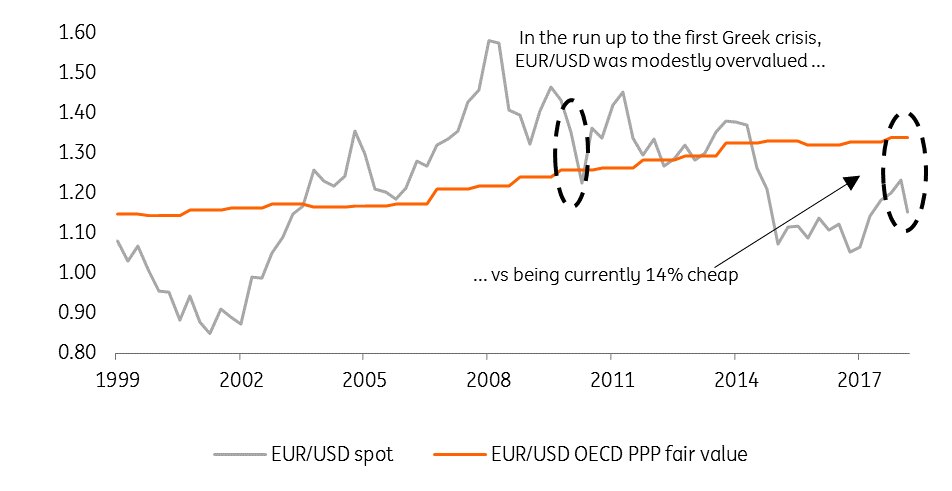

(b) on a long-term valuation basis, EUR/USD is currently undervalued versus a modest overvaluation prior to the 2010 Greek crisis (below), which in turn should limit the scale of its potential downside

(c) the Eurozone runs a large current account (C/A) surplus (versus a flat C/A in 2010) and long-term debt portfolio flows have already left the Eurozone after three years of ECB QE - (versus modestly positive inflows in 2010). Both depicted in our final chart.

EUR/USD very undervalued now vs the 2010 crisis

EUR/USD at 1.10/12 requires a lot more bad news

While we cannot rule out EUR/USD trading to 1.10/12 this summer, this will probably require a lot more bad news out of Italy. In other words, things would have to look as bad as they did for Greece in 2010/12. Our team feels that Italy has a lot more to lose than Greece did at that time and thus a very eurosceptic policy agenda into fresh Italian elections is far from guaranteed. As above, the ECB backstop and the stronger Balance of Payments story also suggest EUR downside will not be as severe as during the 2010/12 period.

That said, our 2018 baseline FX forecasts did not include this scale of Italian political crisis and our 1.30 year-end EUR/USD forecast is under review for a substantial downward revision - probably towards the low 1.20s area.

Eurozone Balance of Payments is far more supportive of EUR now

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more