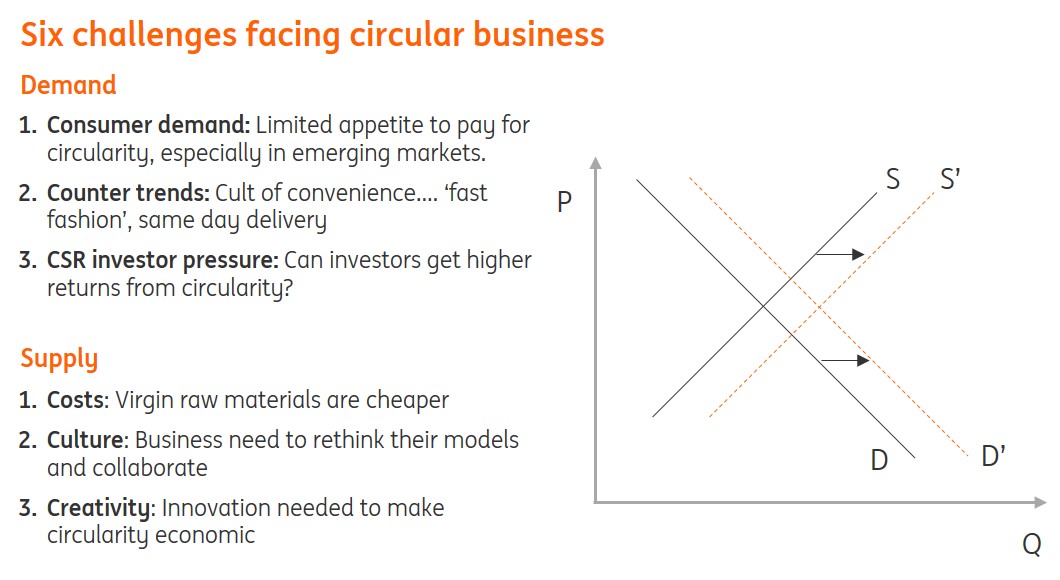

The Circular Economy’s Six ‘C’ Challenge

Despite the promise of the Circular Economy- which aims to deliver economic growth without waste- businesses have been slow to embrace it. Here are six reasons why

Why market forces alone won’t drive it

In a recent presentation to the Financial Services Forum, I addressed the financing of the Circular Economy. A growing number of companies are beginning to acknowledge its potential to deliver sustainable development. But adopting its zero waste philosophy of reduce, reuse and recycle – what I called the ‘veganism of sustainability’ – is easier said than done. Why aren’t circular business models taking off faster? Market forces alone plainly aren’t enough. Here are the six ‘C’ challenges:

Consumer demand

A vocal minority of consumers are advocates of sustainable living, but few are willing to pay up for it. Surveys show that few consumers are prepared to pay more for green products, let alone ones that embrace fully circular principles. And what they tell pollsters may overstate their real appetite to do so. Lack of accepted definitions and labelling of circular products doesn’t help, but in any case, businesses face the challenge of making them price competitive.

Counter trends

Although sustainability is now a cultural trend, there are still cultural trends running in the opposite direction. Some business models are not merely waste-intensively linear, but actively accelerating resource use. Fast fashion has spurred rapid increases in clothing purchases and disposal, with so far limited push back. E-commerce is fuelling a want-it-now culture of over-ordering, fast delivery and return. Moreover, the burgeoning middle class in the emerging markets are embracing the consumerist habits of the developed world.

CSR investor pressure

Businesses are also facing pressure to ‘go circular’ from investors adopting more ethical corporate and social responsibility (CSR) principles. But while this trend is growing, it is hampered by controversies over whether these principles lead to higher investment returns. Some studies show that they do, but the question of whether the profitability of sustainable principles is the cause or the effect of business success is unresolved.

Costs

For many businesses it is cheaper to use virgin raw materials or brand new parts rather than to embrace recycling, reuse or reassembly. Prices of non-renewable resources, while volatile, have been cycling around a flat trend for decades, providing little incentive to limit their consumption.

Culture

Apart from cost, it is simply easier for businesses to continue with traditional resource-using production and distribution methods. Although enlightened large corporations and idealistic start-ups are embracing circular principles, there is still a long way to go in shifting corporate cultures towards circular economy principles. In part this is because, unlike the traditional linear business model, the circular business model involves new forms of collaboration and transaction with companies along, and even outside, existing supply chains.

Creativity

Having accepted the culture of circularity, companies need to innovate and invest in it. Creativity is required not just around eco-design, reuse, repair, and recycling, but also business processes, supply chains and market places for recycling and second-hand products, parts and materials.

Of these challenges, the final challenge of creativity is perhaps the most important. Innovative breakthroughs would go a long way in helping to address the other challenges. The precedent of the rapid progress in reducing the cost of renewable energy, and the development of new platform businesses, give hope that business can accelerate progress towards the pervasive adoption of the circular economy in the long term. But in the meantime, policy intervention is needed to incentivise action through taxes and subsidies, positive advocacy and proscriptive rules and regulations.

Download

Download article"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).