Thailand: Unanimous consensus to keep rates near record-lows

We're struggling to find strong reasons to change our view of no change in the Bank of Thailand policy in 2018

| 1.5% |

Bank of Thailand policy rateUnchanged since April 2015 |

The Bank of Thailand (BoT) Monetary Policy Committee has another policy meeting tomorrow (28 March), but it hasn’t changed rates since the 25bp rate cut to 1.5% in April 2015.

There is unanimous consensus that the central bank will not do anything at this meeting either which is why most analysts are likely to concentrate on the BoT policy statement for future policy move clues. And this is also why we're struggling to find strong reasons to change our view of no change in the BoT policy in 2018.

Weak economic fundamentals persist

Firmer exports and manufacturing growth so far in 2018 may provide a further lift to the central bank’s growth optimism in the policy statement even as underlying fundamentals continue to be dogged by weak domestic demand which is also evident in persistent low inflation.

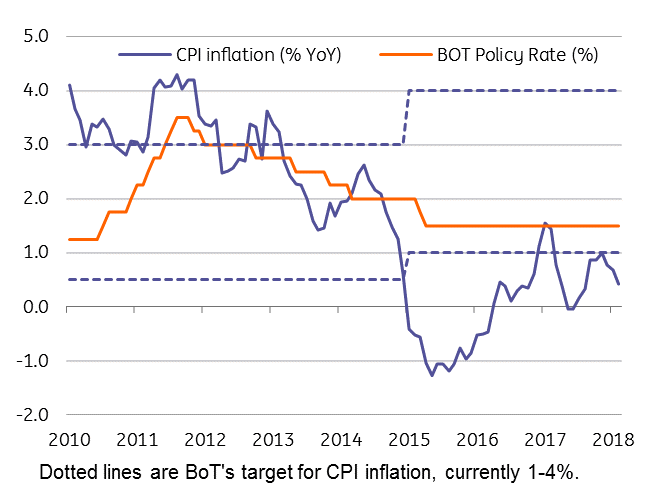

The central bank’s optimism on improving inflation trend this year also seems to be unfounded. The 0.7% year-to-date inflation in February was down from 1.5% a year ago. The BoT’s inflation target of 1- 4% remains at risk of not being achieved again this year (see chart). Therefore, it would hardly come as a surprise if the BoT moves to cut the inflation target itself.

Inflation and the central bank policy rate

Thai baht re-pricing

The currency appreciation slowed in the last two months, but the Thai baht (THB) hasn’t been displaced from its top performing spot among Asian currencies with 4.6% year-to-date appreciation against the USD.

Strong currency will continue to dampen inflationary pressures from rising global commodity prices, especially oil price.

We believe re-pricing for narrower external surplus and lingering political uncertainty surrounding timing of general elections will weigh on the THB performance going forward, which is why we forecast a tight range trading of USD/THB around 31 in the next 12 months.

Download

Download article

28 March 2018

Good MornING Asia - 28 March 2018 This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).