Thailand: Trade balance posts worst deficit in six years

This could hinder the hitherto strength of the currency (THB) amid rising political uncertainty ahead of elections in March. We maintain our view of the USD/THB rate weakening to 32 in the near-term (spot 31.3)

| $4.0bn |

Trade deficit in January |

| Worse than expected | |

A surge in imports dents trade balance

Thailand’s trade balance swung to a larger-than-expected deficit of US$4.032bn in January from a US$1.065bn surplus in December on surprisingly strong imports and weak exports. This is the worst trade gap since April 2013 coming amid the ongoing THB appreciation to the highest level since October 2013. Exports contracted by 5.7% year-on-year, the worst reading in two-and-a-half years, while imports bounced by 14%. This compares to consensus estimates of -2.1% and -1.0% respectively for exports and import growth.

The details trade breakdown wasn’t available at the time of this writing but we suspect electronics and automobiles remained the weak spots in exports, while the trade war manifests into weakness in shipments of products to China and Europe. Fuel has been a source of import strength lately and likely gained further momentum with firmer global oil prices coming into 2019.

Also released alongside trade data, tourist arrivals slowed to 4.9% YoY in January from 7.7% previously.

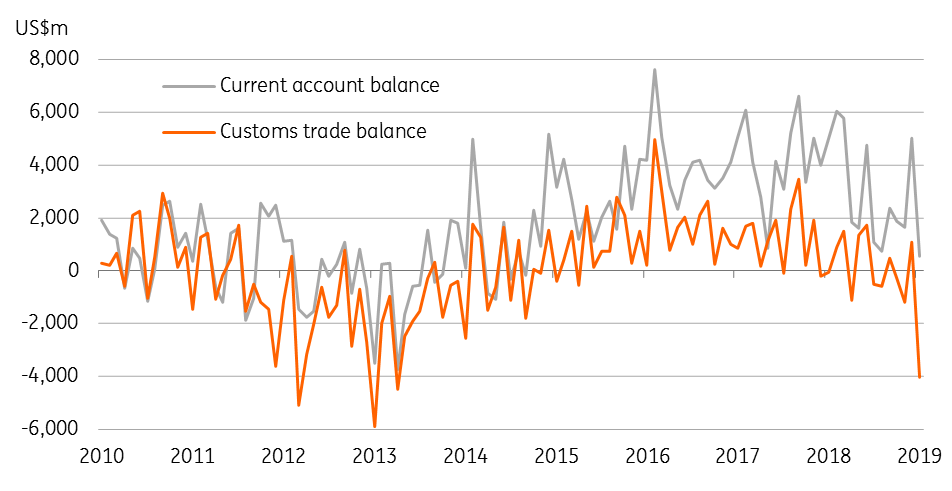

Narrowing external surpluses

Narrowing current account bodes ill for the currency

The double-whammy from a weak trade account and slower services inflows from tourism likely have dented the current account balance in the last month. This prompts us to downgrade our current account surplus forecast for January from US$3.7bn to US$0.5bn. Despite the negative swing in the current account the overall balance of payments (BoP) continued to be strong judging from steadily rising foreign exchange reserves and appreciating currency. The January BoP data is due next week (28 February).

The weak start to the year is consistent with the view of a continued narrowing of the current surplus in 2019. At 7.5% of GDP in 2019, the surplus was down from 11% in the previous two years. We forecast 4.5% this year, though this is still strong among Asian countries to serve as a source of continued currency outperformance.

But for now, today’s data could hinder the ongoing THB strength, while rising political uncertainty ahead of elections in March weighs on the currency performance. The USD/THB rose 0.2% in a knee-jerk reaction to trade data to 31.34. We maintain our view of the pair rising to 32 in the near-term.

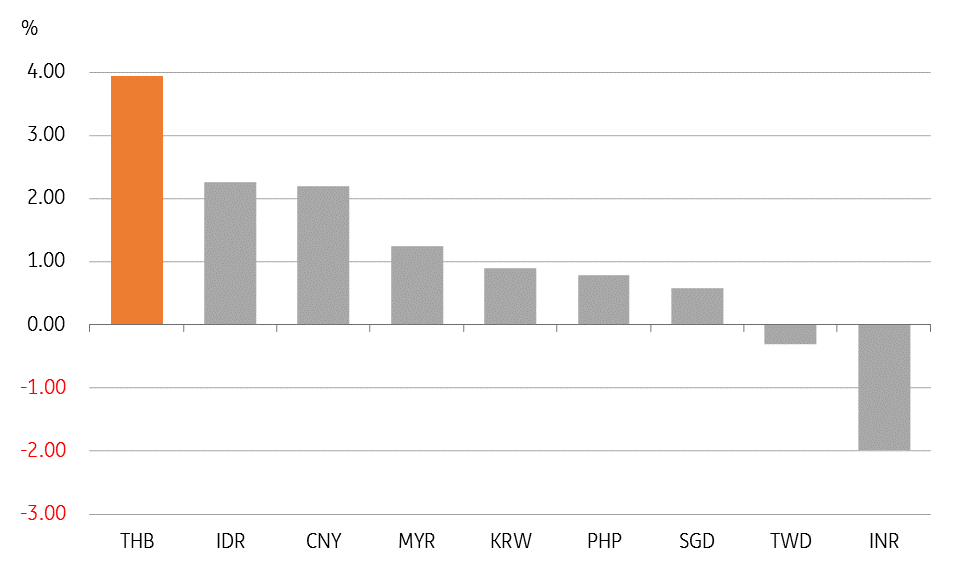

Year-to-date Asian currency performance

Download

Download article

25 February 2019

Good MornING Asia - 25 February 2019 This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).