Thailand macro update – Sinking into recession

As the key economic drivers of exports and tourism continue to be missing in action, the negative GDP growth trend is here to stay for the rest of the year, and perhaps beyond. Rising political uncertainty is another reason why we expect the Thai baht to remain one of Asia's weakest currencies over the remainder of the year

Key takeaways

Covid-19: Thailand has been one of Asia’s Covid-19 success stories. It was the first Asian country outside China to report infections but also the first one to have the outbreak under control.

Growth: However, the economy hasn't been spared from the fallout of this global pandemic. A 12% GDP plunge in 2Q was the steepest since the Asian crisis in 1998. Without vigorous exports and a recovery in tourism, a couple more quarters of negative growth remains our baseline.

Inflation: High unemployment and weak demand have pushed inflation into negative territory. Inflation should continue to be a non-issue for the economy and for policy throughout 2021.

External sector: The current account surplus remains firmly on a downward path this year. Coupled with rising political risk this should keep the THB as one of Asia's worst-performing currencies this year.

Fiscal policy: Covid-19 stimulus worth a total of 14.5% of GDP places Thailand in the ranks of the big spenders throughout this crisis. A little over half of this comprises a genuine boost. Sadly, there is nothing "green" in the hefty stimulus.

Monetary policy: 75 basis points of cuts drove the central bank's policy rate to an all-time low of 0.50%. There is little room for it to fall further, though we don't think that unconventional monetary easing is an option just yet.

Politics: The last thing the economy needs at such a time is political uncertainty. But events over the last two months suggest that political risk is on the rise and this could potentially hinder the economic recovery.

Markets: Thai stocks and the currency have stopped chasing the global emerging market rally, and local bond yields are drifting higher, too. Negative investor sentiment may increase further from growing political noise.

Bottom line: The economy is sinking into a recession. The recovery is going to be even slower than the most recent crisis.

Asia’s Covid-19 success story

Thailand was the first Asian country outside China to get on the Covid-19 curve. It was the first one to get the outbreak under control, too. The first case was reported on 12 January. The spread peaked by late March with seven-day average daily infections close to 120. The government declared a state of emergency in late March and closed the door to foreign tourists in early April. These were relatively loose containment efforts, though they were effective in slowing the spread of the virus.

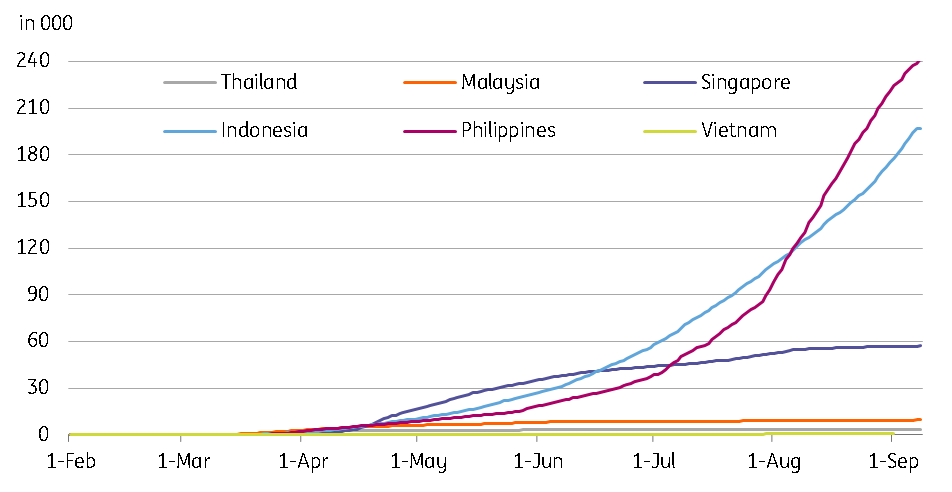

Thailand has been one of Asia’s Covid-19 success stories. Total infections, at 3,446 as of this writing, are much lower than Thailand's ASEAN neighbours. And signs of a second wave outbreak are largely absent. However, recent news of the first local Covid-19 case, after more than three months of no local transmission, isn’t good for the authorities, who are rushing to reopen the borders to foreign tourists. A state of emergency remains in force, with a fifth extension until the end of September.

Covid-19 cases in Southeast Asia - where is Thailand?

The economy isn't immune

Thailand has been relatively resilient to Covid-19 (so far) but the economy has not. It started to confront the crisis from a position of weakness. A sharp slowdown in 2019, when GDP growth dipped to a five-year low of 2.4%, made the economy even more susceptible to the global pandemic. The disease dealt a severe blow to the economy's two main drivers -- exports and tourism. As the weakness from these external drivers broadened to domestic demand, the latter also took a beating from the containment measures.

The economy started to confront the Covid-19 crisis from a position of weakness.

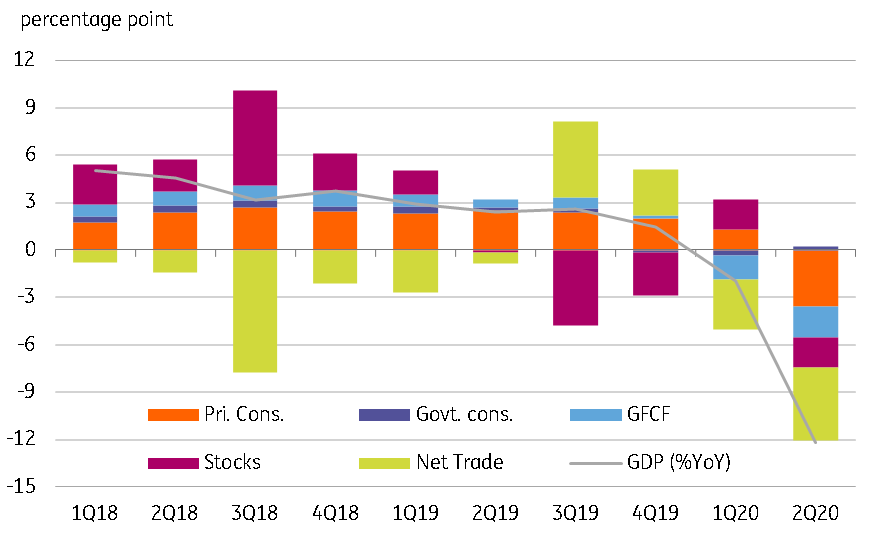

The overall impact is evident in the sharp (12.2% year-on-year and 9.7% quarter-on-quarter) GDP contraction in 2Q20. The 2Q report might look a bit better in comparison with some of Thailand's ASEAN neighbours – Singapore -13.2% YoY, Malaysia – 17.1%, and the Philippines -16.5%. But it is the steepest GDP fall in Thailand in more than two decades, since the Asian crisis in 1998. It is also Thailand's deepest recession since the Asian crisis, as reflected by the third straight QoQ GDP fall.

Both domestic and external demand saw broad-based weakness. Fiscal stimulus spurred government consumption but the 1.4% YoY rise was disappointing given stimulus equivalent to 14.5% of GDP, nearly half of which was on-budget or "real" spending. The collapse in exports of goods and services left net trade as a drag on headline GDP growth for a second straight quarter.

Manufacturing and services were the industry-side sources of the GDP contraction, together accounting for almost the entire GDP fall in the second quarter. Huge falls in accommodation and transport services (-50% YoY and -39%, respectively), were the obvious victims of a collapse in tourism.

Sources of GDP growth – by expenditure

Badly hit tourism sector

Weak domestic demand

Among other economic indicators, CPI inflation saw its steepest decline since the 2009 global financial crisis, falling 3.4% YoY in May, led by declines in food, housing and transport inflation. Inflation recovered to -0.5% YoY by August, though that was mainly a supply-side push to food prices due to a drought rather than a reflection of any pick-up in demand. This left year-to-date inflation at -1%, a sharp negative swing from the +0.7% average inflation in 2019.

Record fiscal stimulus and central bank measures have boosted banking system liquidity and pushed lending rates lower. But there are no takers for available funds. Broad money (M2) and bank deposit growth accelerated above 10% as of June, but the growth of bank lending to the private sector continues to deliver anaemic low single-digit growth. Loans to SMEs and consumers have been slowing despite efforts to boost these through the soft-loans schemes and debt moratorium.

The pandemic is taking its toll on the external payments situation as well. Indeed, exports have been falling but weak domestic demand has depressed imports by even more and this has sustained a large trade surplus of over $20 billion in the first seven months of the year. Almost half of that is offset by net services outflows, causing a sharp dent in the current account surplus, to $9.9 billion YTD from $19.7 billion a year ago.

Abundant liquidity but no takers

More pain ahead for trade and tourism

The economy might have seen the trough of this downturn in 2Q. But the recovery is going to be slow as both exports and tourism will be absent for some time to come. The key export markets of the US, Europe, Japan and ASEAN (together absorbing almost half of Thailand's exports) continue to suffer from the virus. Also weighing on the speed of the recovery are domestic factors such as drought across Thailand, which is depressing agricultural production and exports.

Thailand faces a downgrade from its position as the world's second-biggest rice exporter.

Thailand’s rice exports are down 14% YoY in the first seven months of this year. Just recently the Thai Rice Exporters Association cut its export target by 13% to 6.5 million tons, the lowest annual volume in two decades. If this downbeat forecast is accurate, it could displace Thailand from its position as the world's second-biggest rice exporter. Among other main export sectors, automobiles may see some permanent demand shock from the "new normal" of working from home, while the ongoing technology war between the US and China clouds prospects for electronics.

Tourism makes up a fifth of the Thai economy and visitors from China alone account for about a quarter of total tourism receipts. The tourism sector has ground to a halt since April with no tourist arrivals at all since then. China’s economy is slowly regaining ground after its Covid-related collapse at the start of the year. But it will be a while before Chinese people begin to feel comfortable with overseas travel in view of the tight Covid-19 scrutiny they are likely to be exposed to on departure and return.

Meanwhile, increased infections in the rest of Asia have forced the Thai authorities to shelve the proposal of forming a “travel bubble” with Asian countries. Now they are planning to reopen the island of Phuket to foreign tourists on 1 October as a pilot for the rest of the country given the current situation. Dubbed as “Safe and Sealed” the plan is attached with conditions of 14 days of quarantine, a couple of Covid-19 tests with negative results, 30 days of minimum stay, as well as a direct flight into Phuket. Nothing in this appears particularly enticing.

While the prospect of other foreign visitors returning anytime soon remains almost nil, the government's drive to stimulate domestic tourism will face resistance from weak confidence and rising unemployment.

Exports and tourist arrivals by destinations

Negative spell to continue for a while…

Against such an economic backdrop, a few more quarters of negative growth and inflation remains our baseline view.

We see full-year 2020 GDP growth averaging -6.6% YoY, marking the worst year since the Asian crisis. With no more policy support forthcoming, GDP could fall even more than our forecast. The government and the central bank both anticipate a more than 8% drop this year, which would erase the economic advances made in the last three years. If implemented in its entirety, the large policy stimulus may shore up domestic demand eventually, but weak exports and tourism will still hold back the overall recovery. So, the best hope, in the end, is the low base this year pulling GDP growth into positive territory in 2021. Our growth forecast for next year is 2.8%.

Rising unemployment suggests there will be a prolonged period of weak consumption and prices ahead. As per the projection by a local research body – the Thailand Development Research Institute – 3.27 million workers or about 8.5% of the workforce could lose jobs in this crisis. Inflation should continue to be a non-issue at least throughout 2021. Our forecast for 2020 average CPI inflation is -1.0% followed by an uptick to 0.4% in 2021.

On the external front, we expect the annual current surplus this year to be $17 billion, down from $38 billion in 2019. In GDP terms that would be down to 3.4% from 7.1%. Even so, a relatively large current account surplus among Asian peers sustains some unwanted currency appreciation pressure. The authorities have been cranking up the volume on their rhetoric regarding the strong Thai baht (THB) potentially hindering an export and tourism recovery. They may be relieved to see the currency has now switched to being one of Asia’s FX underperformers this year, after leading the pack over the last couple of years.

… despite record policy stimulus

Four Covid-19 stimulus packages worth a total of 14.5% of GDP places Thailand among the ranks of the big spenders in this crisis. A little over half of this forms real or on-budget spending and the rest comes as monetary support including soft loans, market stabilisation measures, debt moratorium, etc. There are extensive support measures for tourism, including promoting domestic tourism via hotel and airfare subsidies as well as the provision of holiday travel expenses for the front-line healthcare workers and volunteers. The measures also include assistance for farmers.

Huge stimulus isn't of much help at a time of weak economic confidence.

However, this isn't much help at a time of collapsing economic confidence. In his reaction to the 2Q GDP release in mid-August, newly appointed Deputy Prime Minister Supattanapong Punmeechaow said that there would be more measures on the way to boost tourism, jobs and consumption. But, media reports also suggested that these new measures would be financed by the government’s 1 trillion baht borrowing as part of the 1.9 trillion baht package announced at the end of May. Hence, there is nothing really new in this latest announcement.

Sadly, and as in most other Asian countries, Thailand's climate goals have taken a backseat in this unfolding health crisis. We find nothing green in this hefty Covid-19 stimulus package (see our separate note on this topic).

The surge in government spending this year will be faced with a sharp drop in revenues due to slowing growth. This means a sharp rise in the fiscal deficit and public sector debt (expressed as a percentage of GDP). We expect the deficit to rise above 6% in the current fiscal year 2019-20 (ends on 30 September), more than double last year. There may be some reduction in the next financial year but unlikely to the extent of the official projection of 3.7% of GDP deficit. We expect it to be closer to 5%. Our forecasts for public sector debt in relation to GDP are 52% and 58%, respectively for this and next year (45% as of June 2020).

Covid-19 Stimulus - where spending is going

Monetary policy stand-off

While fiscal stimulus is almost maxed out, central bank monetary easing via policy rate cuts has also reached its limits. Three policy rate cuts through May, adding up to 75 basis points in total, have pushed rates to an all-time low of 0.50%. The argument for more policy accommodation remains strong. But the Bank of Thailand's decision to leave policy on hold at the last two meetings (24 June and 5 August) confirms an end to the easing cycle. In our view, stable policy from here on seems to be the safest idea.

A further decrease in the policy rate would be less effective in the current context, where it could affect financial intermediation, increase vulnerabilities in the financial system through underpricing of risks, as well as affect savings. – Latest BoT policy minutes

The next BoT meeting scheduled on 23 September will be the last one under Governor Veerathai Santiprabhob whose term ends this month. He will be replaced by Sethaput Suthiwart-Narueput, an existing Monetary Policy Committee member, an economic adviser to Prime Minister Prayuth Chan-o-cha, and former World Bank economist. Given his credentials, the new governor should have a good grip on policymaking.

With the policy rate near zero, we think markets will be anxious to know whether the new governor will steer policy in this direction once he takes over. We remain sceptical about quantitative easing being on the table just yet. Unconventional easing hasn’t arguably done much good for the economies of central banks that have adopted it, most of which are in developed economies. Given the current stage of development of the Thai economy, such a policy could even backfire by hindering confidence further.

Politics, the beast is back in action

Thailand’s economy and markets have often been subjected to spikes in political risk. And this appears to be repeating itself judging from the events of the last two months.

In mid-July, the entire economic team led by former deputy Prime Minister Somkid Jatusripitak, stepped down to make way for a cabinet reshuffle. Somkid had served in several governments over the past two decades and had been overseeing the recent economic stimulus package. Following Somkid down the path were finance, energy, and education ministers as well as the prime minister’s deputy secretary-general.

We expect a series of extensions to the state of emergency, which was initially introduced to curb the Covid-19 spread, as part of the government's strategy to rein in opponents.

In early August, the new team was on-boarded, including Supattanapong Punmeechaow, a former corporate executive who was appointed Deputy Prime Minister and Energy Minister, and Predee Daochai, a former banker who was appointed as Finance Minister. Less than a month into the job and the new Finance Minister has quit, throwing the economy into more chaos. The administration is now facing anti-government protests by students demanding political reform, including the role of the monarchy in politics. While the government has begun a crackdown on protesters, we expect a series of extensions to the state of emergency, which was initially introduced to curb the Covid-19 spread, as part of its strategy to rein in opponents.

History is a good guide to how ugly politics in Thailand can get. It could be a lot uglier this time round as the growing economic suffering of people compounds their anti-government sentiment. If so, this could delay the most coveted, tourism-led economic recovery in the period ahead. The vicious cycle goes on.

Local markets have stopped chasing the global risk-on rally

No respite to markets from weak tone

Local financial markets are finally coming to terms with these dire economic and political conditions. Since June, Thai stocks and the currency have stopped chasing the global emerging markets rally and local bond yields have been drifting higher. However, unlike the rest of the emerging region where the disconnect between positive market sentiment and weak economic fundamentals still holds, the performance of Thai financial assets now seems to be more in sync with the underlying fundamentals.

Foreign investors have been net sellers of Thai equities every month this year, a streak likely to be extended until the end of the year. We also expect local currency bonds to remain under pressure from a surge in government borrowing. There may be some respite along the way due to the slow implementation of the stimulus, but not much.

The THB’s 4.5% year-to-date depreciation (as of 9 September) against the US dollar is the second-biggest decline in Asia after the IDR (Indonesian rupiah) - a reversal of fortune from being a top performer in 2019 with an 8.6% appreciation. As we see the THB as one of the Asian exceptions to the sell-USD theme, growing political jitters could make things a lot worse for this Asian currency.

Thailand - Key economic indicators and ING forecasts

Download

Download article

11 September 2020

Good MornING Asia This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).