Thailand: It’s going to be the worst since the 1998 Asian crisis

We cut our forecast of Thailand’s GDP growth in 2020 to -4.3% from -0.8%, the worst year for the economy since the 1998 Asian economic crisis. We add 50 basis points in rate cuts to our central bank policy forecast and see the THB weakening to 35 against the USD by end-2Q20

| -4.3% |

ING's 2020 GDP growth forecast |

Sentiment indicator points to worse

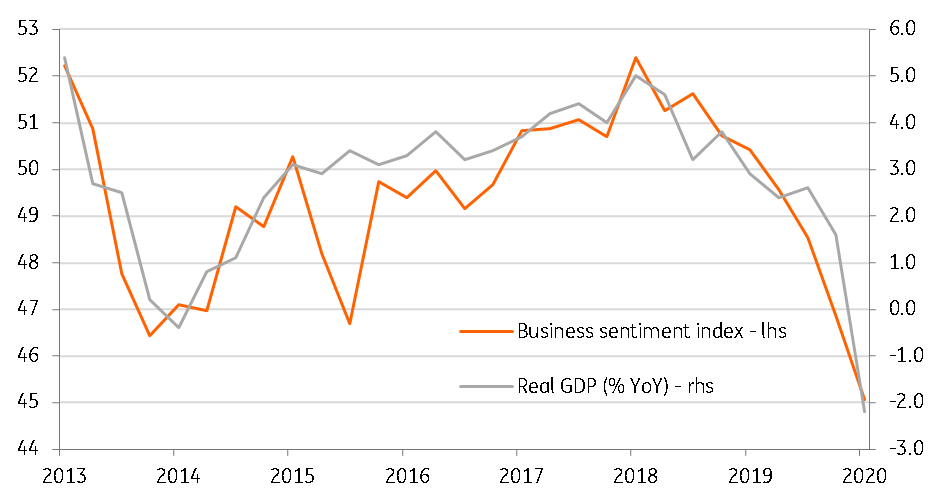

Yesterday's release of an all-time low manufacturing Purchasing Manager Index (PMI) of 46.7 in March and the third consecutive month of it staying under 50, implying contraction, foreshadowed a negative GDP growth in the first quarter of the year. The subsequent data yesterday on Business Sentiment Index (BSI) in March informed about the extent of the GDP fall in the last quarter.

In fact, BSI is a better lead indicator of GDP growth than PMI as the chart below plotting the quarterly average of the index against the year-on-year real GDP growth shows. Unlike PMI, which compares sentiment relative to the previous month (read our Asian PMI note for more), the BSI is the diffusion index with a reading below 50 implying negative responses outweighing positive ones, and vice-versa for that above a 50 reading. The BSI reading for March was 42.6, the lowest since November 2011 and under 50 where it’s been since mid-2019 (44.1 in February 2020).

One way down and deeper - BSI and real GDP growth

The worst since the Asian crisis, if not more

Covid-19 spreading around the world suggests that 2020 is shaping to be worst for the Thai economy since the 1998 Asian financial crisis, of which Thailand was the epicentre with over a 7.8% plunge in the country's GDP in that year. Blame it on the economy’s greater reliance on tourism and trade as both these sectors are going to taking a significant hit from the global spread of the disease.

Following a three-week partial lockdown in Bangkok (started last week) and Phuket island now shut for the entire month of April, there will be a big slump in tourism. Moreover, the lockdown will inflict significant damage to consumer spending. As elsewhere in Asia, private consumption forms a significant chunk of GDP on the expenditure side; in the case of Thailand, it's 52% in 2019. If so, no prizes for guessing that we should see GDP growth moving into negative territory in the first quarter and staying there for the rest of 2020.

We anticipate at least about a 2% year-on-year GDP fall in the first quarter, just as what the BSI indicates. But with a full blow of disease spread in the current quarter, it’s going to be ugly. We see GDP plunging as much as 7.7% in this quarter, followed by a not so worse 4.8% and 2.6% declines in the third and fourth quarters respectively. This brings our full-year growth forecast to -4.3%, a downgrade from -0.8% earlier. If true, 2020 will go into history as the worst year for the economy since the Asian crisis.

Not just us. But, the Bank of Thailand also thinks so. Rather far worse. Just a week ago the central bank slashed its growth forecast for 2020 to -5.3% from +2.8%.

How’s the policy response?

The authorities are doing what they can. The government has already announced two stimulus packages worth THB400 billion and THB117 billion in the last month, for a total thrust of about 3% of GDP. However, the real boost from measures such as cash hand-outs and tax cuts amounts to only about half of that. The government is preparing the third package of THB500 billion to be unveiled this month.

We also expect the BoT to continue to ease monetary policy by cutting interest rates further in the current quarter. The off-cycle BoT rate cut of 25 basis point on 20 March was too little too late, while the central bank refrained from doing more at the regular meeting just a week later. At 0.75% currently, the policy rate is the lowest ever, which probably underlies the BoT’s reluctance to ease further. However, we don’t see this as a constraint. Not particularly amid persistently low inflation, or even negative inflation this year on the back of plunging consumption.

Yes, we are also cutting our consumer price inflation forecast for the year to -0.8% from +0.6%.

More central bank easing, weaker currency

We are adding 50bp in rate cuts to our BoT policy forecast and expect this to occur in the current quarter. There are two meetings in this quarter, on 20 May and 24 June, and a 25bp cut at each won't be an overkill given the current situation. Lower interest rates together with a narrowing current account surplus should sustain the THB as an Asian underperformer in the rest of the year, adding on to the 8.6% depreciation against the USD in the first quarter.

We see the USD/THB exchange rate hitting 35 by end-2Q20, a level not seen in the last three years (spot 33.05).

Download

Download article3 April 2020

In case you missed it: Undone by a pandemic This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).