Thailand: GDP growth slows further to 2.3% in 2Q19

It needs to be seen how quickly fiscal stimulus gets off the ground to kick-start the economy over the remainder of the year. Our full-year 2019 growth forecast remains at 2.8%.

| 2.3% |

2Q19 GDP growth |

| As expected | |

Worst performance in five years

Thailand’s GDP growth dipped to nearly a five-year low of 2.3% year-on-year in the second quarter of 2019 from 2.8% in the first. The result was in line with our 2.3% forecast, which also formed a median of analysts’ estimates ranging from 2.1% to 3.3% growth in the Bloomberg poll. And just as we inferred from the high-frequency data for the quarter, exports and manufacturing continued to be the key expenditure and industry-side drags on GDP growth, while tourism, the backbone of the economy, continued to weaken.

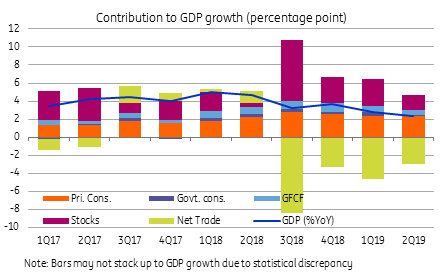

However, above everything else stands anemic domestic demand. All of the GDP growth slowdown came from government consumption and gross fixed capital formation, each subtracting 0.3 percentage points (ppt) from the headline GDP growth. Stocks were also a drag though we view this as less negative for future growth by reducing inventory overhangs on production.

And despite weak domestic demand, the net export contribution continued to be negative, which was at odds with the prevailing large current account surplus.

Exports and manufacturing dent growth

Expenditure-side sources of GDP growth

3% GDP growth seems a far cry

The National Economic and Social Development Council, the agency responsible for the national accounts data, announced a cut to its full-year 2019 growth forecast to a 2.7-3.2% range from 3.3-3.8% earlier, on expectations of weak exports, now forecast to fall by 1.2% this year against earlier expectation for 2.2% growth. We expect the Bank of Thailand (central bank) to follow suit with a reduction to its forecast, currently 3.3%, to something in line with the NESDC's forecast.

We retain our 2.8% growth forecast for the year, which was revised from 3.1% after recent manufacturing figures in late July. While favourable base effects and imminent fiscal and monetary stimulus may help provide some recovery in the third and the fourth quarters of the year, we imagine it’s going to be tough for the economy to outperform the 3% new normal for GDP growth this year.

So, all hopes rest with fiscal stimulus

All eyes are now on the government’s announcement of the fiscal stimulus package. Talk is of a THB 370 billion (about 2.4% of 2018 GDP) stimulus package consisting of measures to support farmers, middle-income earners, and small businesses, as well as to boost tourism. The package aims to support growth above 3%. It needs to be seen how quickly this stimulus gets off the ground to kick-start the economy over the remainder of the year, since the weak coalition government might well face political hurdles in getting the package through the parliament.

Uncertainty about the fiscal stimulus leaves the onus with central bank monetary stimulus. The BoT has started easing with a 25 basis point rate cut earlier this month. We are forecasting one more such move in the fourth quarter, though we wouldn’t be surprised if it cuts by more than that.

Download

Download article"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).