Thai economy on a downward path

With coronavirus threatening trade and tourism, it seems as if Thailand is in for a prolonged downturn. We are cutting our 2020 growth forecast to 1.5%, keeping our view of another central bank rate cut in March on track

| 1.6% |

4Q19 GDP growthFive-year low |

| Lower than expected | |

Downside miss in 4Q19 growth

Growth in Thailand slumped to a five-year low in the fourth quarter of 2019. This was weaker than the consensus median estimate of 1.9% (we were a bit more bearish at 1.8%) and also down sharply from 2.6% growth in 3Q19.

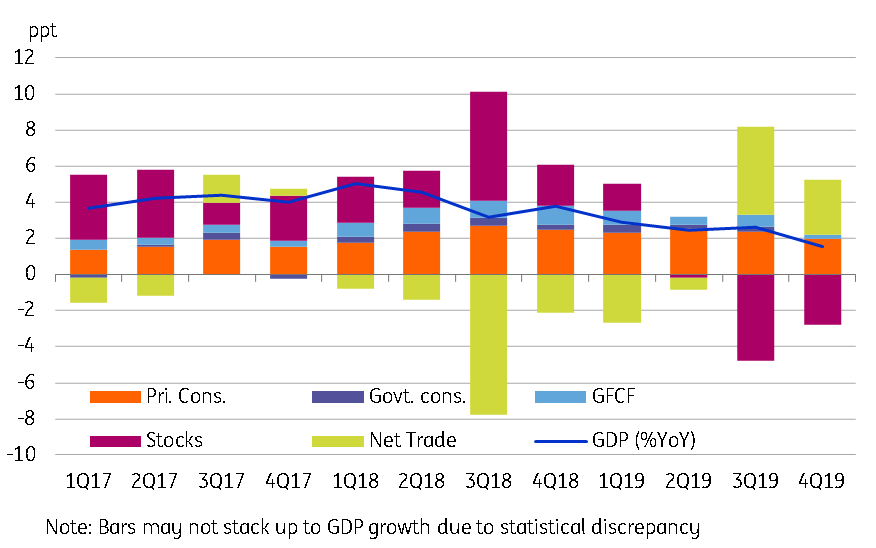

Across-the-board weakness in spending, both domestic, as well as exports, caused the slowdown. The contributions of all main domestic demand components – private consumption, government consumption, and gross fixed capital formation shrank, while de-stocking remained a key drag on headline growth. The export decline accelerated but imports declined more than exports, leaving net trade in the driving seat of GDP growth, albeit with a smaller contribution to GDP growth. Agriculture and manufacturing were the industry-side drags on GDP.

This brings full-year growth down to 2.4%, almost half of what it was in 2018. This makes 2019 growth numbers the lowest since the 1% growth seen in 2014.

Sources of GDP growth

Downgrade of 2020 growth outlook

With perennial weak domestic spending and heavy dependence on tourism, we believe the economy is heading for a prolonged slump this year as coronavirus keeps tourist at bay. Or, probably even a recession as quarter-on-quarter (seasonally adjusted) GDP, which barely grew in the last few quarters, could well move into contraction territory over the next couple of quarters.

The last time the economy plunged into recession was during the military coup in 2014 when annual growth dipped to 1%. We could see something similar this year, or even worse if the virus continues to spread rapidly. But that's not our baseline scenario for now.

The National Economic and Social Development Council now sees GDP growth in 2020 in the 1.5% to 2.5% range, slower than its earlier forecast of 2.7% to 3.7%. We think growth at the low-end of the NESDC’s revised range appears to be a more probable view for the year. We are cutting our forecast to 1.5% from 2.3%.

Will economic policy do any good?

The Bank of Thailand resumed its easing cycle with a 25 basis point rate cut earlier this month. And we are still of the view that they will cut rates again by another 25bp in March.

We believe worsening growth prospects keeps doors open for more monetary easing ahead, while inflation continues to be non-existent and the economy needs a weaker Thai baht to help the recovery. However, we are sceptical that in an environment of weak confidence, more rate cuts will do much for the economy.

Meanwhile, parliament finally passed the FY20 budget bill, clearing the way for THB 3.2 trillion of planned government spending for the year, which has already been delayed by four months now. It would be fair to expect that most of it would be front-loaded to avert a deeper economic downturn.

We think the economy will need extra fiscal support to stay afloat, but gauging from the delay in passing the regular budget, we think it is unlikely we will see such support.

Download

Download article

17 February 2020

Good MornING Asia - 18 February 2020 This bundle contains 5 Articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).