Tapering could be the next ingredient in the credit cocktail

Tapering of the corporate sector purchase programme (CSPP) and the third covered bond purchase programme (CBPP3) is on the cards for 2023 and will likely be discussed at the ECB's December meeting. Naturally, this is a negative driver for credit, specifically the corporate credit and covered bond markets

A notable risk facing credit markets next year is the potential for the European Central Bank (ECB) to reduce the size of its balance sheet via the tapering of the asset purchase programme (APP). This will have rather significant negative effects on the corporate bond and covered bond markets.

Our economists expect the ECB to announce a gradual reduction of the reinvestments of its bond holdings under APP at the December meeting, with the aim of stopping the reinvestments by the end of 2023, as highlighted in the report: ECB minutes show tentatively growing recession concerns.

This could potentially be in the form of:

- 1Q - 80% of reinvestments.

- 2Q - 60% of reinvestments.

- 3Q - 40% of reinvestments.

- 4Q - 20% of reinvestments.

In addition, pandemic emergency purchase programme (PEPP) reinvestments are set to continue until the end of 2024 but it is possible that in the course of 2023, the ECB will announce a similar quantitative tightening for PEPP as well, starting in early 2024. An abrupt stop or actual bond selling of APP (or PEPP) are risk scenarios but are highly unlikely at this point in time.

Corporate bonds and covered bonds will be worse off in the case of tapering

If tapering were to happen, this would be a negative driver for corporate bonds, but with many other drivers in the market, it won't move the needle substantially. Covered bonds may be under more pressure from this tapering, as they are already seeing little positivity. Of course, in the case of quicker tapering or an earlier stop to the programme, the effect will be much more severe in both markets.

The continuation of PEPP reinvestments means relatively little for corporates and covered bonds compared to public debt. CSPP accounts for around 11% of the total APP and CBPP3 accounts for 9%. Meanwhile, corporate bonds account for just 3% of PEPP and covered bonds account for less than half a percent of PEPP. Thus, with a tapering of APP, public debt will be more supported by PEPP, but private debt will see much less support and will subsequently underperform.

Corporate bonds – another ingredient in the cocktail of negative drivers

Tapering CSPP can be added to the list of risks and drivers of increased volatility in credit, alongside the recessionary environment, high inflation, the Russia/Ukraine war, the energy crisis and supply chain shortages.

We foresee the following:

- The lower level of support will add to the turbulence and increase volatility, but will not necessarily move markets wider. Although this does add to the expectation of further turbulence and increased volatility.

- More pressure and spread widening in the case of a faster tapering or an abrupt stop as the market becomes more exposed, with a large participant no longer active at all (we see this as less likely).

- Based on current oversubscription levels, deals can still get done even with lower CSPP participation. Thus, primary market activity shouldn’t struggle to price, meaning less pressure on spread widening.

- An indirect implication may be supply indigestion, as many corporates may push to issue earlier in the year for a better chance of having the ECB involved in the deal (this may mostly be seen in January). This will add some extra volatility and perhaps underperformance.

The tapering of CSPP would strengthen our call for financials over corporates. However, for 2023 we find the call between corporates and financials a hard one to make. For 2022 we saw more value in corporates due to the stronger technical, particularly driven by CSPP. For 2023, we have the following considerations:

- CSPP reinvestments offer more support for corporates but the tapering of reinvestments is on the cards for 2023.

- This may lead to some supply indigestion for corporates as many issuers may fund sooner (in the first quarter) if they pre-empt a tapering or stop to reinvestments.

- The net supply story is more positive for corporates with expected net negative supply, whilst financials will see almost €100bn in positive supply.

- The duration of non-financial corporate sectors is higher than for the financials, which is in line with our call that 2023 will see longer duration credit show additional relative value.

- However, looking at the trading ranges, we see that financials have underperformed and are trading at or even above our defined recessionary spread range. There is more value in financials currently.

- In general, higher interest rates are set to be good for bank earnings.

Having said all that, it will be a close call between financials and corporates next year as it’s all about Alpha in 2023 and the external factors that will contribute to earnings sensitivity such as energy usage, supply chain risks, cyclicality, and even geography. Whether it's financial or corporate, doing the credit work and avoiding too much volatility in margins/earnings will drive performance. But with lower reinvestments, we see an additional positive driver for potential being titled towards financials for 2023.

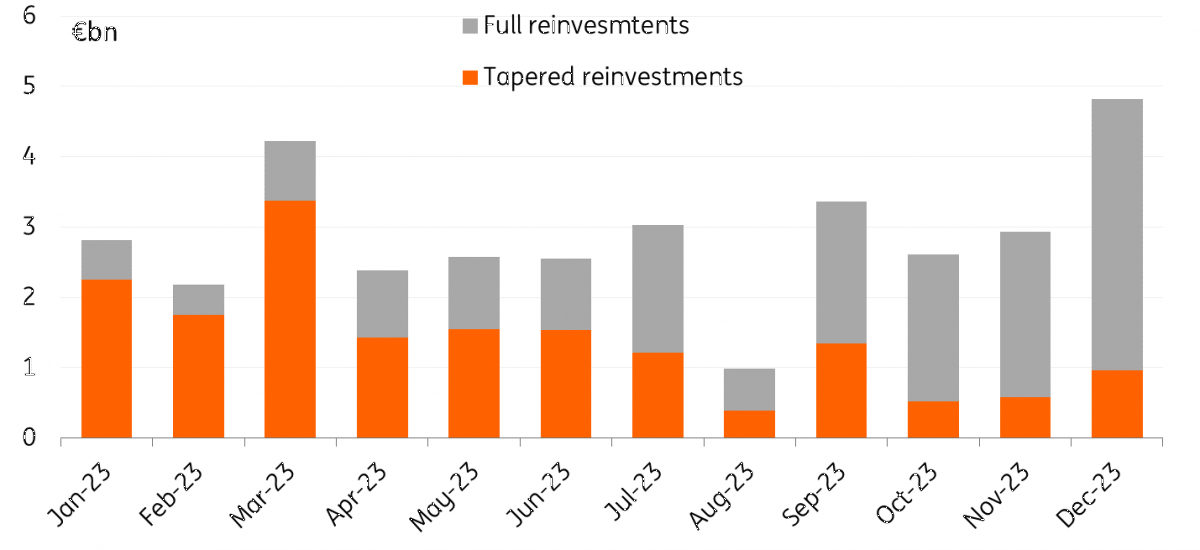

In the case of tapering in the potential form as stated above, the below chart illustrates how low reinvestments would be. Initially, reinvestments would pick up in 2023 and support with between €2-4bn per month. Now reinvestments will be notably lower between €1-2bn per month, offering very little support from August onwards.

Full and tapered CSPP reinvestments per month

In addition, as we have previously mentioned in our report Decarbonising Corporate Sector Purchase Programme credit: Our take, the ECB has just begun to incorporate climate change considerations into corporate bond purchases, via reinvestments. In the case of tapering reinvestments and an ultimate end to the programme, decarbonising becomes somewhat redundant. This is of course not good news for the environmental, social, and corporate governance (ESG) angle, but we expect ESG credit will outperform nonetheless, albeit perhaps to a lesser extent.

Moreover, the effects of decarbonising and focussing on ESG have been rather limited so far. Both corporate ESG and covered bond ESG have not seen any outperformance this year, while the ineligible financials have seen ESG outperformance, particularly in the primary market. Thus relative to holdings, it suggests the ECB has not been a strong catalyst for ESG outperformance. Demand from investors seems to be the larger driver, as illustrated by the substantial inflows into ESG funds.

Covered bonds – a bearish view

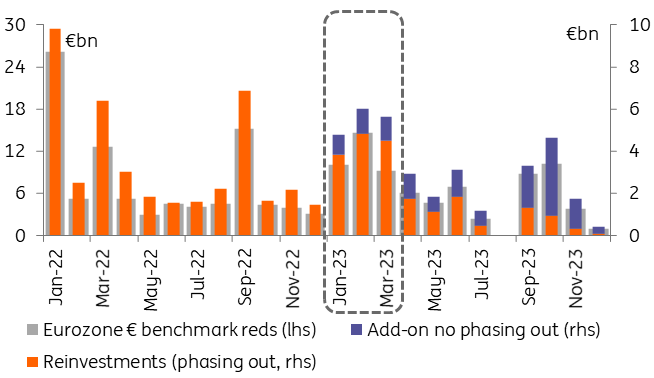

The scenario plotted here towards the end of the reinvestments of redemptions under the APP is faster than the one assumed in our Covered Bonds Outlook 2023. It means that CBPP3 reinvestments will fall from €36bn to €21bn instead of €28bn in 2023. Reinvestments of 80% in 1Q23 will represent just 26% of the €50bn eurozone-covered bond supply in the first quarter instead of 33%. On the assumption that the ECB reinvests 40% through the primary market and order books will be at least 1.5x, this would mean that primary order sizes from the CBPP3 will likely fall to 15% from 20% in the first quarter of the year. It will likely decline further to 10% in the second quarter and 5% towards year-end under our supply estimate for 2023.

Covered bonds will be under more pressure in the case of faster tapering or an abrupt stop to reinvestments. A more rafpid tapering will likely not only have a negative impact on new issue premia against the backdrop of the anticipated heavy supply, but also limit the subsequent secondary performance potential of these transactions. This adds to our already bearish view on covered bonds, which we believe to be expensive in comparison to bank bond instruments further down the liability structure. A quicker-than-anticipated tapering increases the odds that spreads will widen more than anticipated in the first half of the year. We still believe, however, that the impact of tapering on sovereign and SSA spread levels will have the strongest impact on covered bond spreads, more so than the more moderate outright purchases of covered bonds by the CBPP3.

Reinvestments by the CBPP3 will be €15bn lower under the 1Q-4Q 2023 tapering scenario

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article