Decarbonising Corporate Sector Purchase Programme credit: Our take

The European Central Bank (ECB) just announced details around incorporating climate change considerations into corporate bond purchases, via the reinvestments expected over the coming years. This indeed looks positive for Environmental, Social, and Governance (ESG) credit, but the devil is in the details and this does raise questions

This tilt adds another element into the expectation for ESG to outperform vanilla credit; the ECB will not publish their scoring of each issuer

What does this mean?

- We are glad to see the tilt details emerge and the start date set at 1 October shows conviction. However, details are few and will be provided on the scoring of the issuers, which leaves the market facing uncertainty and results in assumptions to which issuers are affected and or favoured.

- It is hard to fully tilt holdings of the complete Corporate Sector Purchase Programme (CSPP) holdings of €345bn without doing so aggressively. Besides, the timespan that the ECB will do reinvestments could be short. As such, reshaping such a large portfolio without being decisive on holdings is difficult, otherwise it will simply fail to move the needle. Hence issuers with low scores or fossil fuel intensive sectors with strong ESG ambitions could still be ignored and see virtually no ECB bids.

- The tilt to ESG is not clearcut, as it does not look at just green or ESG specifically, but is a more complex look into past and future emissions. As a result, it becomes very issuer orientated rather than sector orientated. Therefore, theoretically future purchases do not explicitly exclude fossil generative sectors or issuers.

- It is based on an internal model which also makes it a bit of a black box. Market participants will struggle to judge what this means in terms of primary or secondary market performance.

- All things being equal though, it should be a long-term positive for ESG credit as demand for ESG remains insatiable.

- The maturity limits imposed on lower scoring issuers may result in steeper curves for these issuers, as the ECB will target shorter dated bonds. A lower scoring issuer may also target the shorter end of the curve.

- The impact of this tilt could be strongest for issuers with a high issuer-specific climate score with limited further vanilla or green competitive supply.

The methodology the ECB will use for scoring issuers and begin tilting holdings as of 1 October 2022 are:

- The backward-looking emissions sub-score: based on the past emissions from the issuers, up against sector peers and overall eligible market.

- The forward-looking target sub-score: based on the expected future emissions and ambitions to reduce.

- The climate disclosure sub-score: based on the quality of the emissions data provided by the issuer.

In all scoring, any issuer that does not provide self-reported emissions data will be assigned the lowest score. This incentivises issuers to provide emissions data, have ambitious targets and provide clear quality data.

However, the ECB has not detailed the specific methodology for scoring issuers, thus there will be some guess work involved in reconciling with what will be purchased versus not. Additionally, this will be focussed on tilting the holdings, as such issuers with higher scores will be favoured as CSPP will purchase more bonds from the higher scored issuers and less bonds from the lower scored issuers.

Reinvestments are rather low for CSPP and Pandemic Emergency Purchase Programme (PEPP) this year at an average of €1bn per month, but pick up as of January 2023 with an expected average of €2-3bn per month. Therefore, as of January we may start to see the effects of the ESG tilt.

Reinvestments pick up in January 2023 and set to average €2-3bn per month

There is very little greenium in the credit space at this particular point in time, in both the secondary spreads and primary market performance. We have seen ESG primary market outperformance in the past couple of years with lower NIPs and higher subscriptions, and we expect this will return. We expect ESG will outperform in the coming years. CSPP's tilt towards green will indeed play a role as demand for ESG credit continues to grow.

No ESG outperformance versus Vanilla at this point in time

Higher oversubscription of ESG in the primary market in previous years

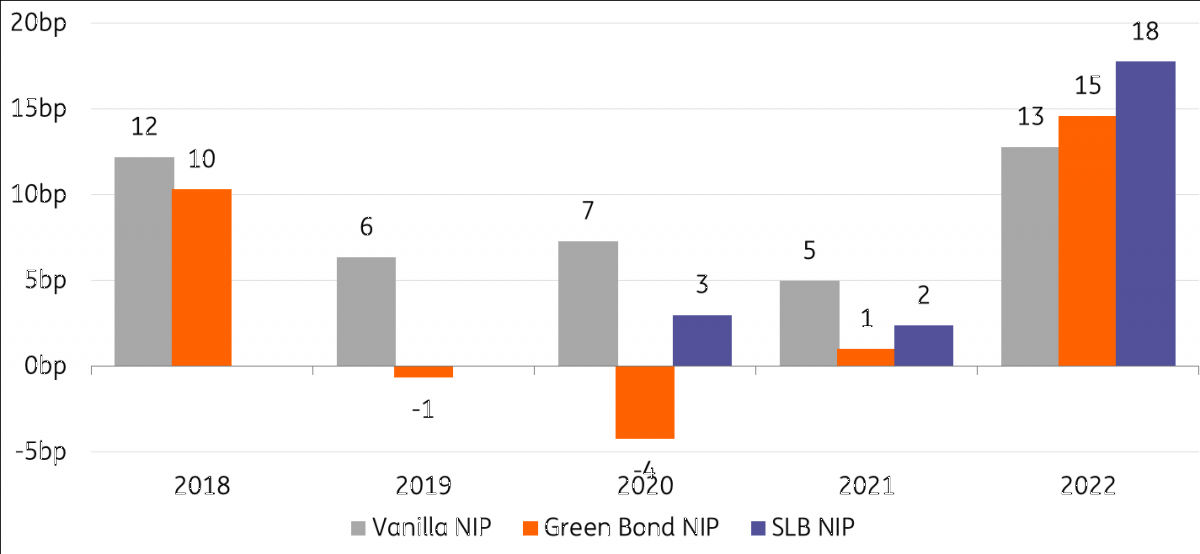

Lower new issue premiums of ESG in the primary market in previous years

Note: this year saw more real estate and higher beta ESG issues relatively, thus shows a reversal of the trend in 2022. Nonetheless, NIPs are not lower in ESG vs Vanilla in 2022.

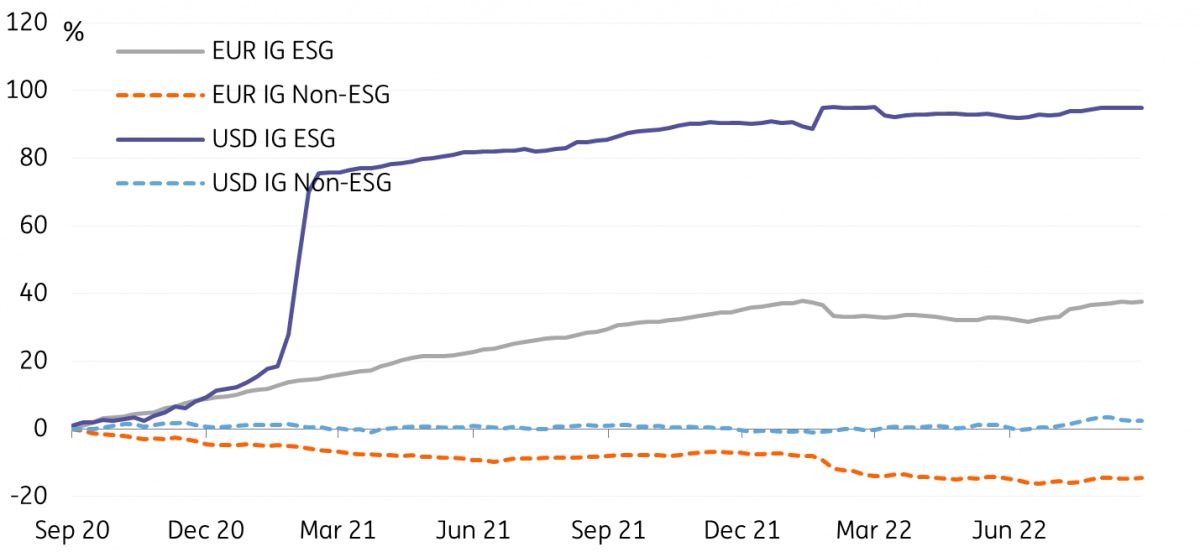

In addition, we see continuous inflows into ESG funds, adding further demand for ESG products. The two-year accumulation of flows into EUR Investment Grade (IG) ESG funds total a substantial 38% of Assets under Management (AuM) inflows. Meanwhile, EUR IG non-ESG funds have seen accumulated flows over the past two years amount to outflows of 14% of AuM.

Inflows into ESG funds are substantial

The ECB may give preferential treatment to corporate bonds marketed as green in the primary market. However, in the absence of a uniform EU Green Bond Standard (EUGBS), the central bank will base the buying of such bonds on strict criteria, such as a) alignment of the green bond framework with a leading market standard, such as the ICMA’s Green Bond Principles or Climate Bonds Initiative, b) a second-party opinion (SPO) confirming that adherence to that standard has been reviewed and confirmed and 3) a pledge in the bond prospectus that regular third-party assurance on the use of proceeds is foreseen (annual verification by an external auditor) until the funds concerned have been fully deployed. These requirements are mostly in line with common practice, with the exception of the third-party assurance pledge in the bond prospectus. This pledge is generally made in the green bond framework but not so often in the prospectus.

To benefit from preferential treatment, issuers of green corporate bonds eligible under for purchases under the CSPP and PEPP would going forward also have to make this pledge explicit in their bond prospectus. That said, with the ECB supportive of the development of the EU Green Bond Standard, we do believe this stricter standard may become the norm for such preferential treatment once the European Green Bond Regulation has been adopted. As this preferential treatment will have a primary focus, it could well be expected to enhance the potential funding cost advantage of green over vanilla issuance foremost in the primary market. How significant the effect would be, will also depend on how strongly the company scores in terms of its issuer-specific climate score at the ECB, and upon the overall new supply from that issuer. After all, according to the ECB, the aggregate purchases of each issuer will continue to follow the tilted benchmark, while bonds that are already held in the CSPP portfolio will not actively be sold. This could well mean that the impact could be strongest for issuers with a high issuer-specific climate score with limited further vanilla orgreen competitive supply.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more