Taiwan: Central bank to stay put

We expect Taiwan's central bank to leave rates unchanged 21 June for an eighth straight quarter amid concern the economy could be affected by trade wars between China and the US (through the supply chain of China's export goods.) The already low policy rate provides little room for a cut

Taiwan electronics industry at risk

Taiwan is caught in the middle of the US-China trade war and is deemed to face increasing risks of an economic slowdown via its electronics industry. This sector has served as part of the supply chain for Mainland China's smart-device manufacturing. If the US imposes tariffs or another sanction on Chinese smart-devices, Taiwan's electronics industry will suffer.

The most likely scenario is that Mainland China buyers will ask for lower prices for parts. And buyers will possibly buy fewer parts if they expect lower export volume due to the tariffs. Put simply, Taiwan's electronic producers could face lower selling prices and sales volume if the US imposes 25% tariffs on Mainland China's high-tech goods.

GDP growth to edge lower

Even though the government has put together some policies to restructure the economy, we cannot see a new growth engine arising. The economy is still very dependent on electronics. As a result, GDP growth will likely peak in 2Q18 at 3.1% year on year from 3.0% in 1Q, followed by growth of 2.4% and 2.0% for 3Q and 4Q18, respectively.

The central bank will stay put

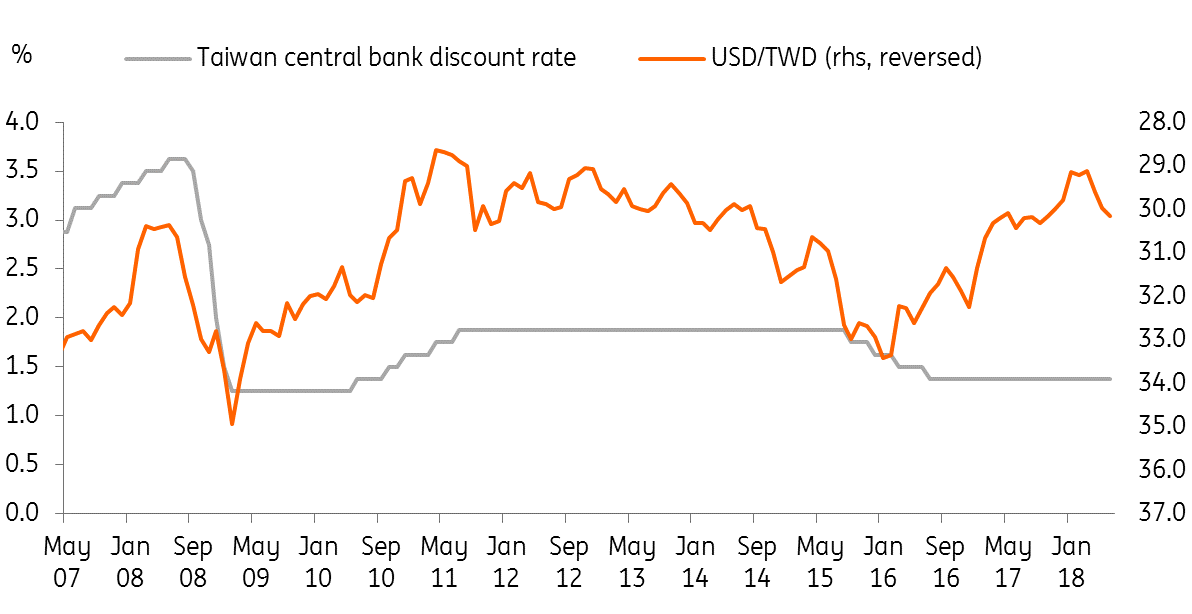

As the economy faces higher risks from global trade wars, the central bank won't be raising interest rates. But it's not good timing to lower rates either. The policy rate is already at a low level of 1.375% and cutting it would do nothing to reduce the risk of a trade war. The Taiwan central bank, just like the economy, is now trapped by escalating tensions between Mainland China and the US, and as such, we don't expect any policy rate change in 2018.

Even with a pause, TWD would weaken

With a possible negative effect on the electronics industry, previous capital inflows into Taiwan's stock market could turn to outflows in the second half of the year. Together with a strong dollar from escalating trade tensions and European political uncertainties, we expect the Taiwan dollar (TWD) to weaken against the US dollar through the rest of the year to 30.60 at the end of 2018, that is equivalent to a 2.5% depreciation of TWD against the USD.

The Taiwan central bank, just like the economy, is now trapped by escalating tensions between Mainland China and the US

This would support exports, but only slightly. If the US were to impose a 25% tariff on Chinese high-tech goods which affected parts produced in Taiwan (thus lowering prices and sales volumes), a marginally weaker currency wouldn't change Taiwan's weaker growth trend.

We expect TWD to weaken even as central bank stays put

Download

Download article

21 June 2018

Good MornING Asia - 21 June 2018 This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).