Taiwan’s central bank unexpectedly hikes rates

Taiwan's central bank has followed the US Federal Reserve by hiking rates. This might seem reasonable, but the two economies' inflation rates are very different

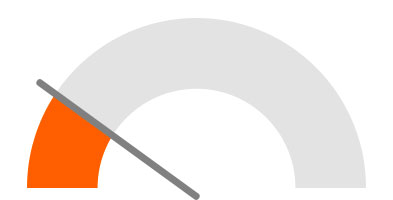

| 1.375% |

Policy rate |

| Higher than expected | |

Taiwan has followed in the footsteps of the US Federal Reserve by hiking its policy rate by 25bps, from 1.125% to 1.375%. This is the first time the policy rate has changed since March 2020.

There are a couple of points we need to consider here.

First, the hike is 25bps. This looks usual for any central bank, but Taiwan's central bank is famous for raising rates by 12.5bps each time. Today's 25bps hike signals that the Taiwan central bank would like to hike more because it wants to stay away from a policy rate that could be too low. Staying away from a very low interest rate can avoid a liquidity trap in the future.

Second, the market might have thought that Taiwan has a high inflation problem which would explain the larger rate hike. In fact, that is not the case. Taiwan CPI inflation was 2.36% in February, and was moving down from near 3% a month ago. This is not even comparable with the US CPI inflation of 7.9%, which is showing no signs of coming down.

Taiwan vs US inflation

What did Taiwan's central bank say?

The central bank said that the 25bps hike was needed because of the commodity price increase, Russia-Ukraine conflict and a recovery in the service sector.

It also revised upward its GDP forecast for 2022 to 4.05% from 4.03%.

Impact of the rate hike

The reasons given for the rate hike decision are not going away quickly, which means there could be another hike.

One thing we worry about is that the Taiwan central bank would like to follow the Fed hike path closely. Based on inflation there is no need to do this, and more hikes would increase the cost of borrowing, which could slow down the economy, which is now in a stage of investing in new semiconductor factories.

GDP growth might be at risk. Our forecast of Taiwan's GDP is currently at 5.3%. We might revise downward if investments are adversely affected by the rate hike.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article