Switzerland: The sun is shining but clouds loom

Low core inflation, high GDP growth, a super cautious central bank and arduous negotiations with the EU: the Swiss economy is doing well but uncertainty is growing

Super strong growth in the first half

The Swiss economy is doing really well. It grew at a fast pace in the first half, with GDP growth reaching 1% and 0.7% quarter-on-quarter in the first and the second quarters, respectively, thanks to a robust foreign demand. The Swiss economy has recorded a QoQ growth rate of more than 0.7% for five straight quarters, something that has not happened since the beginning of 2015 when the exchange rate floor against the euro was abolished. The main driver of growth in 2Q18 was manufacturing (+1.5% QoQ), which benefited from robust foreign demand and the depreciation of the Swiss franc. Note, however, that part of this growth (0.2 percentage points) is somewhat artificial due to license income generated by the marketing of major international sports associations based in Switzerland. The World Cup and the Winter Olympic Games both took place in 2018, which had an impact on GDP data. With no sporting events planned for 2019, however, this effect will disappear.

A positive outlook with some clouds

Switzerland’s leading indicator, the KOF economic barometer, rebounded in September to 102.2, after a weak 98.9 in August, but it is still far from its peak level of 110 in December 2017. A level of 100 indicates that the economy is expected to grow at the average pace of the last 10 years. PMI indicators are also on a downward trend as the composite index reached 58.3 in September versus 60.9 in August and 67 in February. We believe GDP growth will stay robust but won’t speed up in the coming quarters. After a strong first half of the year, GDP growth is likely to approach 3% in 2018. With the fading effect of sporting events, a strong labour market but also a strong Swiss Franc, we expect GDP growth of 1.9% in 2019.

Risks to our forecasts are clearly biased to the downside and come mainly from the international environment. Increased trade tensions could hit Swiss exporting companies hard, with the result that investment and recruitment would likely decrease, leading to lower growth. Political uncertainties, mainly in Europe, with tensions related to the Italian budget and Brexit negotiations, could increase uncertainty in Switzerland and reduce business and consumer confidence, resulting in lower growth. In addition, these tensions, as well as turbulence in emerging countries and repercussions on the foreign exchange market, could induce an appreciation of the Swiss Franc. This would weigh on foreign trade and economic growth in Switzerland.

Arduous negotiations with the EU

Difficulties in negotiations with the EU are also a risk. Indeed, Switzerland and the European Union are currently negotiating a framework agreement (or "institutional framework") that would replace the 120 different treaties that exist right now and put a lasting framework on the relations between the two blocs. Currently, Switzerland has access to the European common market and adheres to the principle of free movement of people. However, it can still negotiate its own trade agreements, as it did a year ago with China. In practice, it is estimated that more than 33% of current Swiss legislation derives from European law, even though no agreement currently obliges Switzerland to transpose European rules onto its own law books. A framework agreement would make the process more automatic by forcing Swiss rules to automatically align with European rules in the areas specified in the agreement (legal developments, supervision, interpretation and dispute settlement). In addition, an arbitration panel would settle disputes between Switzerland and the European Union, and the EU Court of Justice would have a crucial role to play.

Negotiations for the framework agreement began more than four years ago, but the EU wants them to end as soon as possible. A victory for those campaigning "against mass immigration" in a 2014 referendum (a contradiction to the free movement of people principle) worried the EU. The Swiss government succeeded in avoiding a confrontation over the issue, however, by pretending to respect the vote without really implementing it at all. Still, Brexit and the difficult negotiations that have ensued have made the EU even more determined to negotiate this framework agreement as soon as possible.

To force Switzerland to negotiate, the EU has tried to put the government's back against the wall. It decided that, without an agreement, Switzerland would no longer have access to the European research programme and existing treaties will no longer exist. Also, without an agreement, the recognition of the equivalence of the Swiss stock exchange would no longer be extended. This recognition is essential so that European banks and investors can continue to buy and sell Swiss-listed equities. In order to speed up the discussion process and pile more pressure on Switzerland, the EU surprised everyone in December last year by extending the recognition of the Swiss stock exchange by just 12 months. This implies that in December 2018, without sufficient progress in the negotiations, European access to the Swiss stock exchange and Swiss-listed equities will be strongly threatened. Without equivalence, Switzerland could apply the same measure and no longer recognise European stock exchanges. It goes without saying that this threat is extremely serious for a global financial centre such as Switzerland. Without this access, the Swiss financial system would face great difficulty. The Swiss finance minister said last month that, without this equivalence, the very survival of the Swiss stock exchange would be put at risk.

A hostile domestic climate

The problem for the Swiss government is that negotiations with the EU are taking place in a hostile domestic climate. On the one hand, in line with its system of participatory democracy, the country will hold a series of referendums that could dramatically affect its relations with the EU. The ultra-nationalist Swiss People's Party (SVP) - the most powerful political movement in the country - is campaigning against European agreements. In November, the Swiss will vote on a proposal stating the supremacy of the Swiss Constitution on international treaties. This goes against a framework agreement with the EU. The People's Party is also calling for a referendum to revoke the free movement of people. Although it is far from certain that these referendums will find widespread support, some Swiss negotiators want to wait for the results before continuing discussions with the EU.

Meanwhile, in recent months, Swiss unions have been strongly opposed to a loosening of the national regulation protecting wages - the "accompanying measures". These measures force foreign employers who send workers to Switzerland to meet the country's minimum wage and labour conditions. They help keep Swiss wages much higher than in the EU. The EU wants these measures abolished because it believes they penalise foreign companies and are discriminatory. A framework agreement without a modification of these accompanying measures hardly seems acceptable for the EU. The opposition of trade unions thus greatly complicates the negotiations between the Swiss and European authorities.

A pesky double resignation

The negotiation of the framework agreement could also encounter severe difficulties due to the resignation of two pro-Europe federal ministers. Johann Schneider-Ammann, Swiss Minister of Economy from the pro-business liberal party (PLR), has been a defender of close relations with the EU but announced his resignation late last month. Just two days later, Doris Leuthard, the Minister of Transport and Energy and an ultra-popular figure of the Christian Democratic People's Party (centre-right), announced that she was also quitting the Federal Council (the Swiss Federal Government). She repeatedly stated that there is no alternative to good bilateral relations with the EU, which accounts for two-thirds of Switzerland's annual trade volume.

This leaves two vacant seats on the Federal Council, which should be filled by the end of the year with a secret ballot vote of the Federal Assembly. As always in Switzerland, it is the search for consensus that will dictate the two appointments. Indeed, the system is built so that all parties are represented in the Federal Council through the "magic formula", which is a way of dividing the seats between parties based on their election results. In practice, the distribution of seats between parties does not change much over time, even when the composition of parliament changes. A balance in the appointment of ministers is sought to represent different languages, different regions and the gender balance. Normally, the two new ministers would belong to the parties of the resigning ministers, who are in favour of the EU. But, pending these appointments, the places remain vacant, making it more difficult to find a consensus on the content of a future treaty with the EU. In addition, the federal elections of October 2019 are already in sight. The eurosceptic party, SVP, is counting on the fight against a framework agreement in order to grab even more seats in parliament.

These difficult negotiations could lead to uncertainty in the outlook for the Swiss economy, which could impact economic growth.

Low inflation

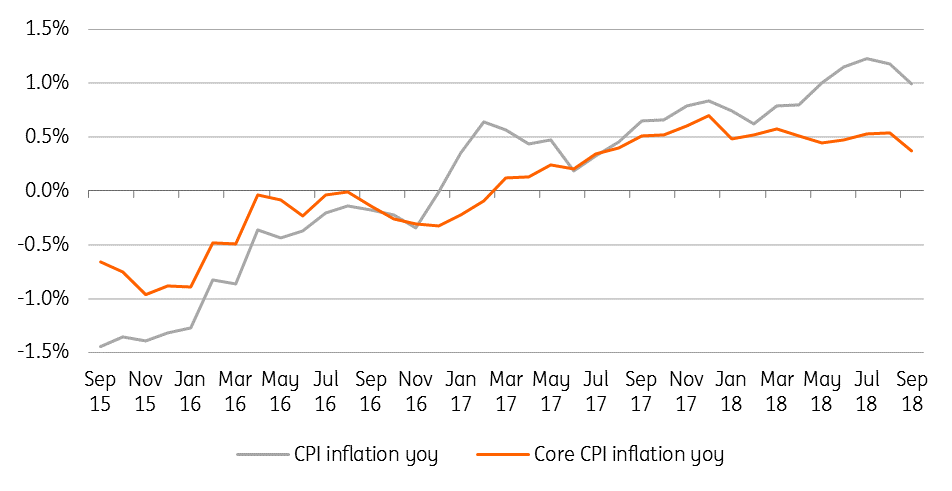

After a long deflationary period, CPI inflation has been in positive territory since January 2017. From 0.6% year-on-year in February 2018, inflation has gradually increased, reaching 1.2% in July and August. In September, inflation decelerated again to just 1%. At the same time, core inflation which excludes prices of volatile components, has remained low at around 0.4%. The relative appreciation of the Swiss Franc since May is likely to diminish import prices for the rest of the year, adding to downward pressures. But, at the same time, oil prices and higher American and European tariffs on global imported goods could push import prices higher. After having reached a level of 0.5% in 2017, CPI inflation is expected to climb to a modest 0.9% in 2018 and 1% in 2019.

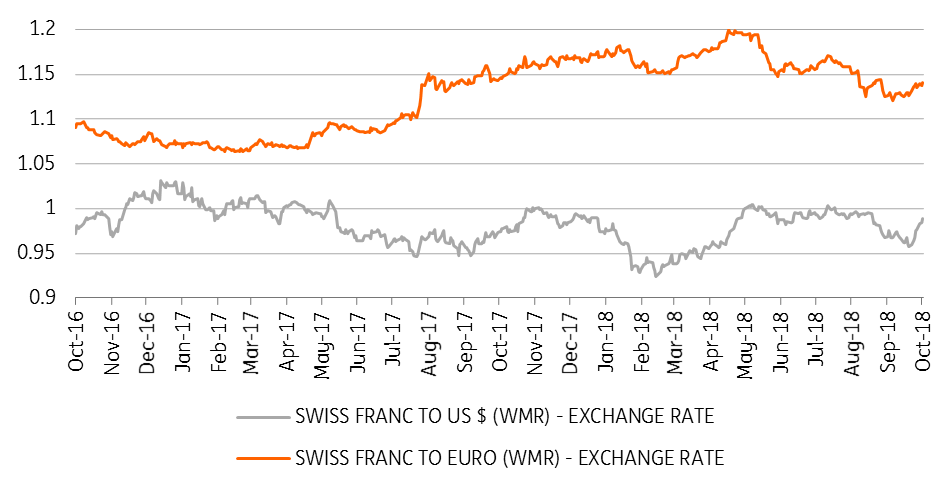

Extremely cautious SNB

The Swiss National Bank has maintained an ultra-loose monetary policy stance. At its September meeting, the SNB left its main policy rates unchanged in negative territory. The target range for the three-month Libor was maintained at between -1.25% and -0.25% and the interest rate on sight deposits remained set at -0.75%. The SNB still believes the Swiss Franc is “highly valued”. It highlighted the recent appreciation of the Swiss Franc and believes the situation in the foreign exchange market is still fragile. Indeed, worries in emerging countries, discussions on the Italian budget and uncertainties surrounding Brexit have pushed the Swiss Franc, a currency considered to be a safe-haven, sharply higher against the euro. On average, the value of the Euro/Swiss franc rate amounted to 1.15 during the third quarter, compared to the average of 1.17 in the second and first quarter. The Swiss economy is a small, open economy that relies heavily on international trade for growth. The appreciation of the Swiss franc may be a drag on exports and therefore reduce growth momentum in the coming months.

At its September meeting, the SNB revised downwards its conditional inflation forecast (i.e. if monetary policy remains the same) for 2019 and 2020, signalling a dovish stance. It probably means that monetary policy will remain very accommodative in the coming years and much longer than previously expected. We don’t expect any rate hike before the ECB starts raising its own rates. Given that the ECB is not expecting to hike before the end of the summer of 2019, we think the SNB won’t hike interest rates before December 2019. Moreover, given the increased risk environment expected for next year, it is even possible that the first rate increase will be postponed to 2020.

The economy in a nutshell (% yoy)

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

8 October 2018

In case you missed it: A war of words This bundle contains 9 Articles