Swiss lockdown measures eased again but recovery will take years

The second phase of easing the lockdown measures in Switzerland is happening but the economic damage is so severe that it will take years to repair

Second phase of lockdown exit

Switzerland entered the second phase of the gradual exit from lockdown this week, and schools, businesses, museums and restaurants can reopen their doors, so long as they take precautionary measures. This new phase will give a breath of fresh air to the Swiss economy, which is suffering the full impact of the coronavirus pandemic. While 30% of employees have been placed on short-time working during the containment, the labour market is suffering more structural damage. For instance, in April, the unemployment rate (which does not take account of short-time working) rose to 3.3% compared to 2.9% in March and the number of unemployed people increased by 43% compared to April 2019. According to the Swiss National Bank, the level of activity is currently between 70 and 80% of its normal level.

Government support is massive

Against this background, the authorities have opened the budgetary floodgates. Last week, Parliament met in extraordinary session and gave the go-ahead to the release of CHF 65 billion to help the Swiss economy cope with the consequences of Covid-19. In detail:

- CHF 16 billion in expenditure to support specific sectors,

- CHF 41 billion in guarantees and sureties, and

- CHF 8 billion in compensation for short-time working have been earmarked.

This plan, which is equivalent to almost 9.3% of GDP, is the largest ever launched in Switzerland. We think this amount may be increased further in the coming months. Taking into account the debt brake mechanism, Switzerland has a very low public debt (24% of GDP) and has recorded a budget surplus in all previous years. It, therefore, has the means available to increase further public spending.

Swiss consumer confidence in free fall

The economy will suffer for a long time

The aid plans may help to combat the effects of the lockdown period (redundancies, bankruptcies, etc.) but will not prevent a serious economic recession in Switzerland. Indeed, the measures will be lifted very gradually, which implies that the recovery in activity will be gradual. The KOF Indicator, the most important leading indicator in Switzerland, fell by 28.2 points in April after a decline of 10.1 points in March. This historic fall is twice as large as previous records (during the financial crisis, after the abandonning of the minimum exchange rate and during the 1990 real estate crisis) and took the barometer to 63.5, while it was still above its long-term average (at 101.8) in February.

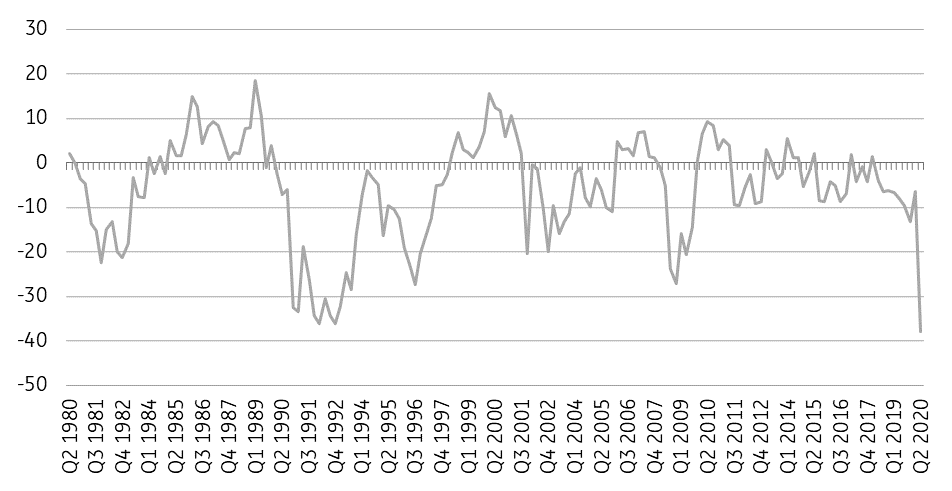

Consumers have never been more negative about the economic outlook

We already see from consumer surveys that consumption is likely to take time to recover. Indeed, consumer confidence in Switzerland deteriorated from -9 points in January to -39 points in April, a level well below that recorded during the 2008-2009 economic and financial crisis. Consumers have never been more negative about the economic outlook and the unemployment index recorded its largest increase in a single quarter since 2007. Finally, when asked whether now is a good time to make major purchases, consumers gave the most negative response ever in April.

In addition, the Swiss economy is heavily dependent on exports and imports. The global economic recession expected in 2020 is therefore likely to have a strong impact on Switzerland's international trade, even when the country's exit from lockdown is complete. The cancellation of major sporting events has a significant impact on Swiss GDP because the broadcasting rights for these types of events go to Swiss companies, boosting the country's GDP by almost 0.4 pp in some years.

Finally, tourism remains an important driver of the Swiss economy, and it is clear at this stage that it will not easily recover in 2020. Therefore, we estimate that GDP is likely to contract by more than 6% in 2020. At this stage, we anticipate a recovery of around 4% in 2021. This means that economic output at the end of 2021 will not have reached its pre-crisis level. We estimate that it will take until 2023 at the earliest to return to the level at the end of 2019.

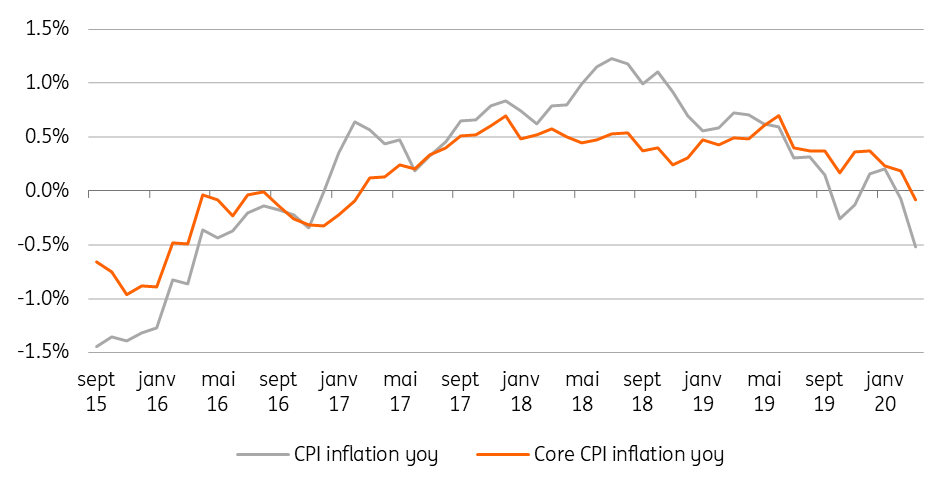

Inflation in negative territory

Already before the coronavirus crisis, consumer price inflation in Switzerland was very low and entered negative territory in October and November. The coronavirus crisis, the economic crisis and the fall in oil prices have not helped, and price growth is now again sinking into negative territory. We expect consumer price inflation to be no higher than -0.4% for 2020 as a whole (0.4% in 2019).

The SNB continues to intervene

The current environment makes the SNB's work complicated. The economic crisis, negative price growth and the appreciation of the Swiss franc, considered a safe haven by investors, is forcing it to maintain a very accommodating monetary policy. For the time being, the SNB has not lowered its interest rates, which are already set to -0.75%, the lowest in the world. Nevertheless, since the beginning of the crisis, the SNB has been intervening heavily on the foreign exchange markets to prevent the Swiss franc from appreciating too much. At present, it seems that it is doing everything possible to keep the EURCHF above 1.05 and that it wishes to maintain this course.

We expect the SNB to continue to intervene in this way in the coming months. The SNB has already indicated on several occasions that it is prepared to reduce interest rates further. In our view, it would really prefer to avoid this and would only cut rates if absolutely necessary (e.g. if the ECB were to cut rates and it became impossible to avoid an excessive appreciation of the Swiss franc). This is not our base case. On the other hand, we believe it will continue to intervene heavily on the foreign exchange market over the next few months, which will result in a sharp increase in its balance sheet. This type of intervention has become the SNB's main tool and we think it will remain that way.

QE would not be much use in Switzerland

We do not believe that the SNB would be prepared to use other tools such as quantitative easing (QE). If this kind of monetary policy instrument makes sense in other parts of the world, it would not be of much use in Switzerland. Indeed, the SNB does not need to lower the Swiss Confederation's financing costs, which are already very low and negative over a horizon of more than 30 years. Swiss government bonds are regarded as a safe haven 'par excellence' and are in insufficient numbers on the markets to satisfy all investors. There is, therefore, no reason for the SNB to start buying this type of asset. Switzerland's specific characteristics mean that the SNB's most effective tool is intervention on the foreign exchange market. It should be noted that, in practice, FX interventions increase the size of the balance sheet, as does QE.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more