Swiss economy close to its pre-crisis level

The recovery continues in Switzerland, with GDP growing by 1.8% quarter-on-quarter in 2Q and the economy now only 0.5% below its pre-crisis level. It should exceed it this summer and be 2% above by the end of the year. This is not enough to raise inflation sharply or for the Swiss National Bank to change its monetary policy

Strong rebound in 2Q

The Swiss economy rebounded strongly in the second quarter of 2021, with GDP increasing by 1.8% quarter-on-quarter, after -0.4% in the first quarter due to the severe restrictions taken to limit the spread of the pandemic. The second quarter was marked by the lifting or easing of many health measures, which allowed the services sector to recover strongly. For example, the value added in the hotel and restaurant sector rose by 48.9% over the quarter, while that of art, entertainment and recreation increased by 52.9%. The trade sector rebounded by 4.8% over the quarter thanks to the reopening of shops. Finally, thanks to the easing measures, private consumption growth was very strong (+4.1% qoq, after -3.1% in 1Q). Investment in capital goods also rebounded (+1.6% compared to -0.9% qoq in 1Q).

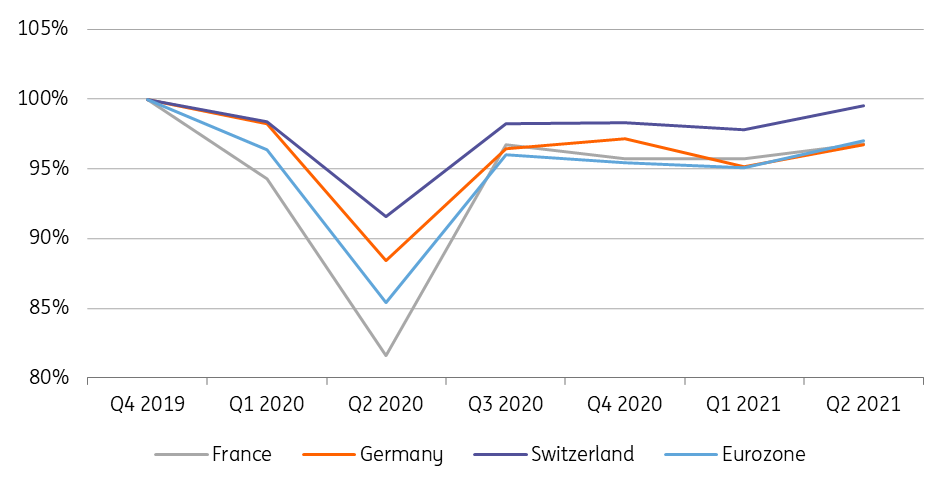

At the end of the second quater, the Swiss econony was 0.5% below its pre-crisis level of activity... the euro area was at the same time 3% below

At the end of the second quarter, the Swiss economy was 0.5% below its pre-crisis level of activity, an exceptional performance compared to neighbouring countries. For example, the euro area was at the same time 3% below its pre-crisis level of activity. This good performance is mainly explained by the much smaller size of the economic shock in 2020, with Swiss GDP falling by only 2.4% over the year, compared with 6.4% in the euro area. Household consumption was 2.2% below its pre-crisis level at the end of the second quarter.

Thanks to the favourable specialisation of Swiss industry (particularly in the chemical-pharmaceutical sector), manufacturing industry continued to grow, by 0.9% qoq in 2Q, but the growth slowed sharply compared to that observed at the beginning of the year (+5.1% in 1Q). Swiss manufacturing is now 4.7% above its pre-crisis level.

Switzerland has weathered the crisis much better than its European neighbours

Real GDP level compared to 4Q 2019

Return to pre-crisis level expected in 3Q

With the level of activity at the end of the second quarter being only 0.5% below its pre-crisis level, the third quarter of 2021 should signal a return to and surpassing of the pre-crisis level of activity for the Swiss economy. The small, open economy is benefiting strongly from the global recovery on the one hand. On the other hand, with the consumer confidence indicator having reached its highest level since 2010 in July and the labour market in good shape, this suggests that domestic consumption should continue to recover. The unemployment rate fell back below the 3% mark in August to 2.9%. It was at 2.3% in February 2020 before the pandemic and had risen to 3.5% in May 2020.

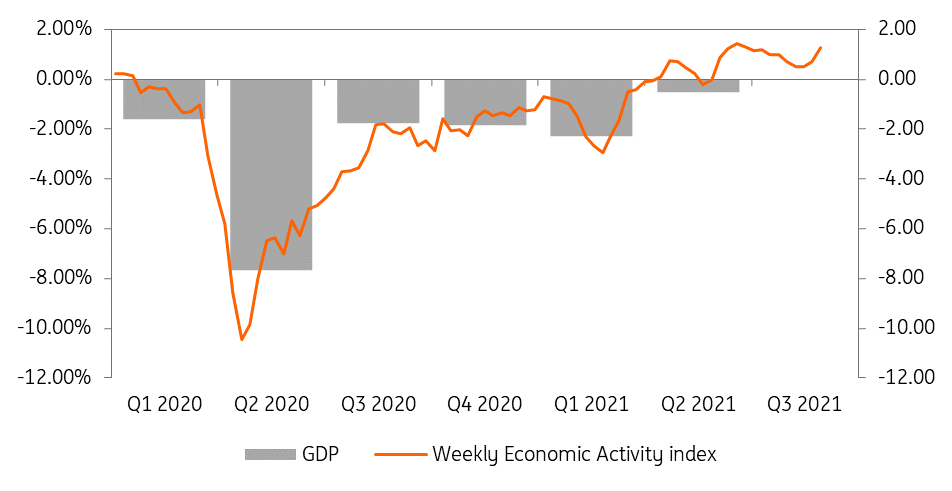

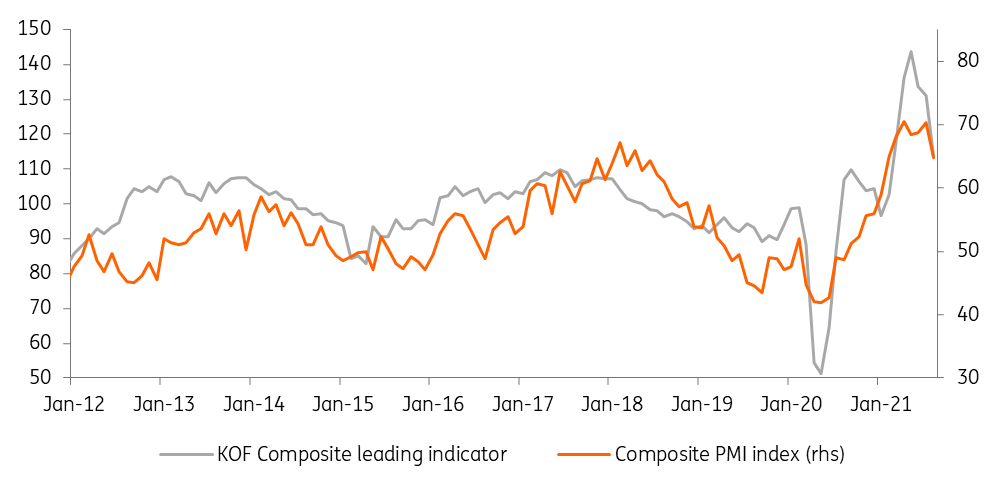

SECO's weekly economic activity index suggests that the pre-crisis level of activity will even be exceeded in the third quarter. Given the still very high but declining level of leading indicators from the May peak, we expect a still strong but normalising recovery for the rest of the year. For 2021 as a whole, we expect GDP growth of around 3.4%, which would imply that activity would be 2% above its pre-crisis level by the end of the year. For 2022, we expect growth to be around 3%.

High frequency data suggests a return to pre-crisis activity levels by 3Q 2021

GDP and SECO's weekly economic activity index compared to 4Q 2019

Leading indicators are still at a very high level, but are declining suggesting a normalisation of the growth rate of activity

Public finances temporarily in deficit

According to estimates by the Federal Finance Administration, the coronavirus crisis has had a serious impact on Swiss public finances. The public finance deficit is estimated at 2.8% in 2020 and is projected at 2.2% for 2021. Switzerland is known for its fiscal rigour and such a level of deficit had not been observed since the early 1990s, well before the introduction of the "debt brake mechanism" in the 2000s. Nevertheless, given the scale of the crisis and the mechanisms put in place by the public authorities to safeguard the economy, the deficit has remained moderate, especially in international comparison (The deficit of the eurozone was 7.2% and that of the United States 15.8% of their respective GDP in 2020). Moreover, unlike the other countries, the public deficit in Switzerland is expected to be reduced in 2022 to a surplus of around 0.6%. Switzerland's Maastricht debt ratio was 28.1% of GDP in 2020 and is expected to be 27.3% in 2021 and 26.5% in 2022, again well below the debt ratios of other countries (in comparison, the eurozone is likely to remain at a debt ratio of over 100% of GDP over the same period).

Very low inflation and a persistent monetary status quo

We expect inflation to average around 0.4% in 2021, before picking up slightly to 0.7% in 2022 and 0.6% in 2023

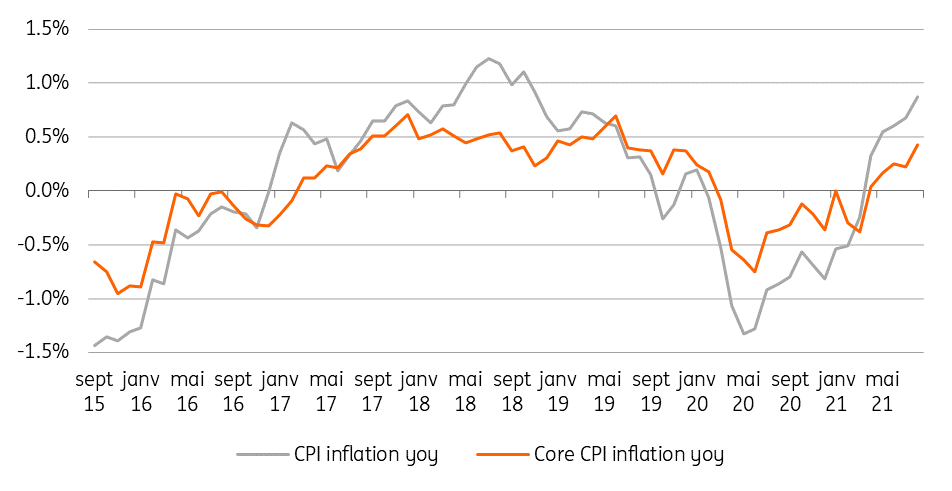

The economic recovery in the world and in Switzerland has allowed Swiss inflation to reach 0.9% in August, a level that is admittedly low, but the highest since October 2018. After a one-year deflationary period that lasted until March 2021, Swiss inflation is thus slowly recovering. Nevertheless, much of the recovery is due to energy prices, and core inflation rose by only 0.4% in August. In the coming months, inflation should remain around 1% for a while, but this will not be enough to raise the average inflation rate in 2021, which is weighed down by the 1Q price drop. We expect inflation to average around 0.4% in 2021, before picking up slightly to 0.7% in 2022 and 0.6% in 2023. These extremely low inflation expectations and the ECB's very dovish monetary policy should not lead to a tightening of the SNB's monetary policy in the coming years. We expect the key interest rate to remain at -0.75% until at least 2024.

Inflation is rising but still at a very low level, suggesting unchanged monetary policy in the coming years

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more