Sweden in 2018: So far, not great

The Swedish economy looks to be slowing down and the currency has weakened substantially in 2018. The Riksbank will respond as it always does: with extreme caution

It’s fair to say that 2018 hasn’t been a vintage year for the Swedish economy. Growth is slowing down, inflation has disappointed, and the housing market still looks wobbly. Meanwhile, the US administration’s aggressive trade policy creates a major risk for Sweden’ export-dependent economy. The Swedish Krona has been the worst performer among the G10 currencies so far in 2018.

Solid growth, but momentum is slowing down

Sweden headed into 2018 on a bit of a winning streak, with four straight years of strong growth averaging more than 3% per year. And with the global economy picking up in the second half of 2017, things ought to be looking up for the export-heavy Swedish economy.

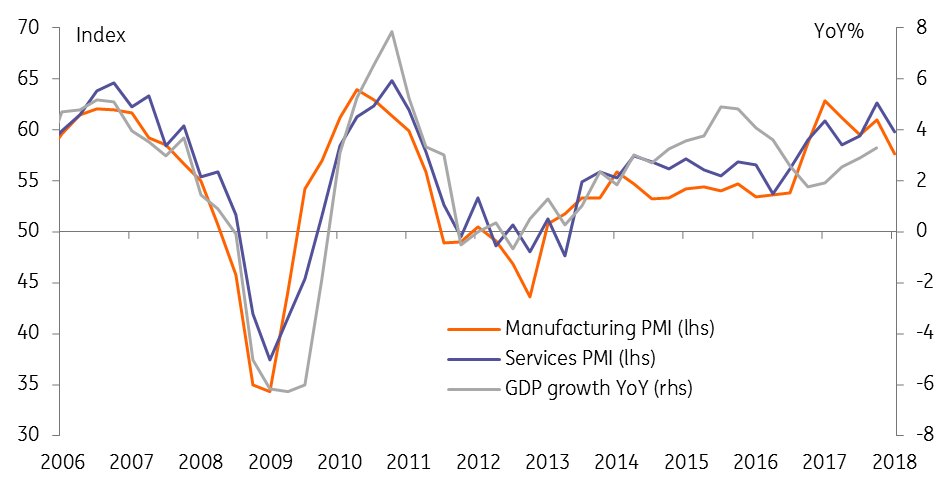

But instead the economy looks to be slowing down, with PMI surveys and other near-term indicators suggesting that 4Q17 could prove the top of the recent growth cycle. While 1Q growth is still likely to come in at a solid pace, around 2.5% YoY, the direction from here looks to be downward.

A key reason for this slowdown is the housing sector. After several years of rapidly rising house prices and increasing construction of new homes, the Swedish housing market hit a wall in the second half of 2017. Prices have dropped rapidly, down 6% nationally and 10% in Stockholm.

Construction also seems to be slowing down, with permits for new construction falling by nearly half in the second half of the year. Developers are struggling to sell all the expensive new flats they have built and planned, and new affordability restrictions on mortgages brought into force at the start of March will not make things any easier. Many developers, especially new companies set up during the boom years are facing an increasingly difficult financial situation.

Swedish PMI surveys point to slower growth

Inflation has softened and the currency depreciated

Inflation has disappointed expectations in January and February, falling back below 2%. While we expect a pick-up in March, that is largely down to higher energy prices and an earlier Easter this year. The underlying core inflation measure is likely to remain well short of 2%: we expect 1.6% in March, up from 1.5% in the previous two months.

Partly as a result of the weaker economic outlook and negative data surprises, the Swedish currency has struggled. After a solid performance in January (as the year-end headwind from low STIBOR rates unwound), SEK has become the weakest performer in the G10.

A key trigger for SEK weakness was the market turmoil at the start of February, followed by President Trump’s increasingly strident approach to trade policy. As a very open, export-oriented economy, Sweden is particularly vulnerable to rising protectionism. As the trade war rhetoric has ratcheted up, investors have started pricing in a risk premium for the krona.

What does this mean for the Riksbank?

The weaker outlook for inflation and SEK sell-off has caught the Riksbank by surprise. The central bank revised down its inflation forecast at the February policy meeting, only to see January inflation undershoot the new forecast a week later. February also came in below their forecast. Though we think March will be in line with, or even a touch above the Riksbank’s expectation, their forecast further out looks too ambitious.

At the same time, the trade-weighted KIX index is now around 6% weaker than the Riksbank had factored into its last forecast. That should offset some of the weakness in domestic price pressure. Still, we think another slight downward revision to inflation is likely at the next Riksbank meeting in April.

That probably means the Riksbank will also push back its interest rate forecast to indicate the first hike will come only at the end of this year. The minutes from the February meeting indicated the committee was already leaning in that direction, and events since then – in particular the increasing trade tensions – will only have added to their concerns. Caution has long been the Riksbank’s preferred stance, and in turbulent times they will most likely stick to that approach.

Download

Download article"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).