Sugar: Oil & the Brazilian Real remain key

The outlook for the sugar market has changed dramatically since the start of the year. From a constructive outlook, the market has been sold off aggressively due to weakness in oil and the Brazilian Real (BRL). These two factors will see producers in CS Brazil increase sugar output significantly this season

CS Brazil 2020/21 season well underway

Crushing in CS Brazil is well underway, and the industry has had a strong start according to UNICA, the Brazilian sugarcane industry association data.

The cumulative cane crush through until the end of May for the 2020/21 season starting in April is 144.8mt, up 12% year on year. However what's even more impressive, is the fact that sugar production stands at a little over 8mt already, up 65%YoY. Total sugar output this season from CS Brazil is set to reach near-record levels, with estimates of almost 36mt, up from close to 27mt in 2019/20.

Mills in CS Brazil have shifted their production mix significantly this season towards sugar, with sugar prices trading well above ethanol parity

Mills in CS Brazil have shifted their production mix significantly this season towards sugar, with sugar prices trading well above ethanol parity, and so sugar provides a better return than ethanol for mills. This has been a big shift from the trend we have seen in recent years. Over the past couple of seasons, given the global sugar surplus, mills had been maximizing ethanol over sugar. So far this season, the cumulative sugar mix stands at 45.92% compared to 33.31% at the same stage last year.

Weak energy prices have driven this shift

The significant sell-off seen in the oil market over the first quarter, through into April was the key catalyst for the pressure on sugar prices, with it dragging Brazilian ethanol prices lower. Country lockdowns and travel restrictions led to a significant amount of oil demand destruction, with global oil consumption falling by almost 30% YoY in April, whilst over full-year 2020, oil consumption is forecast to fall almost 10% YoY.

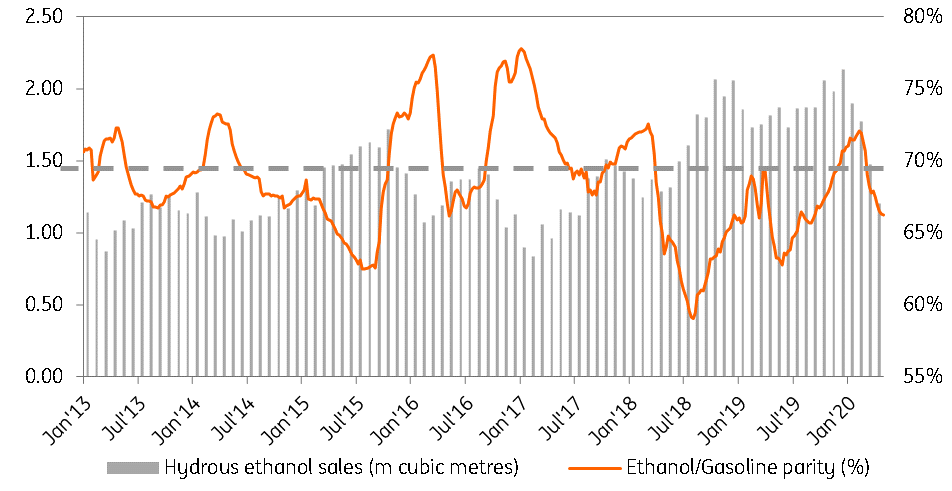

Brazil has also seen overall fuel demand hit as a result of the Covid-19 outbreak. Data from ANP shows that gasoline sales in April fell 29% YoY, and to the lowest monthly levels since November 2009. Cumulative gasoline sales over the first four months of the year fell almost 10% YoY. Meanwhile, hydrous ethanol has seen even larger declines, with sales in April falling 34% YoY, whilst cumulative sales so far this year are down more than 11% YoY.

Looking ahead to the rest of the year, with the worst in global oil demand destruction now behind us, and with supply cuts hitting the market, we do see the upside to oil prices for the remainder of the year and expect ICE Brent to average US$50/bbl over 4Q20. This strength should provide some upside to both ethanol prices in Brazil, and in turn to sugar prices. Already sugar prices have risen from their recent lows in April, along with the recent strength in oil prices.

Brazil hydrous ethanol sales

The BRL weakness

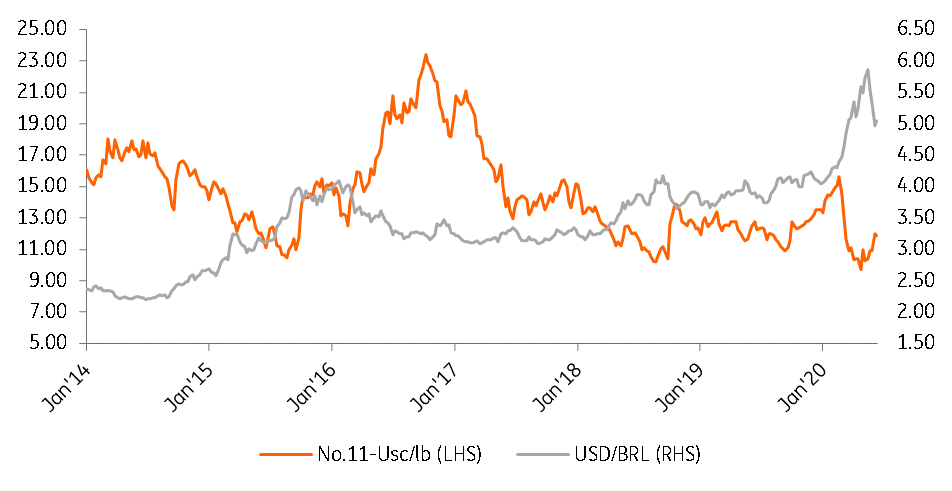

The other key factor which has weighed on sugar prices is the weakness seen in the BRL for much of the year.

The BRL was trading at four to the USD at the start of the year, and in May reached almost 5.9 to the USD. There have been stages through this year, that despite the weakness in the No.11 sugar market, Brazilian producers were able to lock in some of the best prices they have seen since 2016 in BRL terms. Also given that the bulk of ethanol is consumed domestically, and priced in BRL, means that the weaker BRL contributes to an even lower ethanol/sugar parity level, and so another driver behind producers increasing their sugar mix at the expense of ethanol.

Brazilian Real vs. sugar

What does this all mean for the world sugar market?

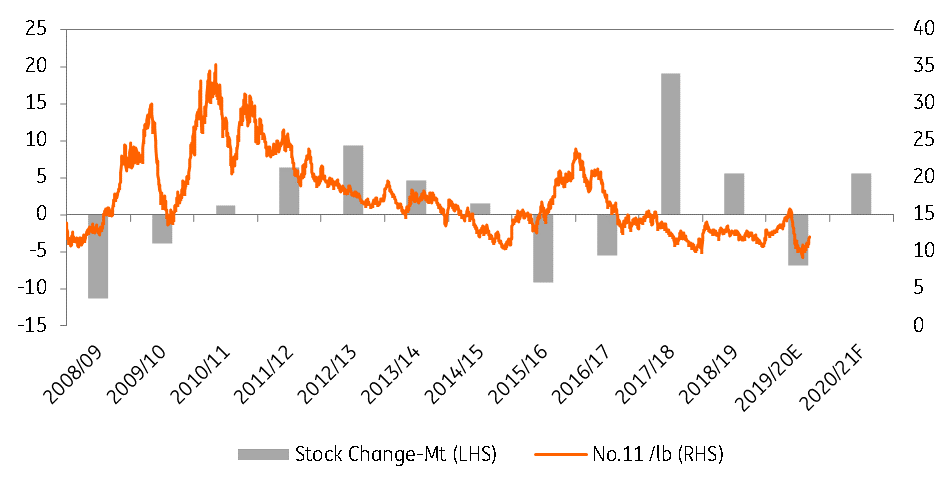

The global sugar market was set to see a deficit in the region of 7mt in the current 2019/20 marketing year, although country lockdowns as a result of Covid-19 will hit sugar consumption, and so reducing the scale of the deficit somewhat. This deficit has been predominantly driven by poor crops from both Thailand and India. Meanwhile, in the 2019/20 season, CS Brazil producers maxed ethanol production at the expense of sugar, which helped to keep sucrose off the global balance sheet. While the deficit in the current season has been somewhat supportive of the market, there are still fairly large inventories, which were built over the two previous seasons.

With CS Brazil set to see a stronger sugar mix in the 2020/21 harvest, sugar output from the region is estimated to increase by around 9mt YoY and the global sugar market is expected to return to a surplus of around 5mt in the upcoming 2020/21

Now with CS Brazil set to see a stronger sugar mix in the 2020/21 harvest, sugar output from the region is estimated to increase by around 9mt YoY. As a result, the global sugar market is expected to return to a surplus of around 5mt in the upcoming 2020/21 marketing year. While recovering oil prices and BRL should provide some upside to sugar over the course of the year, this expected surplus should limit the upside to prices over the next season.

While Covid-19 is likely to have had a fairly big impact on sugar consumption, the outbreak also provides a key upside risk for the sugar market. Brazil has seen a significant jump in Covid-19 cases, with the country having the second-largest amount of confirmed cases in the world. There are worries that a worsening in the situation, could lead to logistical and supply disruptions. This nervousness does seem to be reflected in the vessel line up at Santos in Brazil, with it growing in recent weeks, although part of this also likely reflects stronger output this season.

Global sugar balance

European sugar market remains more constructive

The European sugar market has held up better than the world market, with monthly reported prices from the European Commission has continued to trend higher. Prices in March averaged EUR375/t, up 20% from the lows in January 2019, and the highest levels seen since early 2018.

This strength has been driven by poorer output in the EU. Sugar production in the current 2019/20 season is expected to total 17.4mt, slightly down from the previous season, but significantly below the 21.3mt produced in the 2017/18 season (the first season after the lifting of production quotas). Lower output has come as a result of poorer yields, while for the current marketing year, a smaller acreage has weighed further on production.

Looking ahead, and into the 2020/21 season, the EU market is likely to remain fairly well balanced, and therefore EU sugar prices are likely to remain well supported

Lower production had meant that stocks in Europe were meant to tighten. Whilst inventories are lower than what they were in 2017/18, Covid-19 related lockdowns has had an impact on consumption, and the European Commission forecasts that consumption this season will fall by 300kt YoY to around 17mt. As a result of this weaker consumption, ending stocks this season are expected to edge higher once again.

Meanwhile, trade has also helped to ensure that stocks have not tightened this season. Exports from the EU are well below levels seen in recent years. Cumulative exports through unit mid-May stand at 544kt, 57% lower than what was seen over the same period last year, and 78% lower than what was seen during the same period in 2017/18. Exports over the full marketing year are estimated to total 1mt, which would be even lower than the WTO limits that were in place prior to the lifting of production quotas. Meanwhile, imports have continued to pick up this season, with cumulative imports up 6% YoY through until the end of May.

Looking ahead, and into the 2020/21 season, the EU market is likely to remain fairly well balanced, and therefore EU sugar prices are likely to remain well supported. Whilst sugar beet area is expected to fall once again, beet yields are expected to improve, with the Commission estimating that yields will be almost 1% higher than the 5-year average.

This means that sugar production is expected to be roughly in the same range as we have seen over the last couple of seasons.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more