Speed check! Our guide to UK events this week

As politicians breathe a sigh of relief following last week's Brexit breakthrough, focus switches back to the economy this week

Inflation (Tuesday 12th)

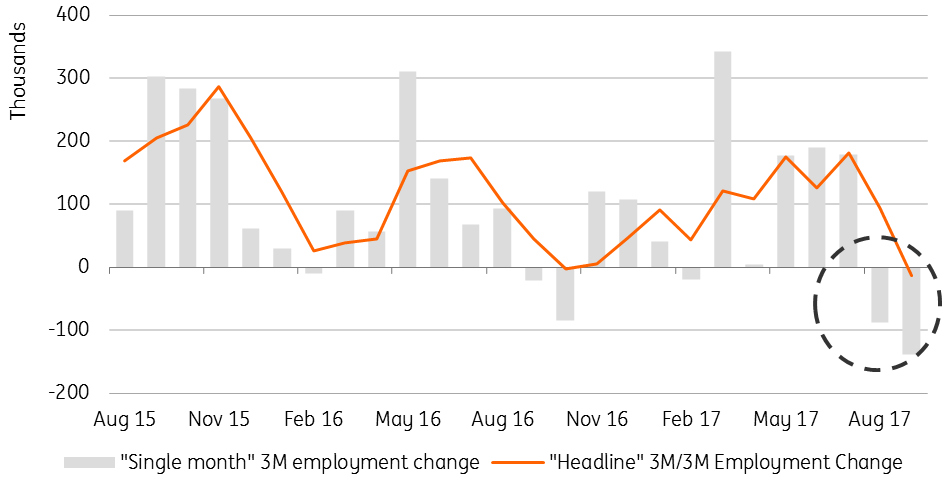

Jobs growth (Wednesday 13th)

It's certainly fair to say the jobs market is going through a rough patch. The headline measure of employment looks set to have fallen by roughly 35,000 thousand (3M/3M average) in October. It's entirely plausible that this is just noise, but the latest services PMI also suggested that the rate of hiring has slowed.

One explanation is that the sluggish growth we've seen this year is starting to take its toll - in the same way, that a burst of economic strength at the end of 2016 buoyed the jobs market earlier in 2017.

Wage growth (Wednesday 13th)

Retail sales (Thursday 14th)

Bank of England (Thursday 14th)

Last week's Brexit breakthrough should herald a relatively swift agreement on a post-Brexit transition period - something Bank of England Governor Carney has been pretty vocal about over recent months. If a transition deal is agreed early next year, this should help unlock some short-term investment as the risk of a cliff-edge in 2019 fades.

This means the Bank of England may strike a cautiously optimistic tone this week - although we suspect the MPC will keep its cards close to its chest when it comes to the timing of another hike. Having said that, policymakers have signalled they'd be comfortable with one hike in 2018. So a February, or more likely, May rate rise can't be ruled out.

But there are still some big Brexit questions to be resolved next year, not least when a final trade deal will be agreed. And with the economy still struggling to regain momentum, we still caution that a hike next year is far from a done deal.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more