Spain: Political challenges ahead as the economy slows down

The next couple of weeks are likely to be stressful for the Spanish prime minister as he confronts a number of thorny issues. Meanwhile, evidence of a slowing economy is mounting. For 2018 as a whole, we forecast a growth rate of 2.6% and 2.0% for 2019

2019 budget is the first political hoop

Parliament's rejection of the draft 2019 budget was the first serious blow to prime minister Pedro Sanchez's minority government. Only 88 parliamentarians (out of 350) voted in favour of the plan at the end of June, so the first political hurdle is the approval of the 2019 budget.

A deal between Sanchez and Pablo Iglesias would mean the prime minister can be more confident about Podemos support in parliament

Spain's leftwing party, Podemos, which holds 67 seats, didn't support the draft budget as it wanted softer deficit targets. However, Sánchez emphasised the importance of fiscal discipline and continued to pursue the deficit target of 2.2% of GDP. Finding a compromise will be difficult, and as the draft budget needs to be submitted to Brussels by 15 October, the pressure will increase.

Recently, however, Sánchez met with Pablo Iglesias, the leader of Podemos, to talk about common goals on education, housing and taxes. A deal between the two would mean Sánchez can be more confident about Podemos support in parliament and this increases the probability of budget approval and the chances that Sánchez governs until the next official elections in 2020.

The Catalonia problem

However, Sánchez's success depends a great deal on the second important political hurdle, namely Catalonia where he needs the support of Catalan pro-independent parties to approve the 2019 budget. Sánchez has already lifted financial controls on the region, moved prisoners closer to home and met with the new leader of Catalonia, Quim Torra. He has also offered the Catalan government a referendum on more autonomy.

However, some sensitive events that are on the horizon could derail the prime minister’s plans. On 1 October, there is the first anniversary of the Catalan unilateral independence referendum, so the tension on the streets is likely to rise, and the trial of the politicians that were jailed after the referendum could start in October. Quim Torra, the President of Catalonia, already said he would not accept “any sentence that is not total acquittal”.

If the budget isn't approved by parliament before the end of the year, then the 2018 budget will roll over, which implies no new measures can be taken

An interesting and closely-watched poll by the Centro d’Estudis d’Opinio shows that support for an independent Catalonia remains high, but it doesn't reach a majority and is actually declining. Today, 46.7% of Catalans want Catalonia to be independent, whereas this was 48.7% in October 2017.

The poll, however, also shows that 62.3% of Catalans think that Catalonia has achieved an insufficient level of autonomy and this percentage already lies above 60% since 2007. The offer of Sánchez to have a referendum on more autonomy certainly is in line with the above, but it remains to be seen if it is enough to get the support of the pro-independent parties for the 2019 budget. If the budget isn't approved by parliament before the end of the year, then the 2018 budget rolls over, which implies no new measures can be taken.

Percentage of Catalans who want Catalonia to be an independent state

A slowing economy

According to the preliminary estimate of GDP, the Spanish economy slowed in the second quarter compared to the first. The economy grew by 0.6% quarter on quarter (QoQ), compared to 0.7% in the first quarter.

This is the slowest growth rate in more than three years. Since 4Q14, the economy has expanded by at least 0.7% QoQ

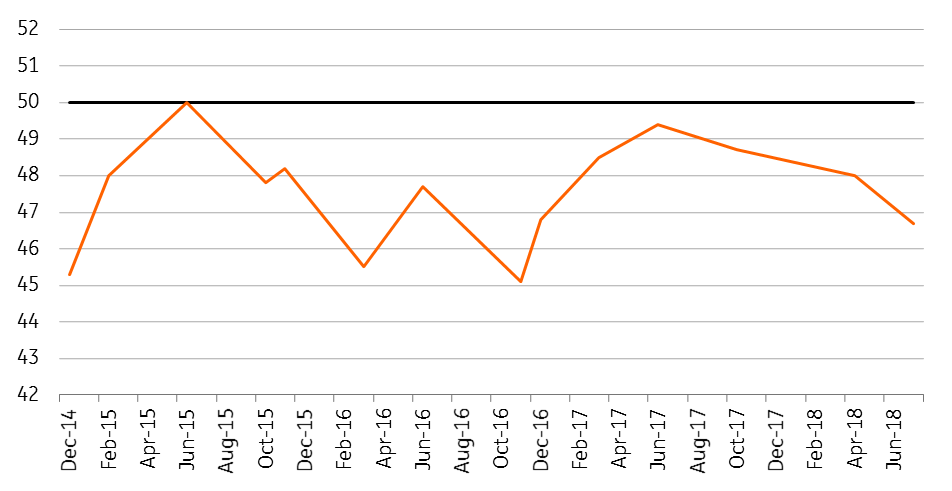

The first figures for the third quarter point to further slow down. Survey data, such as PMIs and the Economic Sentiment Indicator by the European Commission, continue to fall. The services PMI dropped sharply from 55.2 in June to 52.6 in July and remained at that level in August (52.7). The manufacturing PMI has already been in decline since the start of the year and came in at 53 in August.

PMIs stabilised in August, but are at a relatively low level

The first hard data for the third quarter doesn't show much movement compared to the second quarter. Retail sales fell in July by 0.4% year-on-year, compared to -0.1% in June. The uptick in headline inflation, from around 1.0% to above 2.0% in recent months, is a headwind for consumption. Industrial production growth is also on a downward trend since April 2018 and disappointed in July as it only grew by 0.5% year-on-year.

Due to the recent developments in some emerging markets, concern about the international presence of Spanish banks which could have negative spillovers increased. The Spanish banking sector has large exposure in terms of financial assets in Turkey, Brazil, Mexico and Chile.

We think the Spanish economy is still in good shape but nonetheless, we forecast a slight slow down in the coming quarters

However, these spillovers might be limited as Spanish banks follow the so-called subsidiary model, which implies large local claims (and mainly in the local currency) and large local operations. That said, a severe downturn in these countries, combined with falling exchange rates will, of course, impact the profitability of the Spanish banks.

That said, we think the Spanish economy is still in good shape. For example, the strong labour market will continue to support consumption. Nevertheless, we forecast the economy will slow down a bit further in the coming quarters.

Given the extraordinary performance in previous years (above 3% annual growth since 2015), this shouldn't be viewed as a sign of trouble. For 2018 as a whole, we forecast a growth rate of 2.6% and 2.0% for 2019.

The Spanish economy in a nutshell (%YoY)

Download

Download article17 September 2018

ING’s Eurozone Quarterly: A late-cycle economy? This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).