Solid US labour market justifies swift Fed hikes

Jobs growth remains impressive despite the obvious challenges firms are facing in finding suitable workers. This is pushing up pay pressures, which will keep inflation higher for longer and supports the view that the Fed is set to embark on a series of 50bp rate hikes through to the summer

| 431,000 |

The number of jobs created in March |

Jobs growth continues apace

The March jobs report shows that the labour market continues to strengthen with non-farm payrolls rising 431k with an additional 95k of upward revisions to January and February data. This is versus a consensus forecast of 490k. The gains were spread throughout all sectors with manufacturing posting a 38k increase, retail was up 49k, trade and transport up 54k and business services up 102k. Leisure and hospitality continued to grow strongly with employment growth of 112,000 while Federal government was the only disappointment with 1,000 jobs lost. In aggregate, payrolls now stand at 150.93mn, which is 1.58mn below the February 2020 peak.

US non-farm payrolls (millions)

The household survey, which is used to calculate the unemployment rate showed employment rising an even more impressive 736k. The number of people classifying themselves as unemployed fell 318k so the result is the unemployment rate dropping more than expected from 3.8% to 3.6%. The participation rate continues to grind higher and now stands at 62.4%, a full percentage point below the pre-pandemic level with the participation rate of the over 55s 1.4 percentage points lower.

A lack of supply holds back jobs growth and the economy

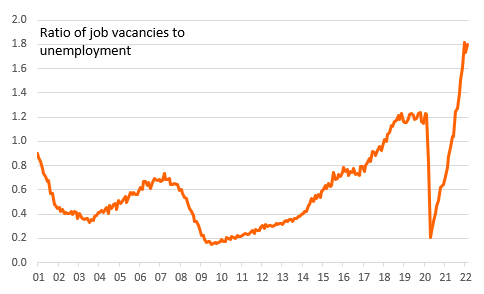

It’s fair to say that the job creation numbers would be even better were it not for employers struggling to find suitable workers. This week’s Jobs Opening and Labor Turnover Survey report showed there are more than 11mn vacancies in the US so there is absolutely no issue with demand. It is that lack of supply of workers that is holding back the economy. There are now more than 1.8 vacancies for every single unemployed person with yesterday’s National Federation of Independent Business (NFIB) survey showing a net 47% of small businesses having job openings they couldn’t fill.

1.8 job vacancies for every unemployed American

While firms are desperate to hire, they also don’t want to lose the people they already have. This effort to retain staff is further incentivizing companies to pay their workers more with average hourly earning rising 0.4%MoM/5.6%YoY. Pay gains are spread across all industries and companies big and small. The NFIB reported 49% of small businesses raised worker pay in the past three months alone with 28% expecting to raise wages further in coming months. All of this puts up business costs, but in an environment of strong corporate pricing power, firms can pass some of this on to their customers.

Labour market pressures justify 50bp Fed hikes

Will supply of workers improve? Well, labour participation rates remain relatively low and the notion of people making lifestyle changes could explain this. People who have seen their 401k retirement plans surge in value, for example, or some people who built up a cash reserve due to financial support may not feel it is the right time to return yet. Also, the pandemic still makes some people reluctant to return to work full time while (legal) immigration, which could pick up some of the slack, has been restricted due to the pandemic.

Rising wages may well attract more people back in time, but this is not like turning on a light switch. Demand outstripping supply will likely remain in place for quite a long time, thereby keeping inflation pressures elevated and the Federal Reserve in hiking mode. We look for 50bp Fed hikes in May, June and July, before they switch to 25bp as quantitative tightening kicks in and contributes to tighter monetary conditions.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more